The FTSE Finish Line - August 09 - 2024

FTSE A Whipsaw Week Nearing Unchanged On The Week

London's FTSE 100 is flat on Friday as industrial metal miners continued bolstered recovery and better-than-expected U.S. jobs data dispelled concerns about a recession in the world's largest economy. The benchmark FTSE 100 index had a 0.06% increase. For the second consecutive week, the FTSE is expected to report weekly falls, but has staged a strong rebound to get close to unchanged on the week.

Weekly U.S. unemployment claims declined more than anticipated on Thursday, according to data, indicating that concerns about the labor market's ability to collapse were exaggerated and that some concerns about a possible U.S. recession have been allayed. A severe sell-off throughout global markets occurred on Monday as a result of Japan's currency carry trade unwinding and weak economic data from last week that heightened fears of a U.S. recession.

Industrial metal miners led gains in London on Friday, jumping 1.9%, as base metals and copper prices increased on expectations of rate cuts as well as better-than-expected U.S. data. Real estate sectors and MET/L Rate sensitive real estate investment trusts both saw 1% increases.

The stock of investment platform Hargreaves Lansdown increased 2.2%. Among the best performers on the FTSE 100 index, which rose by 0.3%, was the stock. The corporation has consented to an acquisition by a group headed by CVC Capital Partners for £5.44 billion ($6.95 billion). Cash payments of 1,140 pence per share to shareholders of Hargreaves Lansdown constitute a 5.8% premium to the closing price of the company's shares. This purchase, which is a part of the ongoing wave of takeovers of British companies, is the second-largest by value for a London-listed corporation this year. The stock had increased 46.80% year to date as of the most recent close.

Bellway's shares rise 2.6%, leading the FTSE 250 index. The British housebuilder reports a smaller-than-expected drop in annual revenue, and says buyer confidence is improving due to lower mortgage rates. The company's forward order book stands at £1.41 billion, up from £1.19 billion a year ago, indicating stronger demand. Analysts expect the company's performance to improve in the next fiscal year, assuming the market remains stable.

A wealth of inflation data from the United States and the United Kingdom, as well as data on Britain's gross domestic product, are anticipated by investors for next week.

Technical & Trade View

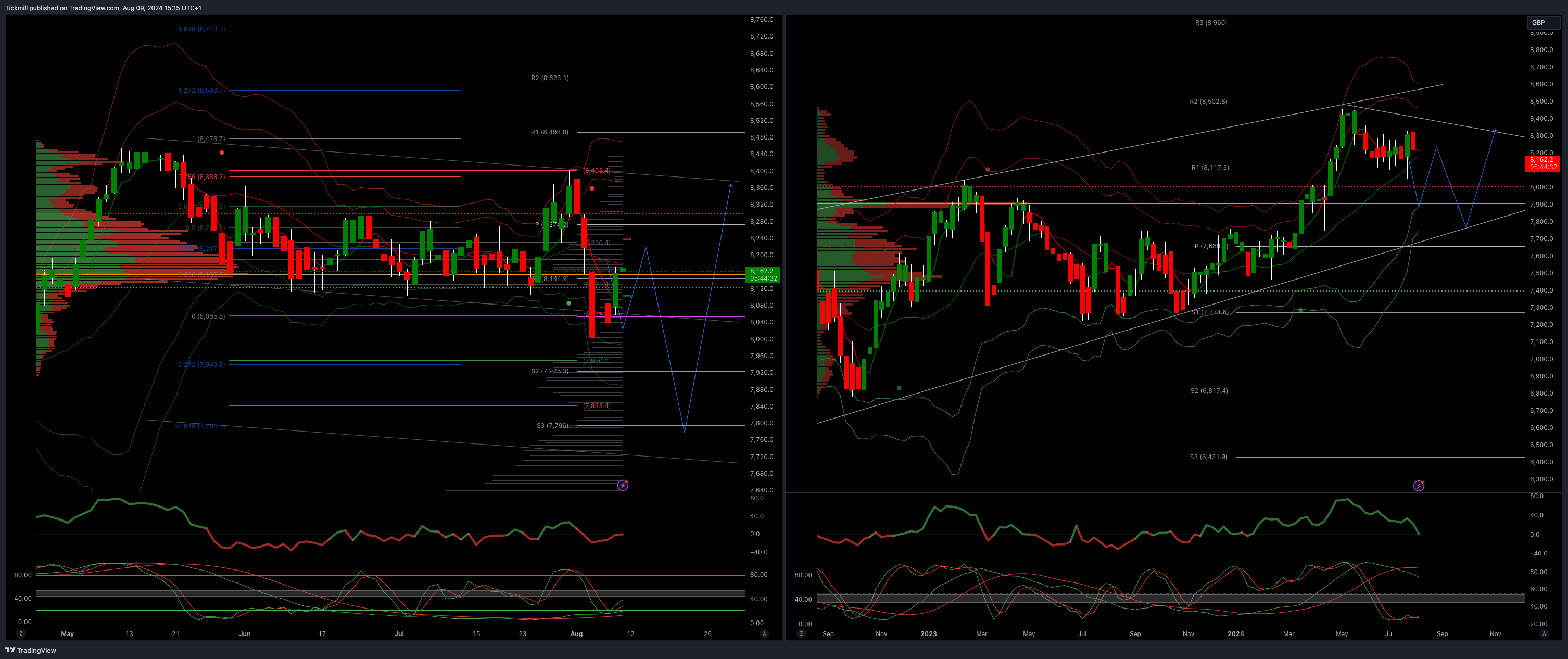

FTSE Bias: Bullish Above Bearish below 8225

Primary resistance 8400

Primary objective 7750

Daily VWAP Bullish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!