The FTSE Finish Line: July 22 - 2025

The FTSE Finish Line: July 22 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

London's primary stock indexes showed varied results on Tuesday as investors reacted to a wave of corporate earnings and prepared for the release of important economic data later this week. The FTSE 100 benchmark was marginally higher heading into the close, posting 0.3% gains.

This morning, the ONS reported that the government recorded a public sector net borrowing (PSNBex) deficit of £20.7bn in June. While this figure exceeded market expectations by over £3bn, the cumulative deficit for the first quarter of the 2025-26 fiscal year, at £57.8bn, aligns closely with the OBR’s monthly projections. However, the cash-based measure of the government’s financing need for the same period has reached £55.7bn, approximately £7bn higher than the OBR’s forecast as of June. This metric, which directly influences the arithmetic for the gilt sales program, suggests potential upward risks to the financing remit, possibly to be addressed in the yet-to-be-scheduled Autumn Budget. That said, these risks appear relatively modest at this stage, given the potential for revisions, timing effects, and unforeseen shocks. A closer look at the details reveals a significant increase in the debt interest bill, which rose by £7.4bn compared to the same period last year, marking a 28.5% jump. On the revenue side, tax receipts growth remains resilient, showing a 6.7% year-on-year increase for the quarter. This indicates that much of the pressure on public finances continues to stem from the spending side, particularly driven by the impact of inflation.

Single Stock Stories & Broker Updates:

Centrica shares rose 3.8% to 162.55p, making it a top gainer on the FTSE 100. The UK approved the £38 billion Sizewell C nuclear plant, with the British state holding a 44.9% stake and Centrica 15%. Year-to-date, CNA is up ~22%.

Shares of UK water companies Pennon, United Utilities, and Severn Trent rose 2.3%, 1.01%, and 1.4%, respectively. J.P. Morgan upgraded Pennon's rating to "overweight" from "neutral" and raised its price target to 600p from 500p. The brokerage also increased the price target for United Utilities to 1,300p from 1,200p, while cutting Severn Trent's target to 3,050p from 3,175p. JPM noted that the environment secretary agreed to five recommendations for a new independent regulator and a regional, catchment-based approach for water planning. They view UK water stocks as undervalued and remain "overweight" on Severn Trent and United Utilities. As of the last close, PNN, SVT, and UU are up ~16%, ~10%, and ~9.55% this year.

Mitie shares rise 6.7% to 144.6p after Q1 revenue increases 10.1% year-on-year, with organic growth at 8%. The company secures new contracts and extensions worth £1.2 billion. It plans to address costs from unrecouped insurance contributions. Jefferies forecasts that annual consensus will remain stable post-Q1 update. MTO is up approximately 24.5% this year.

Compass Group rises 7.5% to 2720p, its biggest intraday gain since May 2022, following the announcement of its acquisition of Vermaat for 1.5 bln euros. It raises the annual profit growth forecast to around 11%, up from high single-digit. Year-to-date, CPG is up 0.19%.

Kier Group shares fell 6% to 197.4p, making it the top loser on the FTSE mid-cap index. Stuart Togwell will replace Andrew Davies as CEO on Nov. 1, 2025; Davies retires on Oct. 31. The company expects full-year revenue and profit to align with expectations. Year-to-date, KIE is up 29.2%.

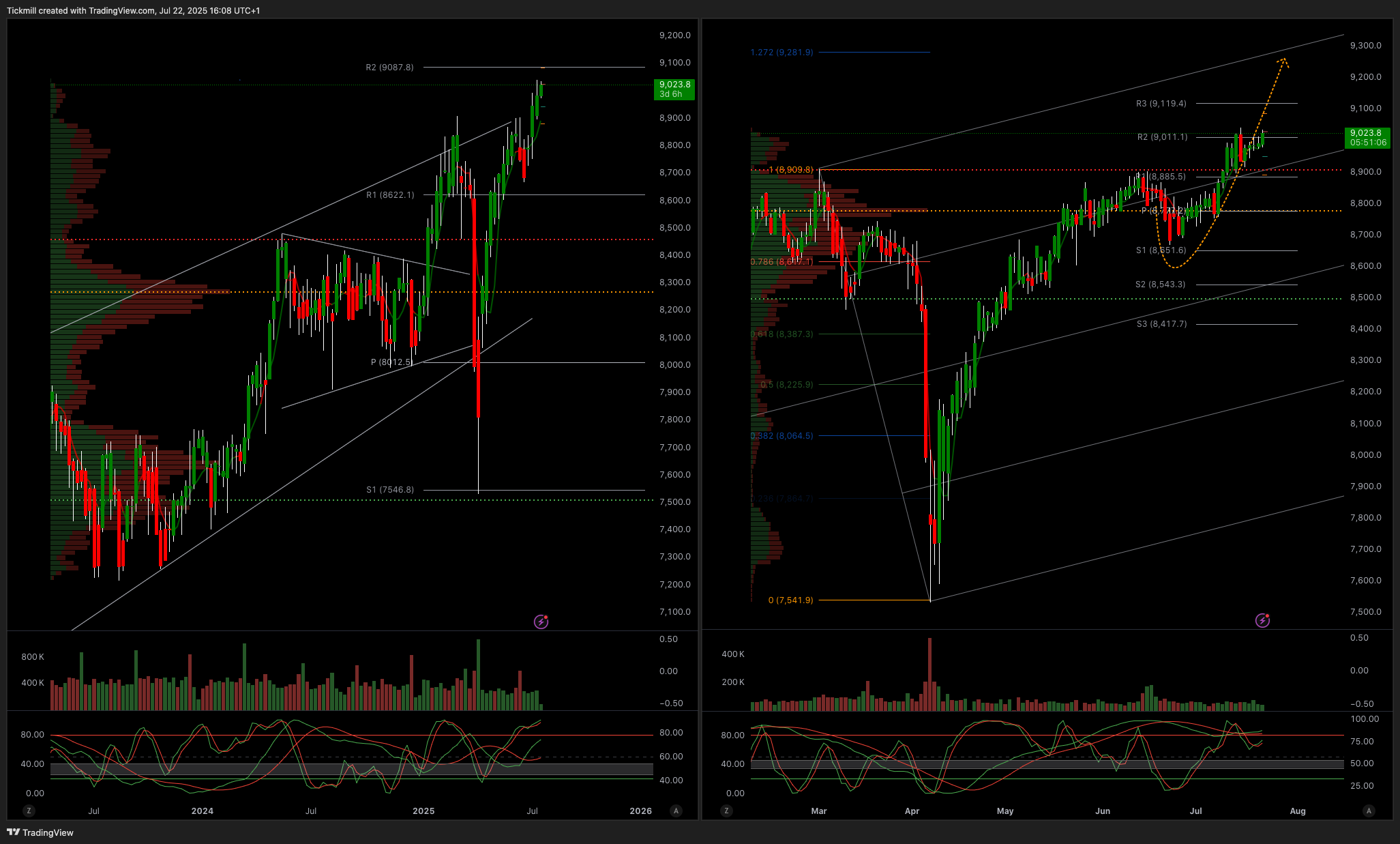

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8700

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!