The FTSE Finish Line: January 8 - 2025

FTSE Banks Bid As UK Yields Continue To Rise

The FTSE 100 in the UK saw a very modest increase on Wednesday, supported by recovering bank shares, with contributions from the aerospace and defence sectors as well, following U.S. President-elect Donald Trump's call for increased spending from NATO partners. The blue-chip index climbed by 0.2%. Yields on British government bonds remained at high levels, with the 10-year note's yield close to its peak in over a year. Gilt yields have increased in recent weeks as most investors anticipate that the Bank of England will reduce interest rates by only about half a percentage point this year, while inflation is expected to stay above the central bank's 2% target. Banks provided significant support for the FTSE 100, gaining 1.7% following a decline of over 1% in the previous session. HSBC increased by 1.8%, reaching its highest level since 2008, while Barclays rose by 2.5%. The aerospace and defence sector also saw a boost, climbing by 1.4%, with companies such as Rolls-Royce and BAE Systems benefiting from U.S. President-elect Donald Trump's call for increased spending from NATO allies. However, Shell's performance limited the index's gains, as its shares fell by 1.4% following a revision of its liquefied natural gas production forecast for the fourth quarter and indications that its oil and gas trading results are likely to be significantly lower than in the previous three months.

Single Stock Stories:

London-listed shares of Flutter Entertainment dropped as much as 4.8% following the company's announcement that it expects 2024 earnings from its rapidly growing U.S. brand, FanDuel, to be significantly lower. This is attributed to an unprecedented winning streak enjoyed by American football gamblers. Flutter estimates that U.S. revenue will be approximately $370 million below its previous guidance midpoint of about $5.78 billion. Additionally, the company projects that U.S. adjusted earnings will be about $205 million lower than its earlier guidance midpoint of approximately $505 million. In response to Flutter's news, shares of rival Entain, which operates a joint venture with MGM Resorts in the U.S., fell by about 2%. Despite the recent decline, Flutter's stock has gained 49% in 2024.

Shares of Britain's Topps Tiles rose by 2.7% to 39.5p after the company reported a 3.5% increase in like-for-like sales for the first quarter. The tile retailer also posted group sales for Q1 that were up 4.6%. Additionally, Topps Tiles announced the retirement of CEO Rob Parker, who will remain in his position until a successor is appointed, with the new CEO expected to be announced towards the end of 2025. Despite the recent gains, the stock has dropped approximately 22% in 2024.

Broker Updates:

Shares of Hochschild Mining fell by 2.8%, making it one of the top losers on the FTSE midcap index. Berenberg has revised its price target for the company down to 240p from 250p while maintaining a 'hold' rating. The brokerage anticipates that production in 2024 will be around 344,000 ounces of gold equivalent (AuEq), which is at the lower end of the company’s guidance of 343,000 to 360,000 AuEq. It also expects all-in sustaining costs for the fiscal year to be $1,531 per ounce, higher than the company's guidance of $1,510 to $1,550 per ounce, mainly due to elevated costs at Mara Rosa during its ramp-up phase. Berenberg noted that performance risks persist at Mara Rosa as it approaches its first wet season (November to March), which they believe introduces some moderate downside risk. Despite the recent decline, Hochschild Mining shares have risen approximately 106% in 2024..

Technical & Trade View

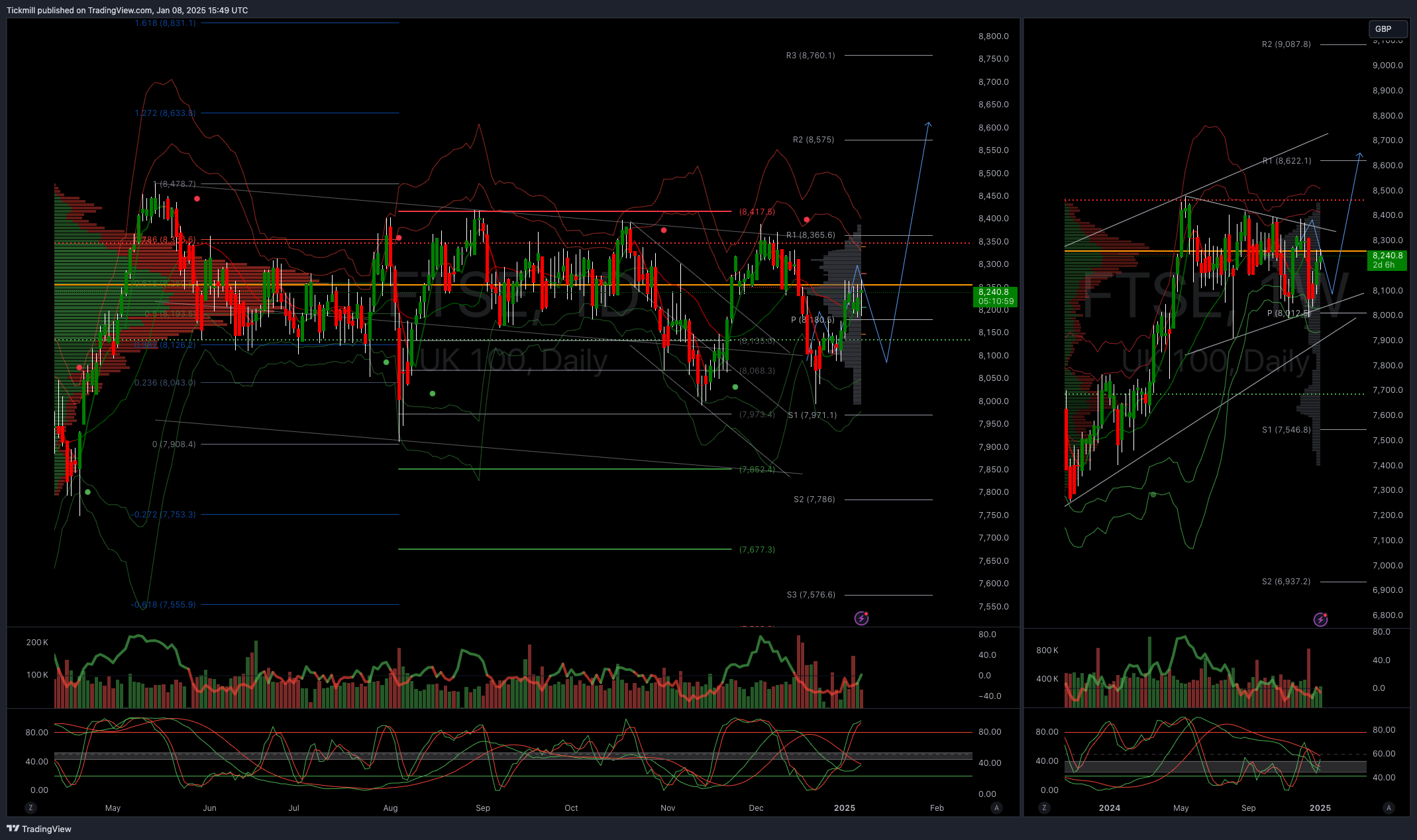

FTSE Bias: Bullish Above Bearish below 8225

Primary support 8000

Below 8000 opens 7855

Primary objective 8600

Daily VWAP

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!