The FTSE Finish Line - August 08 - 2024

FTSE Bid As Markets Continue To Rebound From Monday’s Rout

Thursday saw modest gains in London's FTSE 100, which tracked the mood of the world markets as investors evaluated corporate updates and major firms traded without being entitled to their dividend payouts. The benchmark FTSE 100 index saw a 0.7% increase. After a sharp sell-off jolted global markets on Monday, the benchmark index had its best day in nearly four months on Thursday, extending a broad recovery to a second session. Precious metal mining companies led index declines, falling by 2%, despite rising gold prices. The index was dragged down by Fresnillo, which traded without the right to its most recent dividend payment.

UK insurer Beazley's shares surge after upgrading its annual combined ratio forecast. The company's stock price rose 10.2% to 702 pence, making it the top gainer on the FTSE 100 index. Beazley has upgraded its combined ratio forecast for 2024 after its pre-tax profit nearly doubled in the first half. The company now expects an undiscounted combined ratio of around 80%, compared to its previous forecast of low 80s. JPM analysts believe that additional capital returns are likely at this stage of the year. Beazley's stock price is at its highest level since July 1 and has risen 22% so far this year.

Entain, a British gambling group, has raised its annual net gaming revenue (NGR) forecast to low single-digit positive growth and expects core profit between £1.04 billion and £1.09 billion. The company's shares have risen 8% to 565.4p, making it the second top gainer on London's blue-chip index, as its Q2 results were buoyed by active punters cashing in on sporting events such as Euro 2024, the European Champions League, and the English Premier League. The stock had fallen over 47% so far this year prior to the latest close.

Hikma Pharmaceuticals, a British drugmaker, saw its shares rise by 5.3% to 1,937p, making it one of the top gainers in the FTSE 100 index. The company has revised its annual revenue growth forecast to 6% to 8%, up from the previous outlook of 4% to 6%. Hikma also expects its full-year core operating profit to be in the range of $700 million to $730 million. The company reported a 10% growth in its half-year group revenue, with growth across all three business segments. Including the session's gains, the stock is up 8.3% year-to-date.

