The FTSE Finish Line - October 10 - 2024

FTSE Flat In An Uninspiring Session, Despite A Pop In House Prices

U.K. equities remained largely unchanged on Thursday, despite a closely monitored index of U.K. home prices turning positive for the first time in nearly two years, buoyed by expectations of further interest rate reductions by the Bank of England. The benchmark FTSE 100 index edged slightly lower -0.02% in a relatively subdued session.

In single stock stories, shares of British drugmaker GSK rise 5.4%, leading the FTSE 100 index. The shares are on track for the best one-day percentage gain since December 2022. GSK has settled about 80,000 or 93% of Zantac litigations for up to $2.2 billion, lower than the estimated costs of up to $3.5 billion. The company will also pay $70 million to settle a whistleblower lawsuit, without admitting wrongdoing. The stock has risen about 6% year-to-date.

Shares of UK's non-life insurers index rose 1.04%, outperforming the FTSE 100 index. Beazley, Lancashire, and Hiscox saw increases of 2.1%, 4.5%, and 1.5% respectively. Analysts expect lower-than-anticipated losses for insurers from Hurricane Milton, which made landfall as a category 3 storm. Initial estimates of up to $100 billion in global insurance industry losses have been revised downward to over $50 billion. Barclays estimates insured losses could be as low as $10 billion. BZG, HSX, and LRE were among the top gainers on the FTSE 100 and FTSE 250 indices, while Direct Line and Admiral saw marginal changes.

Indivior, a British pharmaceutical company, saw its stock price drop by 17.2%, the lowest level since January 2021. The stock was among the top losers on the London Stock Exchange. The company has cut its net revenue forecast for the second time in three months, now expecting full-year revenues to be between $1.13 billion and $1.17 billion, down from a prior range of $1.15-$1.22 billion. Indivior no longer expects its Sublocade treatment for opioid use disorder to reach a $1 billion net revenue run rate by the end of 2025. The company estimates its preliminary Q3 net revenues to be in the range of $302 million to $309 million. Including the session's losses, the stock is down around 50% year-to-date.

In broker updates, Shares of Premier Foods jumped as much as 2% to 186.2 pence, their highest since June 15, 2011. Barclays upgraded the stock to "Overweight" from "EqualWeight" and hiked the price target to 207 pence from 143 pence, citing lower food inflation levels in the UK and Premier Foods' step-up in promotional activity, M&A activity, new category and international expansion as potential drivers of volume growth. Premier Foods reported a rise in first-quarter sales on the back of strong branded sales growth and maintained its forecast for the year. The stock had risen 34.66% year-to-date as of the previous close

