UK PM Faces Severe Backlash Following Yellowhammer Release And Scottish Court Ruling!

Yellowhammer Published

Following the publication of the explosive “Yellowhammer Document” earlier this week, the UK Labour party is now pushing for parliament to be recalled. Shadow Brexit secretary Sir Keir Starmer told reporters that the document outlines “severe risks” should a no-deal Brexit take place and said it is now “more important than ever” that MPs be returned to parliament to give them "the opportunity to scrutinise these documents and take all steps necessary to stop no-deal".

Government Plays Down Yellowhammer Impact

However, Defence Secretary Ben Wallace played down the potency of the report, telling reporters that the government was working hard to manage and mitigate these risks, adding that the report only highlights what could happen “if the government didn’t do anything about it”. Starmer was quick to say that the government is taking “lots of measures” to reduce these risks and noted that the chancellor of the exchequer had “opened his chequebook” to allow for higher funding around managing the risks of a no-deal Brexit.

Key Takeaways From The Yellowhammer Document

The published document, which is redacted in areas, outlines the following main risks from a no-deal Brexit:

- The supply of certain fresh foods could decrease” along with a “shorter supply” of some key ingredients.- The price of food and fuel would rise sharply, “disproportionately” impacting lower-income households.- Medicine and medical supplies could see “disruption lasting up to six months”.- Protest and counter-protests would increase, leading to a higher risk of civil unrest.- Lorries could be forced to wait for up to two days to cross the English Channel.- Many businesses could be forced into bankruptcy.- Growth in the black market for illegally smuggled goods.- Many adult social care providers could fail.

Revisions Coming

However, following the release of the document, the Defence Secretary has said that the planning file is a “living document” and subject to change, with an updated version due to be published soon. Indeed, Michael Gove, who is in charge of planning for a no-deal Brexit, said that “revised assumptions” will be published “in due course, alongside a document outlining the mitigations the government has put in place and intends to put in place".

Scottish Court Rules Johnson's Proroguing Was Illegal

The current political backlash against Johnson’s proroguing of Parliament, as well as the growing risk of a no-deal Brexit, has escalated significantly. This week, a Scottish court ruled that Boris Johnson’s decision to suspend Parliament was illegal, saying it was “unlawful because it had the purpose of stymying Parliament”. This decision, which comes on the back of both the High Court in England and Wales upholding Johnson’s decision, has intensified the debate around whether Johnson was acting illegally. The UK Supreme Court will now have to decide next Tuesday whether to uphold or overturn the Scottish ruling. If upheld, MPs will then be returned to parliament, which will be a boost for the campaign against a no-deal Brexit and should see further upside in GBP.

Market Reaction & Technical Perspective

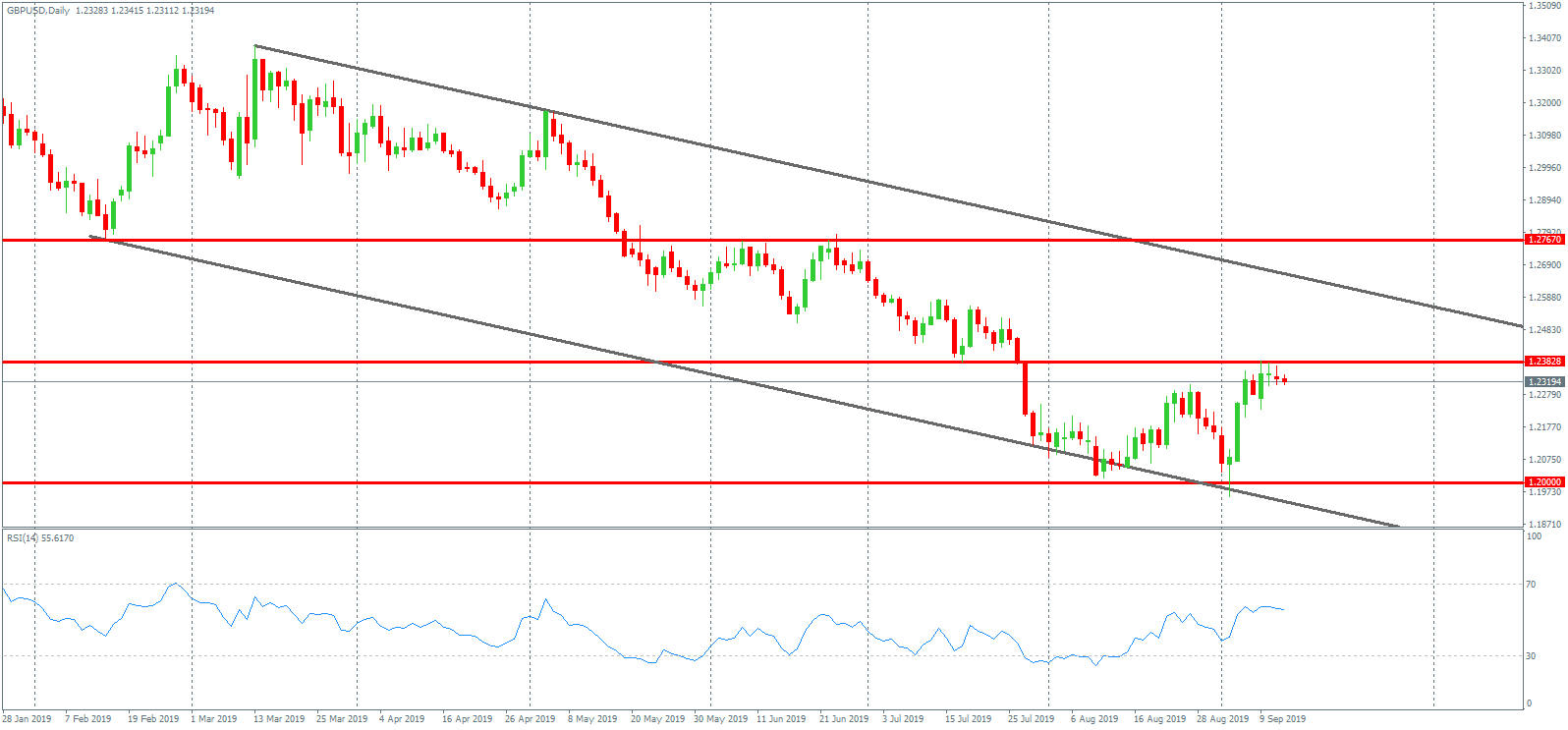

For now, GBPUSD remains bid, sitting just under the 1.2382 level resistance following a strong rally off the 1.20 base. The squeeze in GBP reflects a cautious optimism that MPs will be able to block a no-deal Brexit, which will be furthered should the Supreme Court uphold the Scottish decision, stoking a further move higher. A break back above the 1.2382 level will put the focus on a challenge of the bearish channel top next ahead of the 1.2767 resistance level. However, if the Supreme Court rules in Johnson’s favour, we will likely see a move lower, putting the focus on a fresh test of the 1.20 base.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.