Tesla Reversing Hard From Highs

Tesla Slips Lower

Shares in Elon Musk’s flagship company Tesla are plunging lower again today as the reversal from YTD highs deepens. Tesla stock had been on a solid bull run over recent weeks, buoyed by Musk’s support from Trump after Musk invested heavily in Trump’s presidential campaign. However, since peaking at around high 357s on Monday, Tesla stock is now down around 15% and fast approaching a retest of the broken 2023 highs.

USD Strength & Fading Fed Easing Expectations

Continued strength in the US Dollar is one key driver behind the reversal. With traders scaling back their Fed easing expectations in line with Trump’s return to office, USD has continued to print fresh highs. The latest US inflation reading this week showed that CPI rose again last month back to 2.6& annualised, further dulling rate-cut forecasts. Speaking yesterday, Powell added to hawkish sentiment with remarks which focused on the resilience of the US economy and the fact that the Fed is in no rush to cut rates and can afford to take its time. The read on that is that there is a growing chance the Fed holds rates steady next month with CME pricing dropping 20% on the back of those remarks.

Trump to End EV Tax Credits

News that Trump is planning to end the EV tax credits instated under the Biden administration is also hurting Tesla this week. The expectation is that demand will fall if Trump removes the tax incentive, a move which Tesla is reportedly on board with. On X this week, Musk declared that all government subsidies across the board should be dismantled.

Technical Views

Tesla

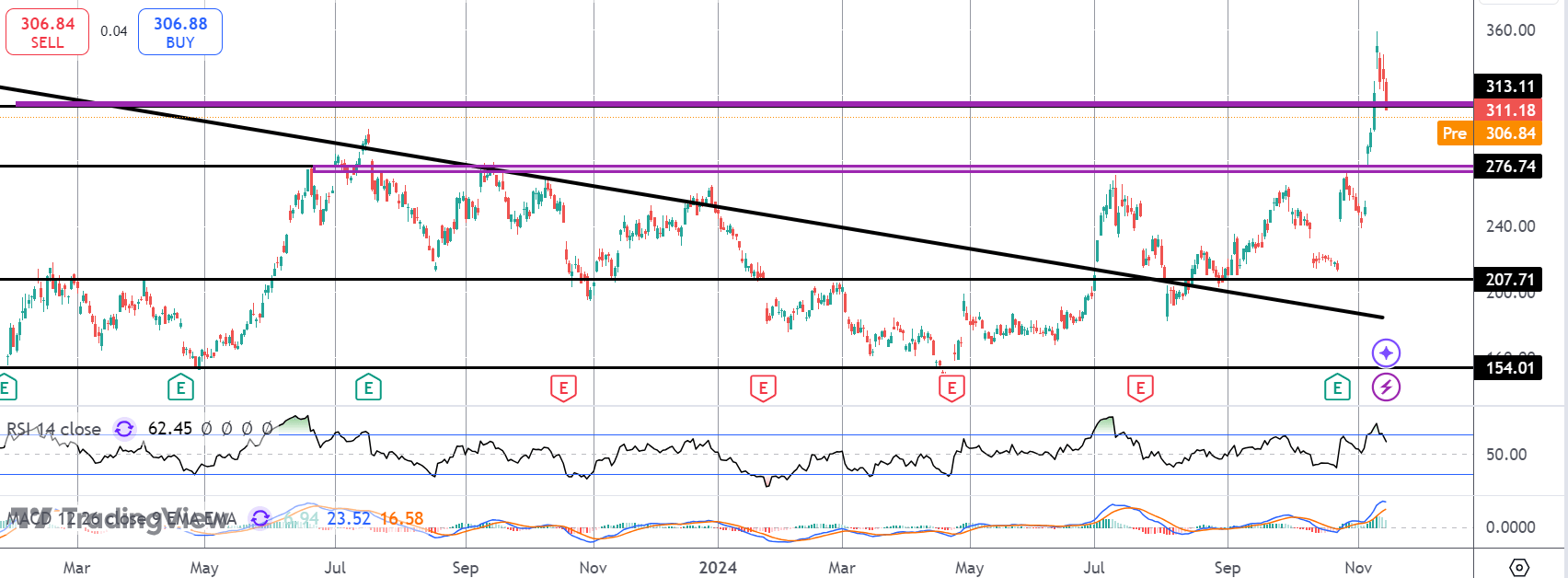

The sell off in Tesla has seen the stock falling back below the 313.11 level. With momentum studies weakening, the stock looks vulnerable to a further drop lower towards 276.74 next, which bulls will need to defend to maintain the broader bullish outlook.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.