US CPI Data Signals Fragility in Disinflation Narrative, Boosting Treasury Yields and Pausing USD Rally

Today’s market action is a clear demonstration of the fragility in the disinflation narrative, with the latest US CPI data coming in hotter than expected across all components. This data puts a pause on the idea of a smooth disinflationary path that many market participants have been hoping for. Despite signs of a potential softening labor market, particularly the spike in weekly Jobless Claims, the inflation picture remains a key driver for both the US USD and broader market sentiment.

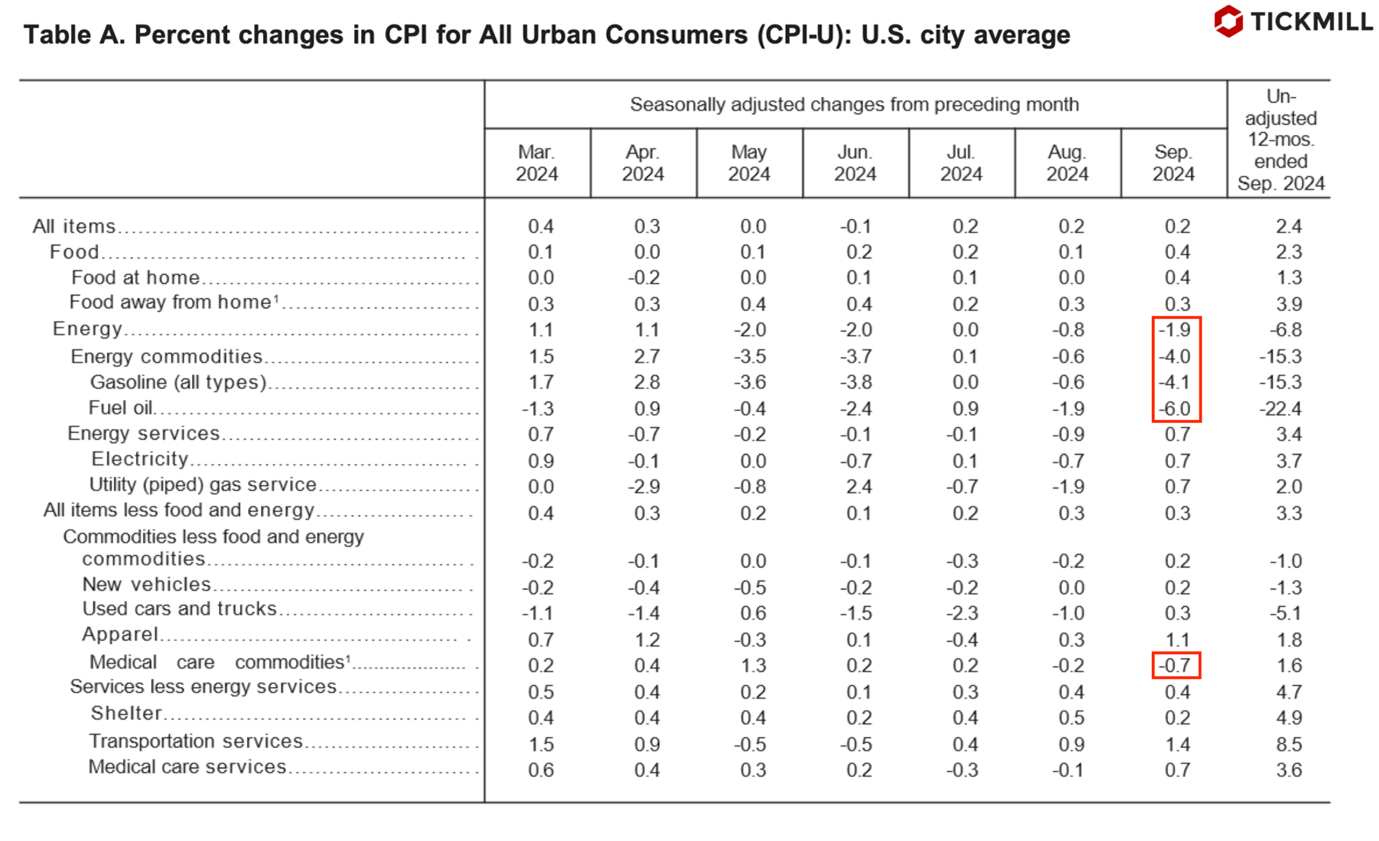

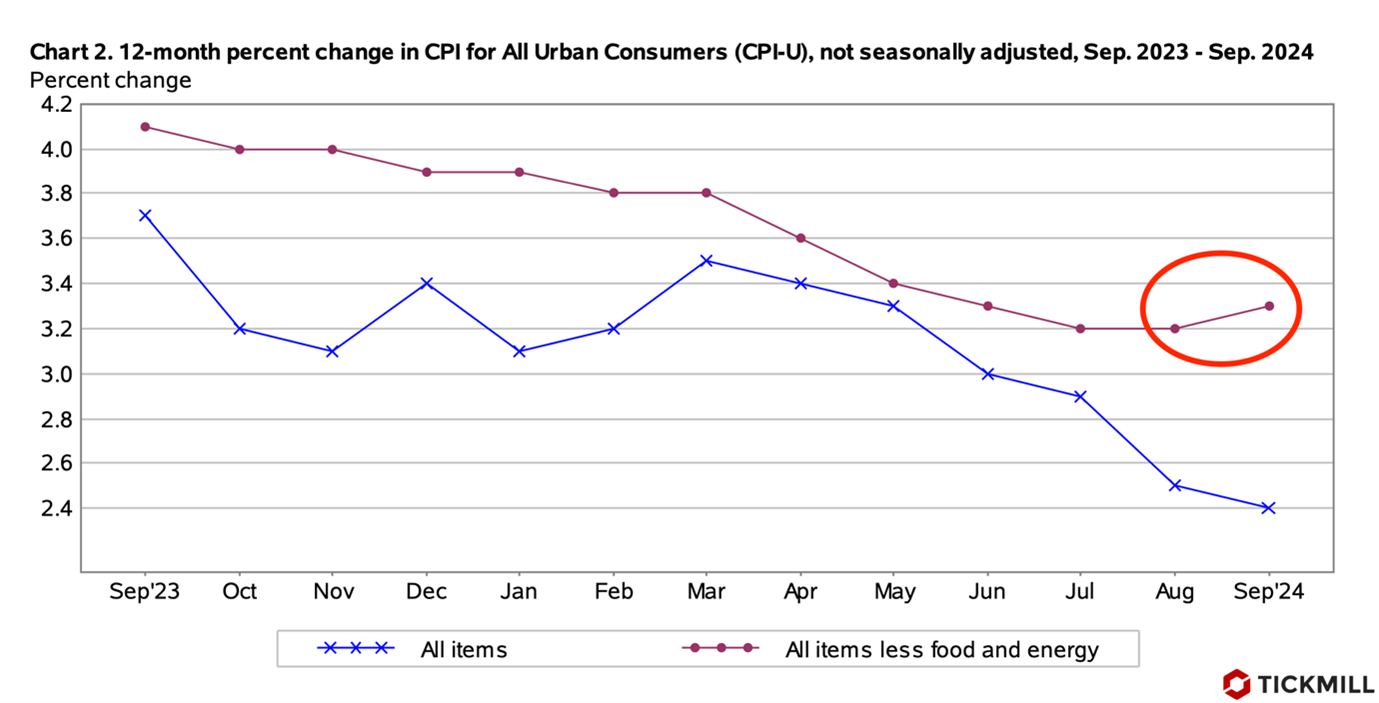

The September CPI report showed a slight easing in headline inflation, which slowed to 2.4% year-over-year, the smallest increase since February 2021. However, this was still above the market consensus of 2.3%, reflecting persistent inflationary pressures. The main downward contribution came from the energy sector, particularly energy services and goods, which posted a significant month-over-month decline, with energy commodities dropping by 4.0% and fuel oil plunging by 6.0%:

Despite this, most other categories—except for medical care services—showed positive MoM gains, leading to a surprising rebound in core inflation. After flatlining for the previous two months (July and August), core inflation picked up again, undermining the previous trend of consistent deceleration that had lasted for over nine months:

This acceleration in core inflation complicates market expectations regarding the Federal Reserve’s policy direction. Investors will likely anticipate an even less dovish stance from the Fed, potentially even pricing in a pause in the easing cycle during the upcoming November meeting. As a result, market participants may increase unwinding bets on a rate cut, pushing bond yields higher and causing volatility in equity markets, which are already near all-time highs.

