The FTSE Finish Line: August 4 - 2025

The FTSE Finish Line: August 4 - 2025

Patrick Munnelly, Partner: Market Strategy, Tickmill Group.

Bank stocks were the driving force behind a rise in British equities on Monday, recovering from a significant decline on Friday, as investors anticipated potential interest rate reductions by the Bank of England later this week. The primary index, FTSE 100, increased marginally following its largest percentage fall in nearly four months on Friday. British bank shares rose by 2.1% on Monday after the UK's Supreme Court reversed a decision regarding motor finance commissions, alleviating concerns about a potential redress scheme that analysts had predicted could lead to costs in the tens of billions of pounds. Lloyds Banking Group saw its shares increase by 7.4%, marking its largest daily rise in more than nine years. Close Brothers experienced a surge of nearly 20%, while Barclays shares climbed by 2.3%. The aerospace and defence sector also saw a gain of 2.2%.

This week, the Bank of England is expected to reduce its key interest rate from 4.25% to 4% on Thursday, with an additional cut anticipated before the year concludes, even as consumer price inflation approached nearly double the central bank's 2% target in June. Meanwhile, a significant downward adjustment to previous U.S. jobs data on Friday, along with President Donald Trump's decision to dismiss the head of Labor Statistics, has heightened concerns among investors regarding the reliability of U.S. economic data.

Single Stock Stories & Broker Updates:

UK lenders Close Brothers, Secure Trust, Lloyds, Barclays, and S&U PLC have seen significant stock movements. LLOY and BARC have risen by 5.7% and 1.7%, respectively, while CBRO has surged by 24.3%, marking its highest one-day percentage increase since September 2024. CBRO is the leading gainer in London stocks. STBS has jumped 19.1%, achieving its largest one-day percentage gain since August 2022, and SUS has increased by 8%. On Sunday, the UK's Financial Conduct Authority introduced a redress scheme for consumers with motor finance compensation claims, estimating costs between £9 billion and £18 billion ($12 billion-$23.9 billion). Lloyds and Close Brothers stated that they will monitor provisions for motor finance claims. JP Morgan considers the current provisions held by UK banks to be adequate against this potential liability. Year-to-date, LLOY, BARC, and CBRO have recorded gains of approximately 46%, 35%, and 103%, respectively, while STBS has surged around 214%, and SUS has risen about 31%.

Shares of British oil company BP increased by 1.3% to 404.2p. BP announced a discovery of oil and gas in Brazil's Santos basin, which is thought to be a substantial reservoir of oil and gas. "We are thrilled to share this significant discovery at Bumerangue, BP's largest in 25 years," stated Gordon Birrell, EVP of production & operations. As per the last market close, the stock is up approximately 3% year-to-date.

Technical & Trade View

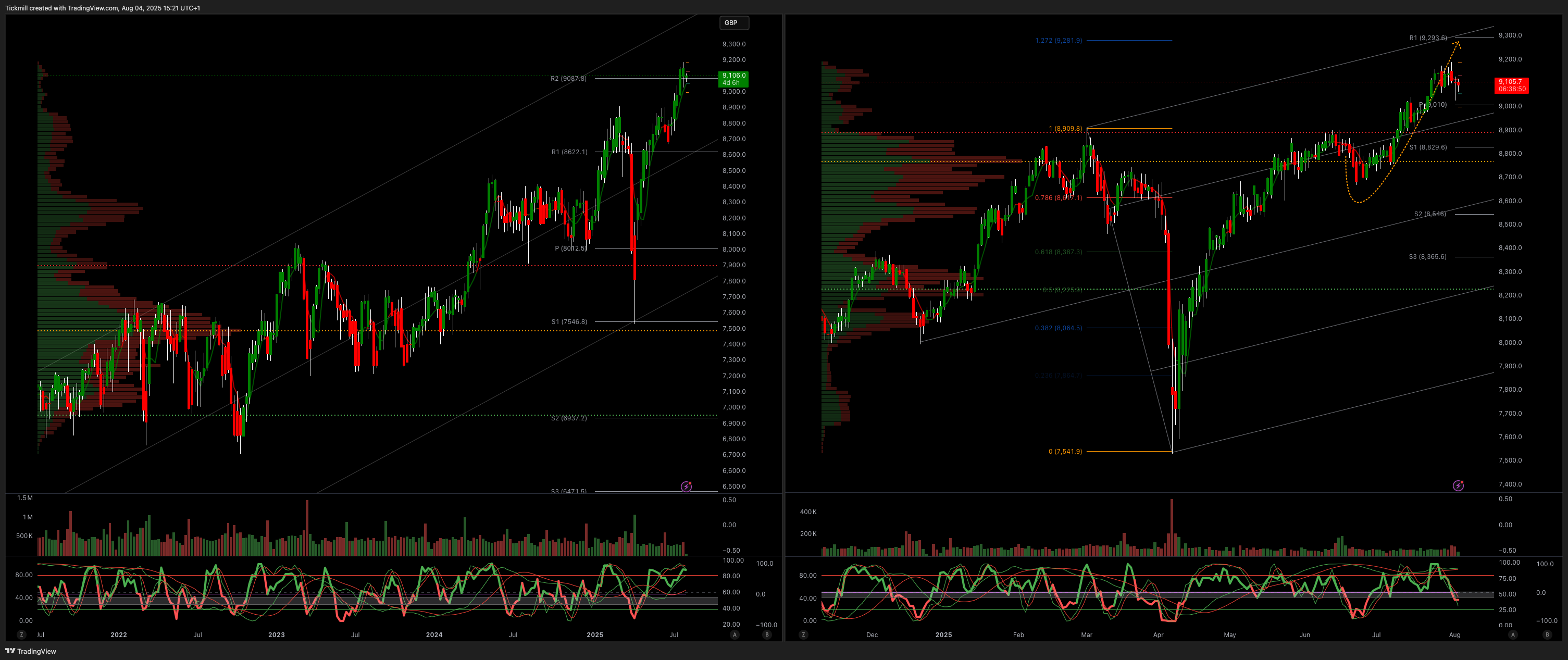

FTSE Bias: Bullish Above Bearish below 9000

Primary support 8600

Below 8500 opens 8400

Primary objective 9200

Daily VWAP Bearish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!