The FTSE Finish Line - October 11 - 2024

FTSE Flat Again, Mirroring UK GDP

U.K. stocks were little changed on Friday as official data showed the U.K. economy returned to growth in August, but the pace of expansion was weaker than in the first half of the year. The real economy grew 0.2% in August after showing nil growth in July and June, the Office for National Statistics said. The rate came in line with expectations. In the three months to August, real GDP advanced 0.2% compared to the three months to May and gained 0.8% from the same period last year. U.K. Chancellor Rachel Reeves said it is welcome news that growth has returned to the economy. "While change will not happen overnight, we are not wasting any time on delivering on the promise of change," she said. The benchmark FTSE 100 is basically flat after finishing marginally lower the previous day.

In single stock stories BP's shares decline after forecasting a drop in Q3 profit due to weak refining margins. The British oil company expects a $400 million decrease in Q3 profit, and its oil trading result is also anticipated to be weak. Additionally, the company's oil production and operations unit will be impacted by a $100 million charge.

UK investment manager Jupiter's shares dropped 1.3% to 86.5p.From 51.3 billion pounds in the previous quarter, assets under control dropped to 50.1 billion ($65.38 billion). Negative investor sentiment caused the company to record 1.6 billion pound net outflows in the quarter.

Jupiter said that although client attitude has not changed materially, generally flows match their estimates at the beginning of the year. Year-to- date shares for Jupiter have down 6%.

Hays, a British recruiter, saw a 2.5% increase. On the FTSE mid-cap index, which lost 0.1%, the stock is among the top percentage gainers. Jefferies says the business's 14% drop in Q1 like-for--like net fees is in line with company consensus. Jefferies analysts observe that "momentum was stable throughout the quarter, consultant productivity continues to improve, and structural cost saving programmes are progressing well." By the end of 2027, the firm wants yearly structural savings of £30 million. Still, the corporation projects a drop in H1 profit from the last six-month period. With the gains of the session included, the stock falls 19.53%.

Sainsbury's, a British supermarket group, hits a 2-month low as its top shareholder, the Qatar Investment Authority (QIA), cuts its stake by selling 306 million pounds worth of shares, representing about 5% of its holding. Sainsbury's shares fell 4.6% to 274.8 pence, the lowest since August 12, making it the biggest percentage loser on the FTSE 100 index, which is down 0.1%.

Technical & Trade View

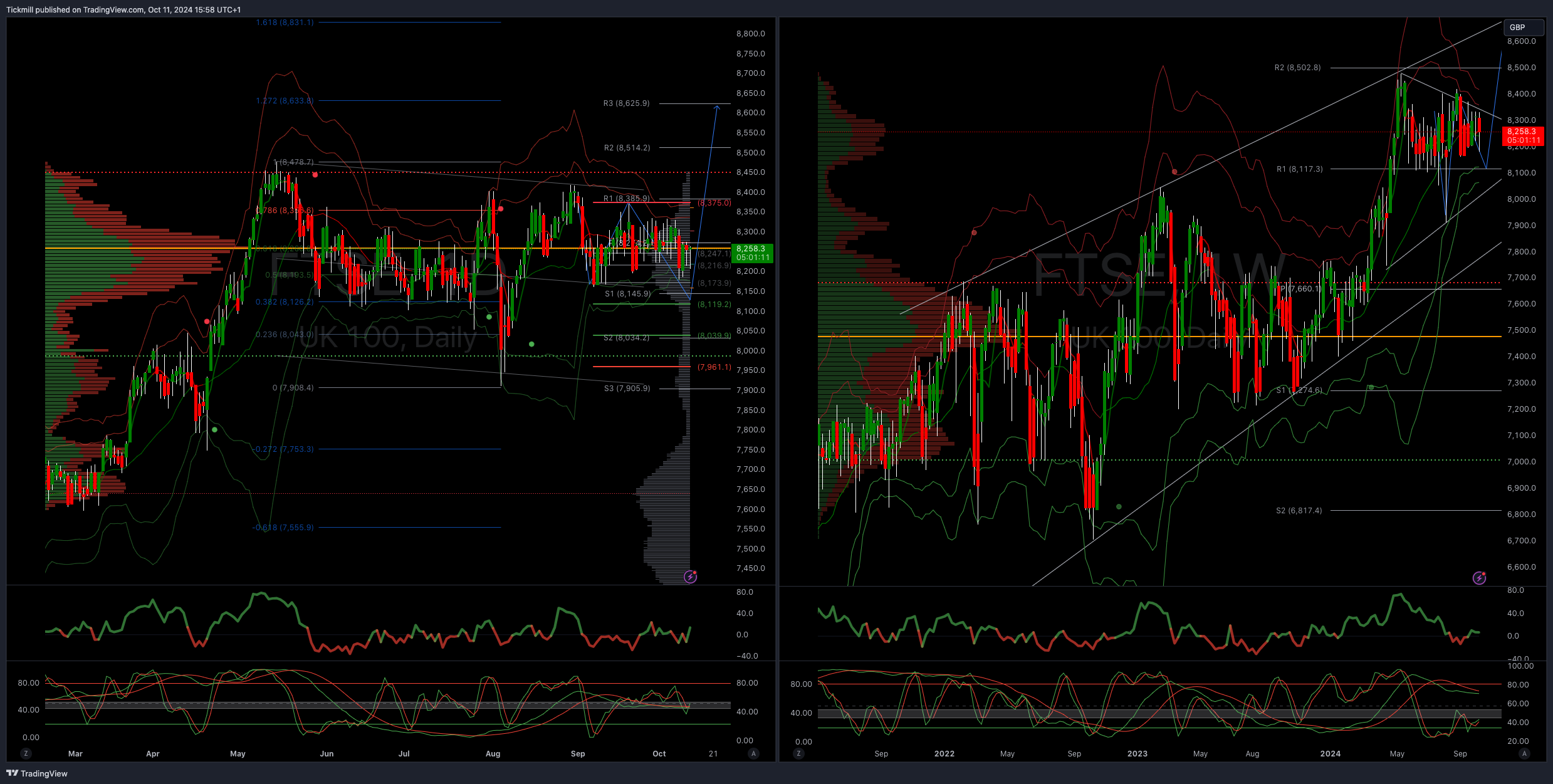

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8100

Primary objective 8600

Daily VWAP Bullish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!