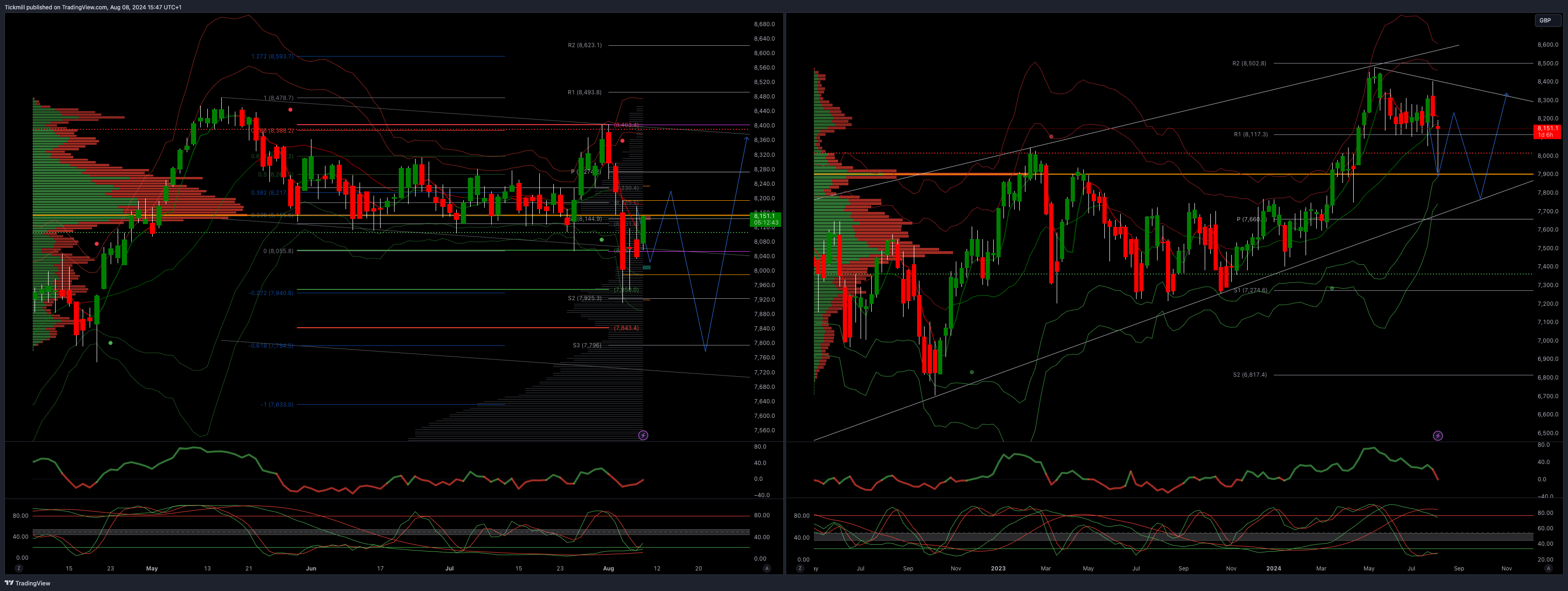

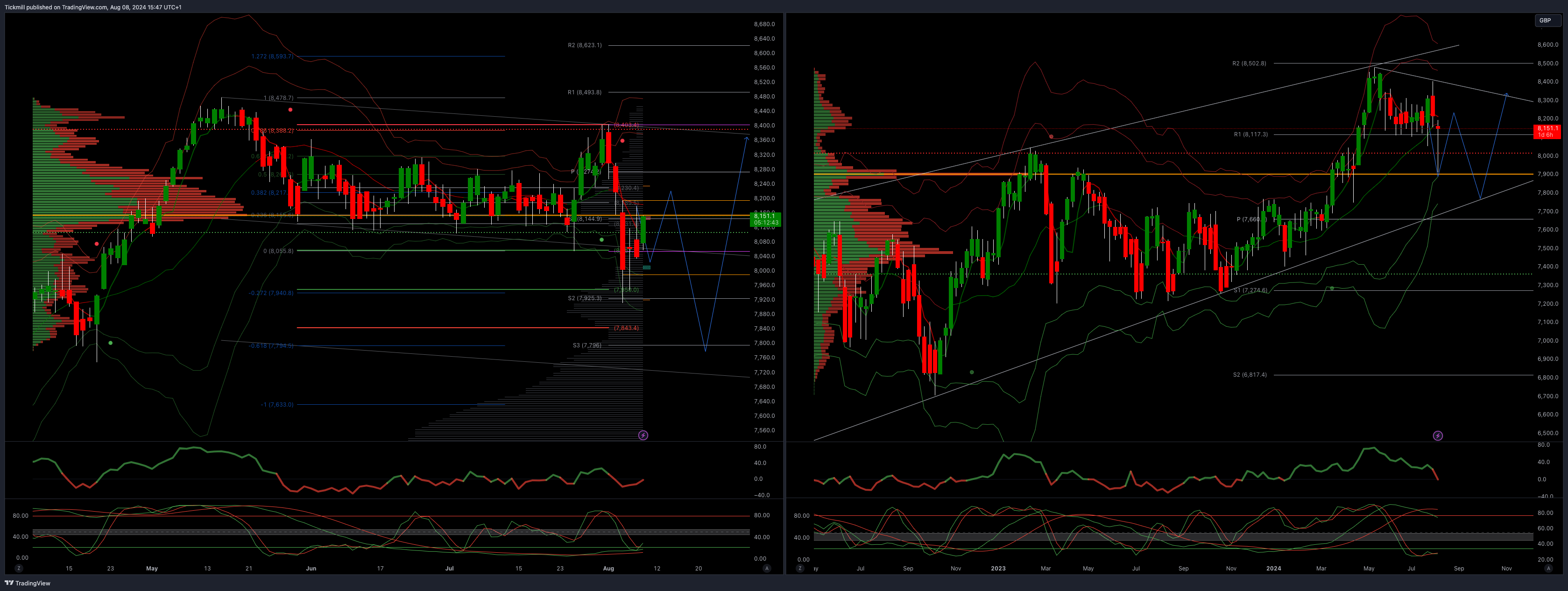

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

Primary resistance 8400

Primary objective 7750

Daily VWAP Bullish

Weekly VWAP Bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!