The FTSE Finish Line: March 20 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group

UK shares hovered near the flatline on Thursday, initially weighed down by banking stocks. As widely anticipated, the Monetary Policy Committee (MPC) left the Bank Rate unchanged at 4.50% during its March meeting. This decision aligns with the MPC's recent pattern of cutting rates only once per quarter—having reduced rates in August, November, and February, while maintaining them in September, December, and now March. The move underscores the committee's cautious approach to monetary easing. Today's outcome was largely expected, with the forecasts of all but two economists polled by Bloomberg predicting no change. Markets, too, had priced in just a ~2% probability of a 25 basis-point cut being announced. Earlier in the day, data revealed that British pay growth remained steady in the three months to January, defying concerns from employers about the potential impact of an upcoming tax increase on hiring. The Bank of England's decision follows remarks from Federal Reserve Chair Jerome Powell, who signalled that the U.S. central bank is in no hurry to cut interest rates. Powell suggested that the Trump administration's trade policies might be slowing the U.S. economy and contributing to temporary inflation pressures.

Single Stock Stories & Broker Updates:

Compass falls 2.9%, among top FTSE 100 losers. Sodexo and Elior Group down 14.3% and 5.6%, respectively. Sodexo lowers FY24/25 organic revenue forecast to 3%-4% from 5.5%-6.5% and operating margin growth to 10-20 bps from 30-40 bps, citing slower organic growth in North America. JPM predicts the warning will impact the overall catering sector.

3i Group, a UK investment company, falls 6%, marking its largest decline since September 2022, becoming the top loser on London's FTSE 100. The company's portfolio, Action, faced YTD sales issues due to a food retailer's ERP system transition, which has now been resolved. 3i Group projects Action's 2025 LFL sales to exceed YTD figures in the mid to high single-digit range. The stock has dropped 1.43% this year up to Wednesday's close.

Crest Nicholson shares rose 12.8%, marking the biggest one-day gain since June 14 and positioning them among the top gainers on the FTSE 250. The company reports a strong start to 2025 with improved sales rates and projects mid-single-digit growth in home completions over five years, targeting over 2,300 units compared to 1,873 in 2024. Open market sales, excluding bulk deals, increased from 0.50 to 0.61 homes in the 10 weeks ending March 14. CRST is down ~10% year-to-date.

Wickes shares rose 8%, among the top gainers on the FTSE small cap index. Trading for the 11 weeks of 2025 met expectations with higher LFL retail sales. Adjusted PBT was 43.6 million pounds, surpassing the 43.2 million pounds estimate. A 20 million pound share buyback was announced. Analysts at Peel Hunt noted the group is poised for market growth with strong operational gearing and cash conversion. WIX is up approximately 20% YTD.

Investec's shares fell 5.05% , marking their largest drop since Sept. 20, 2024. The company projects adjusted EPS of 75p to 81.2p for the year ending March 31, with a midpoint of 81.2p. The YTD cost-to-income ratio improved to 53.8% as revenue increased faster than costs. The stock is down ~5% YTD.

Shaftesbury Capital, a UK-based REIT, surged 12.5%, marking its best single-day gain since November 2020. Norway's sovereign wealth fund purchased a 25% stake in its Covent Garden estate for £570 million, valuing the portfolio at £2.66 billion. Analysts at Peel Hunt view this partnership as beneficial, projecting a reduction in the loan-to-value ratio from 27.4% to 16% and net debt to EBITDA down to seven times. SHCS stock has risen approximately 4% year-to-date.

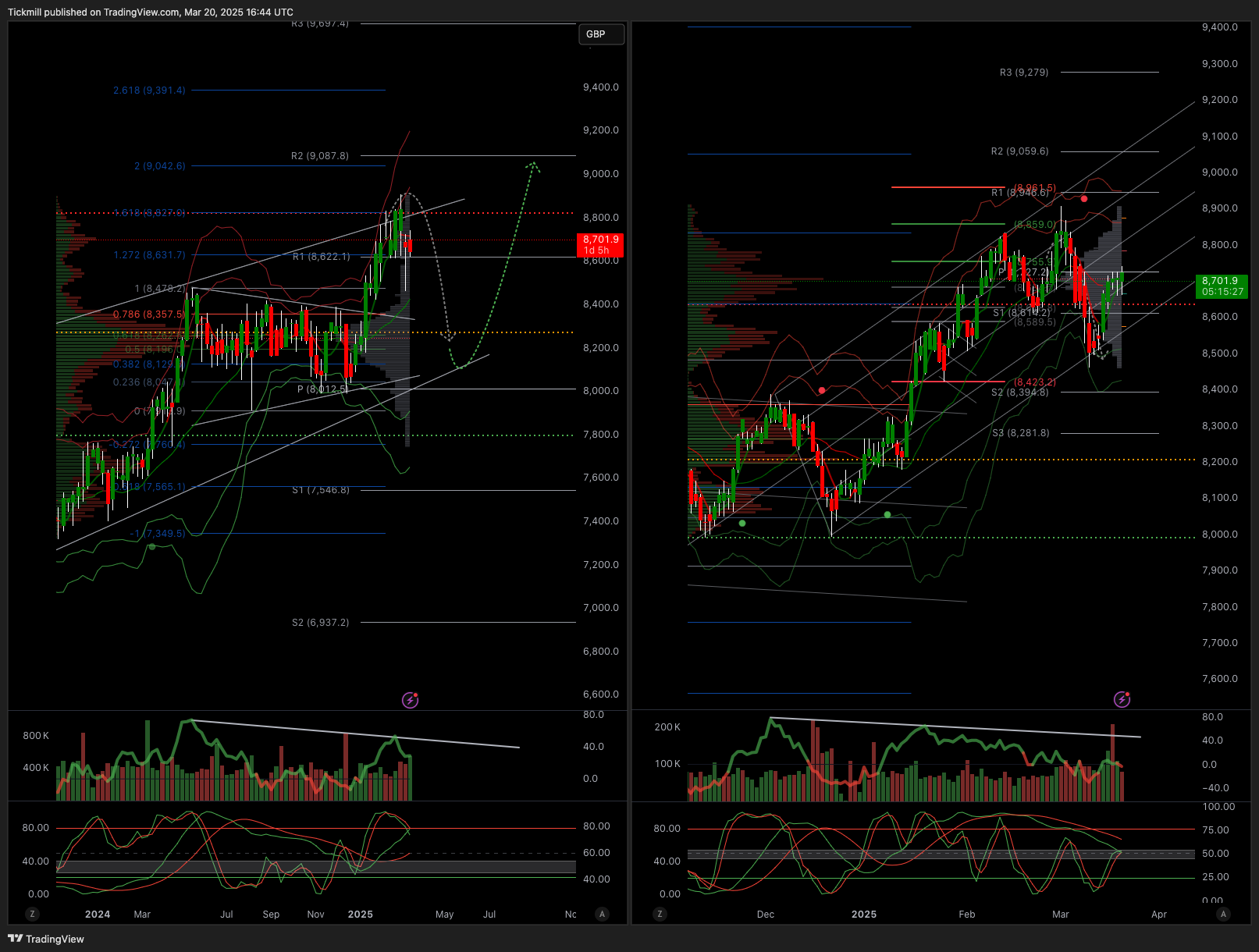

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8950

Primary support 8700

Below 8700 opens 8600

Primary objective 9050

Daily VWAP Bullish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!