The FTSE Finish Line: July 29 - 2025

The FTSE Finish Line: July 29 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

London's stock indexes displayed mixed performance on Tuesday as investors digested a range of corporate updates and the implications of the newly signed U.S.-EU trade agreement. The FTSE 100, an international benchmark, edged higher, while the midcap FTSE 250, which focuses on domestic companies, declined. Healthcare stocks led sectoral gains, rising 1.8%, driven by AstraZeneca's 2.8% surge following second-quarter revenue and profit figures that exceeded expectations. Conversely, chemical stocks fell 2.5%, with Croda International plunging 5.1% after reporting disappointing first-half sales. Industrial miners also faced pressure, losing 1% amid falling copper prices, which contributed to declines of 2.4% for Glencore and 1.2% for Anglo American.

Meanwhile, a recent survey revealed that shop prices in Britain rose at their fastest pace in over a year in the 12 months leading up to July, with food prices seeing notable increases. The Bank of England is expected to cut borrowing costs on August 7, marking the fifth reduction since August of last year. Investors are also weighing the impact of a new 15% tariff on most goods imported from the European Union, a significant hike compared to pre-2025 levels. Ahead of the August 1 tariff deadline, U.S. President Donald Trump announced plans to implement a "world tariff" of 15% to 20% on trading partners that do not engage in separate trade negotiations with the U.S. Meanwhile, senior economic officials from the U.S. and China continued trade talks in Stockholm for a second day, seeking to resolve ongoing disputes and extend the current tariff ceasefire for an additional three months.

Single Stock Stories & Broker Updates:

AstraZeneca's shares increased by as much as 1.9% to 11,000p. The company surpassed profit expectations for Q2 and continues to uphold its revenue and core EPS forecasts for the full year. Jefferies anticipates that the limited impact of foreign exchange could lead to potential profit upgrades of around 2% in consensus. So far this year, AZN has risen approximately 4%, lagging behind the FTSE 100 index, which has gained about 11%.

Card Factory shares rise 9.2% to 97p, marking the largest intraday gain since December 2024. The company reports mid-single digits year-over-year sales growth for the five months ending June 30 and maintains expectations for mid-to-high single-digit sales growth and adjusted profit before tax in FY26. It plans to acquire funkypigeon.com for £24 million (~$32 million), expecting the purchase to boost earnings for the fiscal year ending January 31, 2027. Year-to-date, CARDC is down 2.8%.

Shares of Greggs down 2% at 1,612p; reports 14% fall in first-half profit, citing challenging market footfall and weather disruptions. Reiterates FY25 cost inflation guidance of around 6%; stock down ~40% YTD.

Shares of Forterra, a manufacturer of building products, have risen by 9.1%, reaching 200.5 pence. The stock is the leading performer in the FTSE All Share Index, which has increased by 0.2%. If these gains persist, this would mark the company's largest one-day percentage increase since November 2020. The company anticipates that its adjusted EBITDA for the second half will be slightly higher than the first half, and has reported a 82.4% year-over-year increase in adjusted profit before tax for the first half. According to Peel Hunt, the company is well-positioned for considerable improvements in profitability as volumes start to recover. Including today's movements, FORT stock has risen nearly 23% year-to-date.

Technical & Trade View

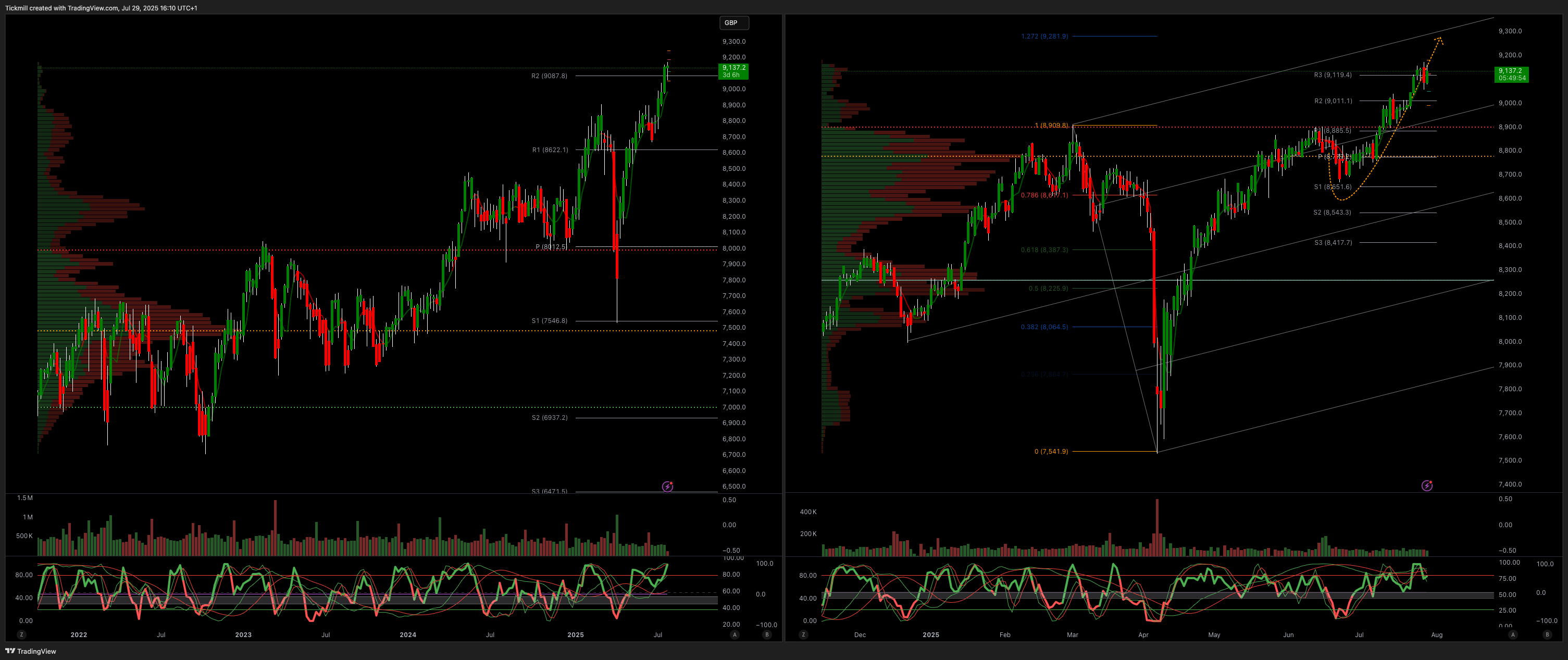

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!