The IndeX Files 15-06-2021

Equities Remain Near Highs, For Now

Global equities benchmarks have started the day on a positive note with the four indices tracked here all in the green. Stock markets have seen a renewed wave of buying over recent sessions in line with the weakness seen in the US Dollar. The recent headline miss on the May NFP release turned the greenback lower and the global reserve currency has been fairly rangebound since then.

However, there are clear risks for equities traders this week. The June FOMC brings with it the prospect of a more hawkish message from the Fed. In line with higher vaccination numbers, broader reopening and better data (May CPI jumped again), the market is anticipating the Fed to elucidate more on the potential for tapering this year. If the Fed follows through on these expectations, equities are likely to be shunted lower as Dollar shorts unwind and buyers step in.

While the Fed has been adamant over recent months that it is not concerned by any short term lift in inflation, there have been some comments recently from certain Fed members suggesting that tapering discussions are at least now moving into view. The key this week will be the extent to which the Fed details these discussions.

Technical Views

DAX

The rally in the DAX has seen price breaking above the 15743.01 resistance level. With both the MACD and RSI in bullish territory, the focus is on further upside in the near term. Any dip back below the level will find first support at the 15486.96 level.

S&P500

The S&P has traded up to new, all-time highs this week with price breaking above the 4236.50 level. Both MACD and RSI are bullish here, though we are seeing bearish divergence, which bulls should be wary of. Any dip lower will turn the focus to support at the 4182.50 and 4116 levels next.

FTSE

The FTSE is continuing to track higher here with price moving above the 7137 level this week, on course to test the 7241 level next. While MACD and RSI are both bullish, both indicators are flagging bearish divergence, warranting caution here. Any break lower will see the rising trend line as first support ahead of the deeper 6895.6 level.

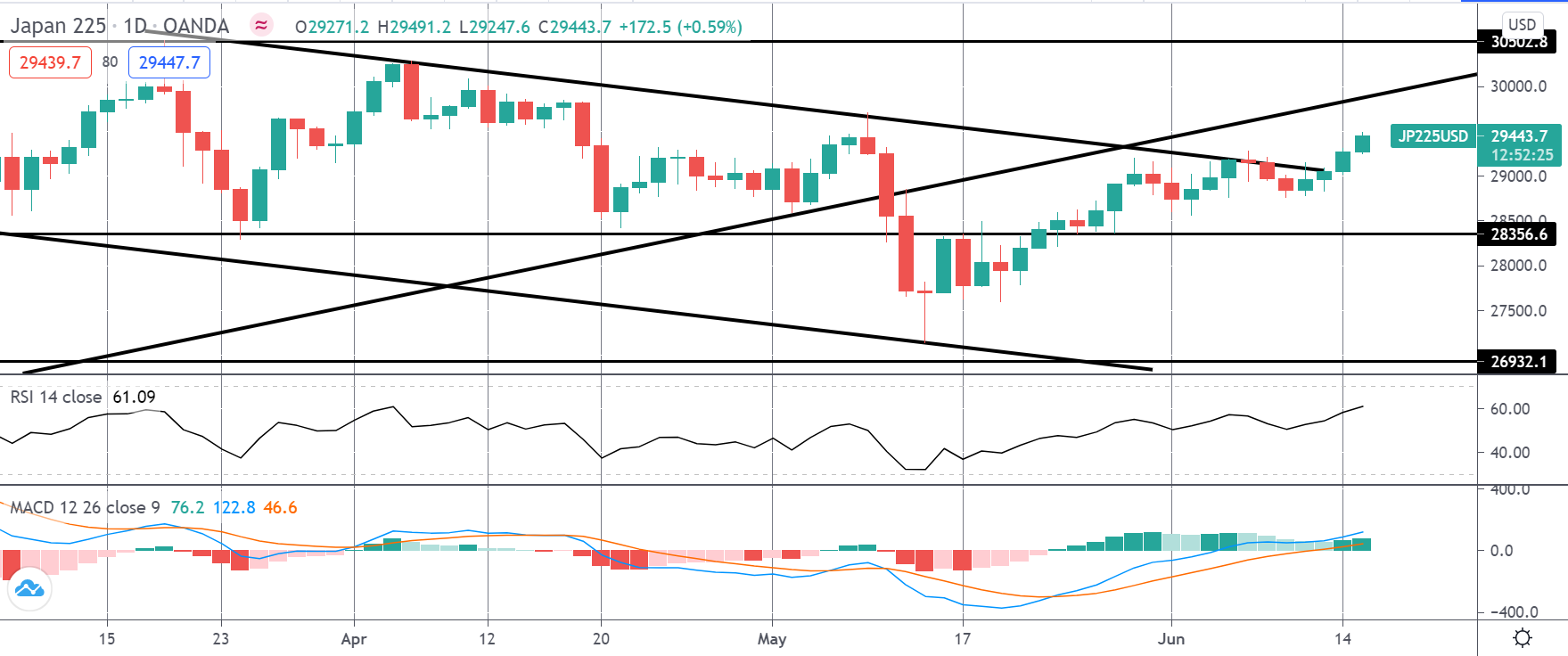

NIKKEI

The rally in the Nikkei has seen price moving back above the bear channel top this week, on course to retest the broken bullish trend line next. With MACD and RSI both positive here, the focus remains on a further push higher.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.