The FTSE Finish Line - June 25 - 2024

FTSE Investors Turn Cautious Ahead Of Key UK & US Data

FTSE 100 in the UK pulled back modestly on Tuesday, with energy shares gaining and defence stocks declining. Investors remained cautious ahead of economic data that could impact expectations for U.S. and UK interest rates. Investors were cautious ahead of the release of U.S. personal consumption expenditure data (PCE) on Friday, with expectations of a slowdown in inflation. The upcoming release of UK gross domestic product (GDP) data could further support the confidence of Bank of England (BoE) policymakers in favour of an interest rate cut in August. Speculation about an August rate cut was revived by comments from BoE officials last week, although strong retail sales figures on Friday tempered these expectations.The political uncertainty in London, with parliamentary elections on July 4, is also contributing to investor caution. It is anticipated that the BoE will refrain from publishing the minutes of its meeting ahead of the election. The next BoE meeting is scheduled for August 1st, nearly a month after the election.

Admiral Group, a UK-based insurer, has surged to the top of the FTSE 100 index after Berenberg raised its rating and price target. The company's shares jumped by as much as 3.3% to 2,654 pence, making it the top gainer on the FTSE 100. Analysts at Berenberg increased their price target for Admiral Group to 3,127 pence from 2,973 pence and upgraded their rating to "buy" from "hold." They highlighted Admiral's strong track record of outperforming in a competitive market and emphasised the company's customer-first brand as a small competitive advantage over its peers. Additionally, they noted signs of improvement in the company's international operations, particularly in Italy. Despite this positive news, the stock has been down 3.7% year-to-date as of the last close.

Airbus' delivery forecast cut causes a 2.3% tumble in Britain's aerospace and defence stocks, while the FTSE 100 remains largely flat. Airbus has downgraded its forecast for deliveries to around 770 jets from the previously anticipated 800, leading to a 1-month low for the aerospace and defence sub-index at 11,067.6p. This has resulted in a 3.4% drop for Rolls Royce and a 1.1% decline for BAE Systems, with Melrose also experiencing a nearly 4% decrease in their shares. Additionally, Chemring, Senior, QinetiQ, and Babcock have seen their shares fall between 1.5% and 1.7%. Meanwhile, Airbus shares have plummeted around 9% to December lows, contributing to the sub-indexes overall 30% increase so far this year.

