Traders Scale Back ECB Rate-Cut Calls

Lagarde Turns Less Dovish

EURUSD is coming under a little selling pressure today, mainly via a stronger US Dollar. Yesterday, EUR bears were caught off-guard by ECB head Lagarde’s comments that the bank’s easing cycle was nearly done. Alongside the well-signalled .25% rate cut, Lagarde told reporters that the eurozone economy is now in a good position, noting rapidly falling inflationary pressures.

ECB Easing Expectations

While the market is still projecting a further rate cut (in line with Lagarde’s comments that easing is ‘nearly’ done), traders are now pegging October as the next likely date for easing, down from September prior. The risk, of course, is that the eurozone outlook could turn more positive in this timeframe leading to rate cut expectations being pushed back further or scaled back altogether. As such, there is plenty of bullish EUR risk in the coming months if data remains supportive.

EZ GDP Jumps

The latest eurozone economic data released today has added further support to this view. The final eurozone GDP print for Q1 was revised higher to 0.6% from 0.3% prior, above the 0.4% the market was looking for. This marks the strongest expansion in eurozone activity since Q3 2022, headlined by an almost 10% contribution from Ireland. Retail sales for last month, however, were seen flatter than expected taking some of the shine off the data. However, with the ECB turning more hawkish, EUR looks poised to gain more from positive prints than it should lose on negative data.

Technical Views

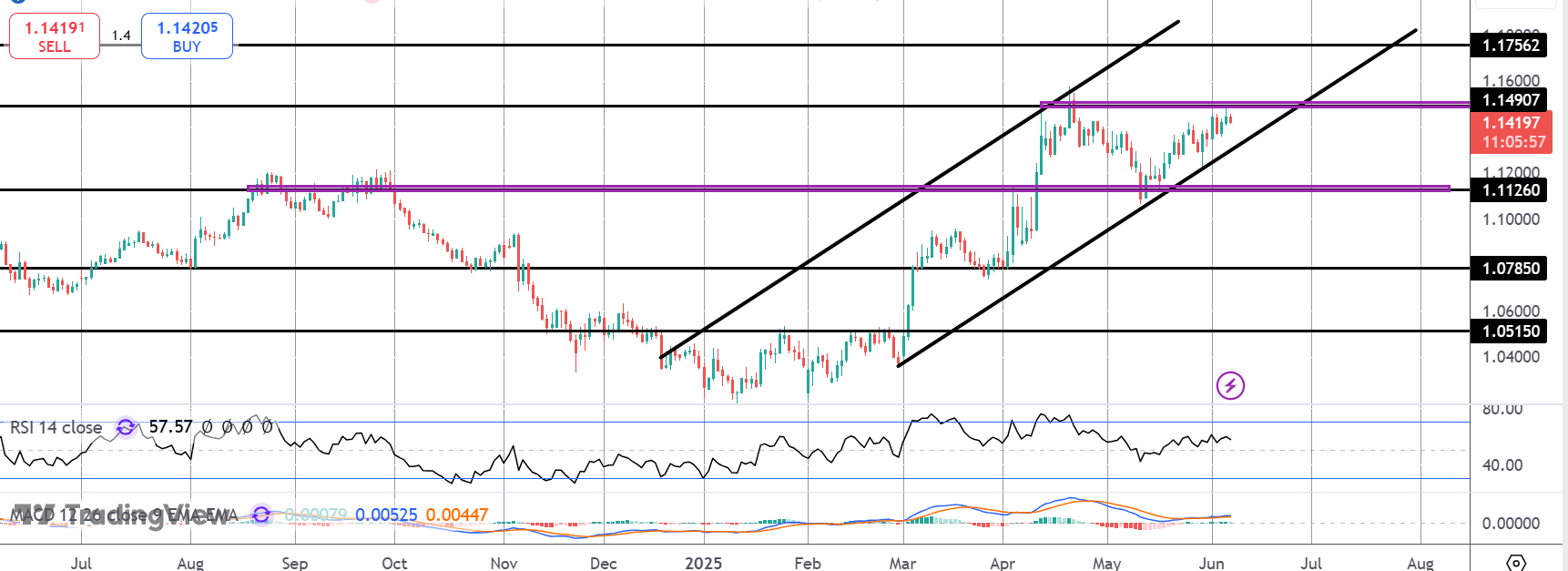

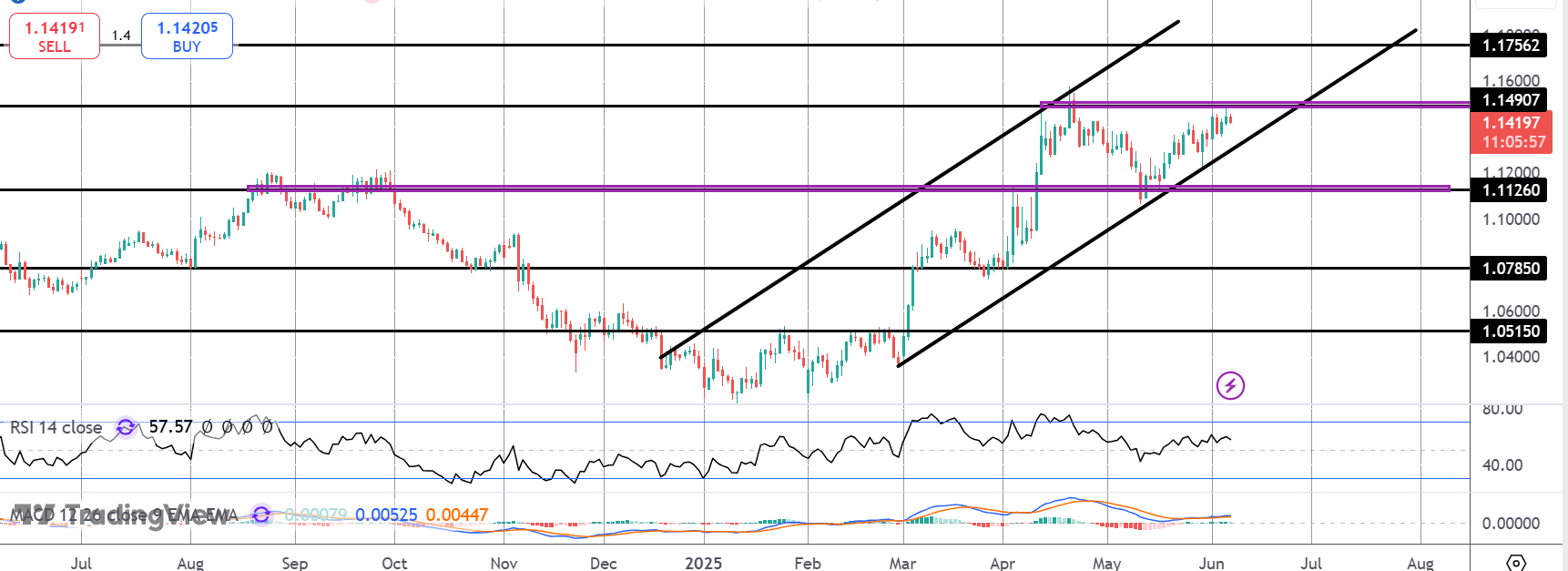

EURUSD

The rally in EURUSD remains capped for now into the 1.1490 level with risks of double top forming here unless we see an upside break quickly. Above here, 1.1756 is the next bull target, supported by the bull channel which continues to frame price action. 1.1126 remains the key downside level to watch. If we break above there, 1.0785 will be the deeper target to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.