When inflation persists or accelerates, even marginally, it forces the Fed to adopt a more hawkish stance to prevent runaway price increases. This, in turn, keeps or raises borrowing costs and puts downward pressure on stock valuations. Higher rates also make U.S. bonds more attractive, leading to a stronger dollar, which can dampen export growth and corporate earnings. As equity markets are highly sensitive to Fed policies, the fragility could lead to increased volatility or even sell-offs if expectations for rate cuts fade further.

The USD’s rally paused, mainly due to algorithmic reactions to the conflicting data released simultaneously. Jobless Claims surged to 258K, much higher than the consensus estimate of 230K, initially interpreted by the algorithms as a negative for the USD. However, the jump in claims can largely be attributed to the aftermath of hurricanes affecting southern states, making this number less reflective of underlying economic weakness. It's essential not to overinterpret this single data point, given the nature of the exogenous shock.

Treasury yields, on the other hand, continue to rise, outpacing other sovereign debt markets, which highlights the growing yield differentials between the US and other developed markets. This dynamic, typically supportive of a stronger USD, underscores the market’s shifting focus back to interest rate expectations and inflation. Despite the volatility, fundamentals are reinforcing the Greenback’s strength, especially as rising Treasury yields make the USD more attractive from a carry trade perspective.

The interest rate futures market is now pricing in an 80.1% chance of a 25 basis point rate cut at the Federal Reserve’s November 7 meeting, with the possibility of a 50 basis point cut being completely ruled out. This shift is important, as it shows that while the market still expects some easing, the trajectory is likely to be more gradual than previously anticipated. A higher-for-longer stance seems increasingly probable given the sticky inflation data, even as some softening in the labor market becomes evident.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.