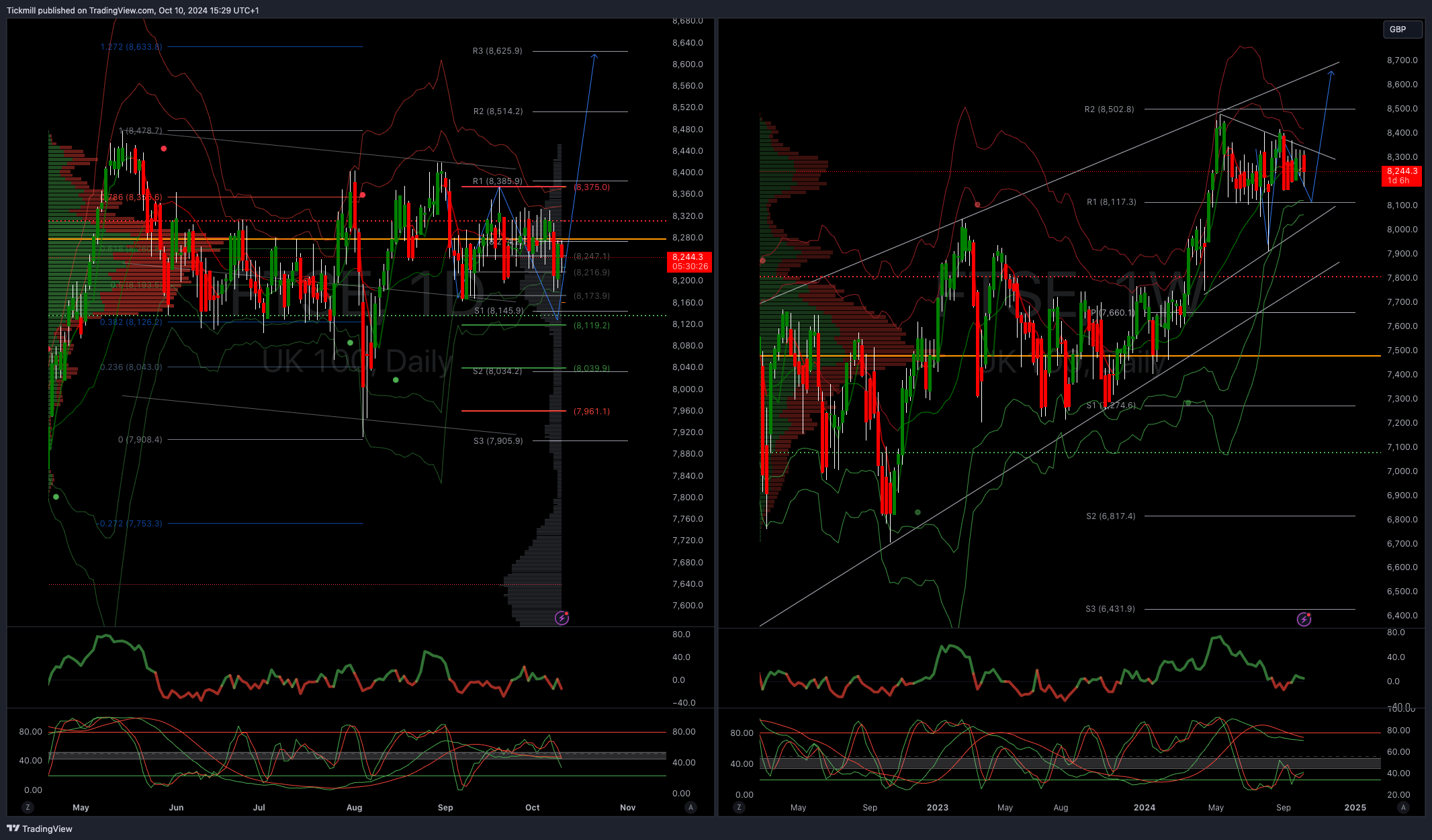

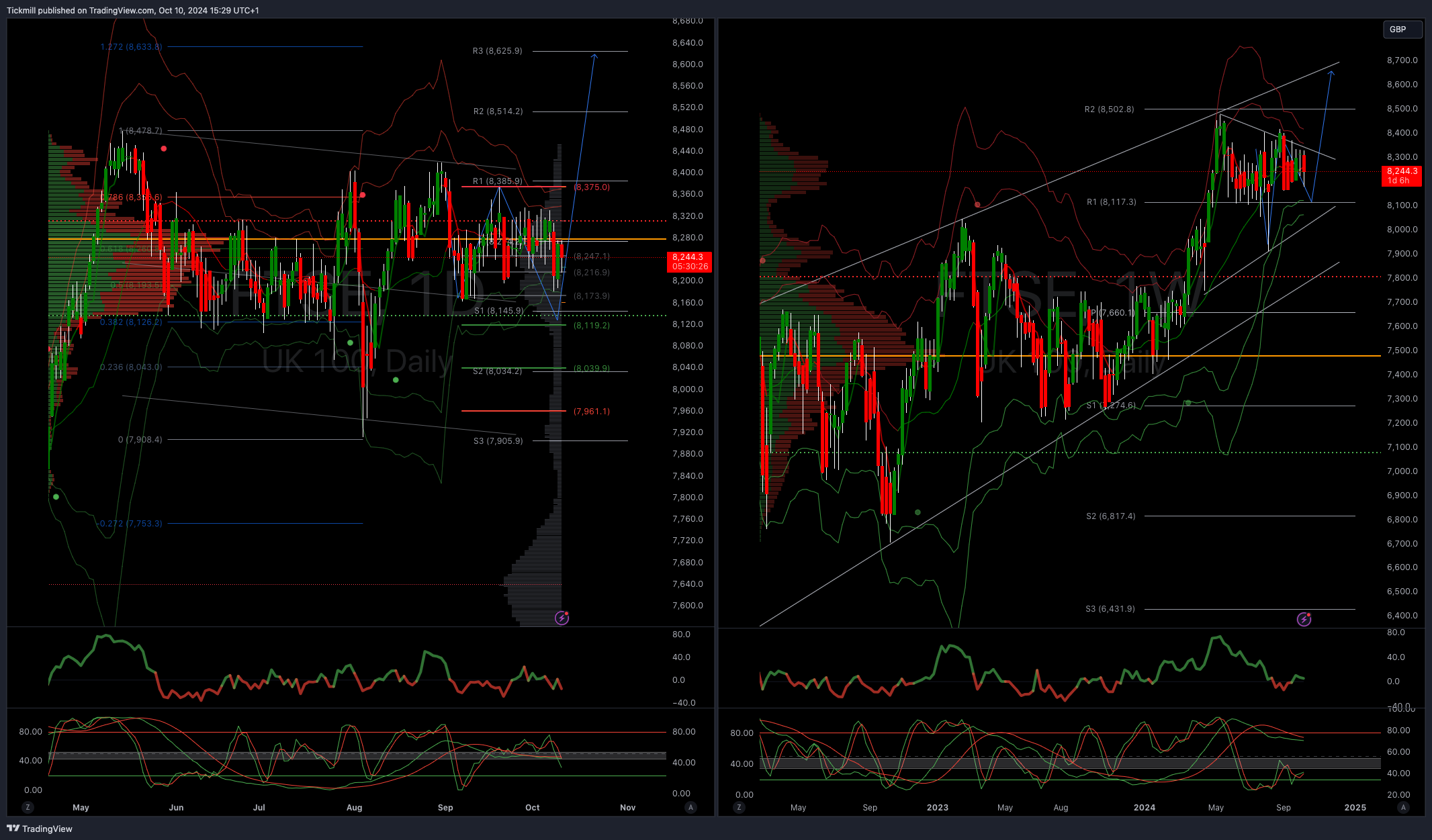

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8100

Primary objective 8600

Daily VWAP Bearish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!