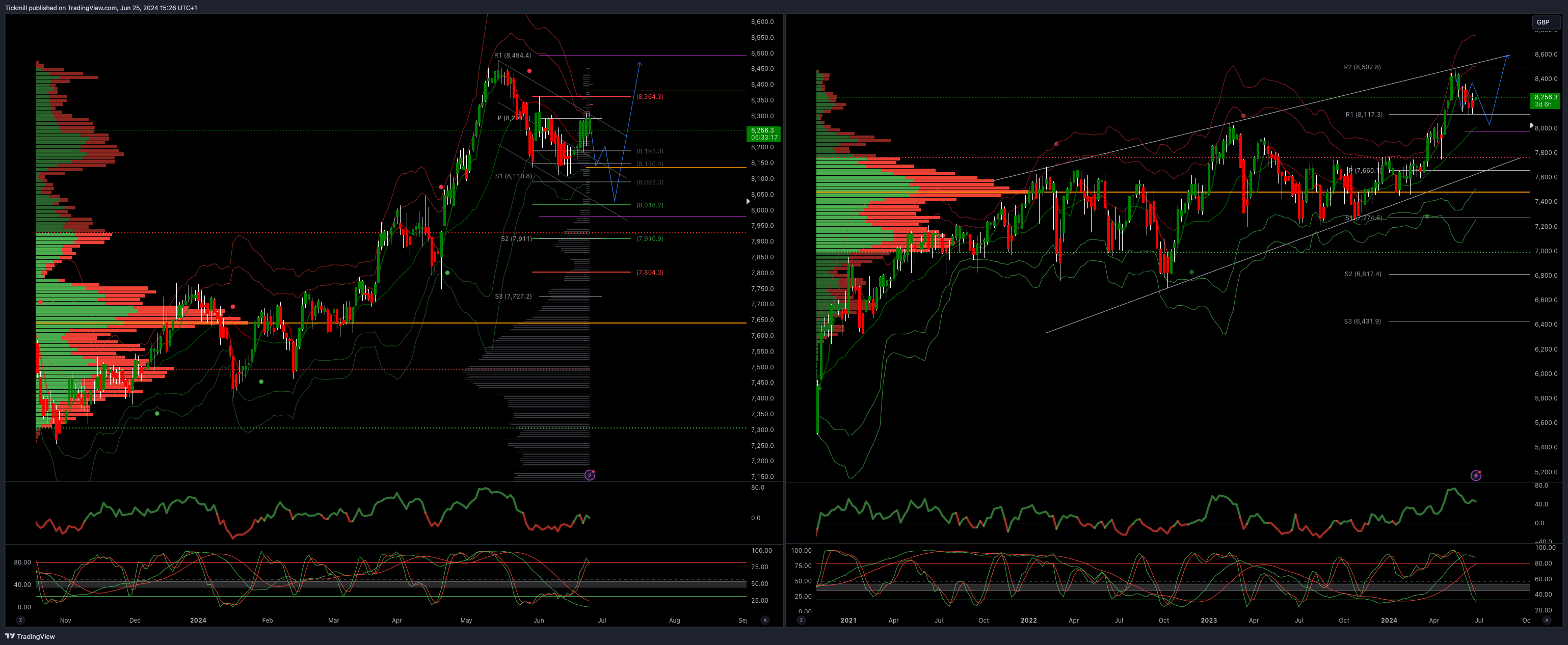

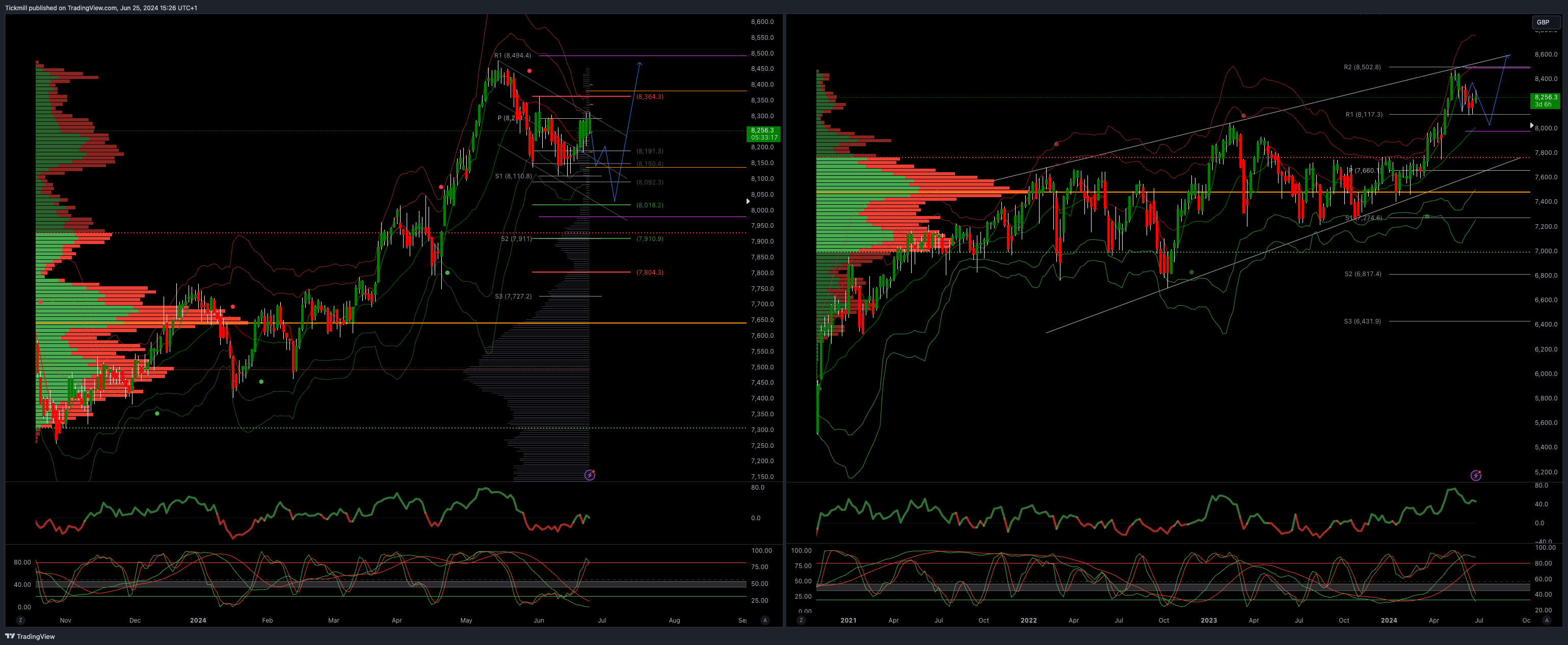

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8300

Above 8363 opens 8500

Primary support 8000

Primary objective 8023

5 Day VWAP bullish

20 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!