The FTSE Finish Line: July 31 - 2025

The FTSE Finish Line: July 31 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

London's leading stock indexes recorded modest gains on Thursday, bolstered early on by upbeat corporate updates from major players like Rolls-Royce. However, a wave of tariff announcements tempered investor enthusiasm, leaving the benchmark index hovering near flat into the close. The aerospace and defence index was the top gainer, increasing by 5.7%, largely due to Rolls-Royce's reaching a record high and rising 9.2% after improving its outlook for full-year operating profit and free cash flow. As the August 1 deadline approaches, U.S. President Donald Trump has announced new tariffs affecting copper imports and goods from Brazil, South Korea, and India, while also terminating exemptions for small-value international shipments. On the other hand, industrial miners experienced the most significant decline, decreasing by 4.3% in response to falling copper prices. MET/L Glencore dropped 4.3%, Anglo American fell 4.8%, Antofagasta saw a 5.7% drop, and Rio Tinto decreased by 4.1%.

Single Stock Stories & Broker Updates:

Rentokil shares rose 3.5% to 358.9p, making it one of the top gainers on the FTSE 100 index. The British pest control firm maintained its full-year outlook and reported a 3.1% growth in half-year revenue. It anticipates that annual results will meet market expectations. However, shares have decreased by approximately 14% year-to-date up to the last close.

Rolls-Royce shares rose 10.7% to 1,094p, hitting a record high as the FTSE 100 gained 0.51%. The company raised its FY operating profit and free cash flow forecasts, with H1 operating profit up 67% to £1.7 billion ($2.25 billion). Year-to-date, RR is up ~90%, while the FTSE is ~12% higher.

Drax shares rose 5% to 712p, with the company supplying 5% of Britain's electricity and extending its share buyback by £450 million. Pellet production reached record levels, up 5% in the first half, while HY adjusted core profit fell 11% to £460 million. DRX is up ~10% YTD.

Shares of St James's Place rose 5.6% to 1,234p, the highest since April 2023. The wealth manager reported a doubling of half-yearly net inflows, launched a £63.4 million share buyback, and posted a 17% YoY increase in HY post-tax underlying cash results. Year-to-date, SJP has increased by about 42%.

Shares of Robert Walters fall 6.9% to 151.4 pence, a low since November 2009. The company reports a 14% drop in H1 fee income, declares no interim dividend, and sees no near-term improvement in hiring markets. Including current changes, RWA is down about 52% YTD.

Just Group's shares surge 68.7% to 213 pence, marking a potential record one-day increase. The company will be acquired by Canada's Brookfield Wealth Solutions for £2.4 billion, with shareholders receiving 220 pence per share. Year-to-date, shares are up 31.16%.

Technical & Trade View

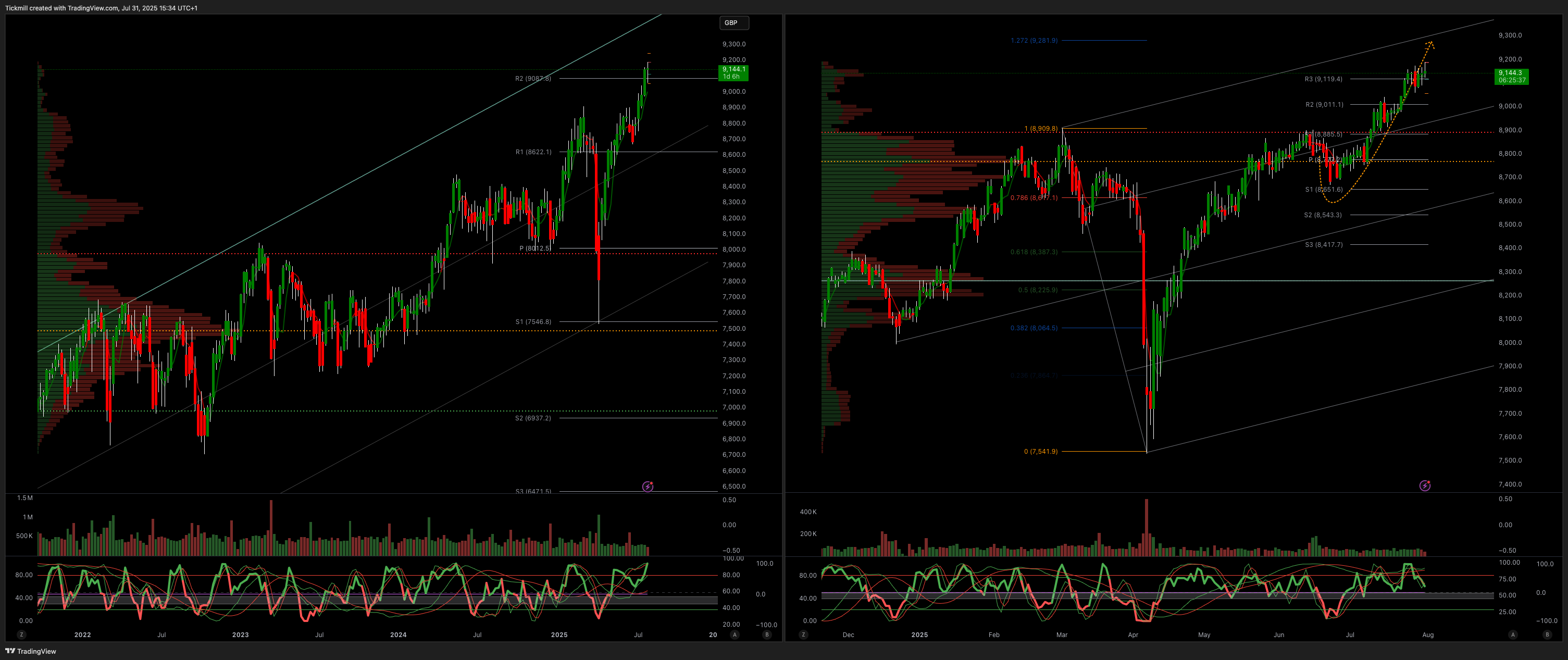

FTSE Bias: Bullish Above Bearish below 9000

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!