Tech Traders Brace For NVIDIA Earnings

Nasdaq Lower on AI Fears

The Nasdaq is sitting on a key support level today ahead of the keenly anticipated Nvidia earnings due today after the market close. The company, which is seen as the bell-weather for the US AI industry has taken on central importance for the Nasdaq over the last year. Last year, ballooning profits saw the company overtaking Microsoft and Apple to move into the top spot as ranked by market cap. While currently sitting in second position, the company’s earnings often dictate the broader sentiment in the tech sector near-term.

Today’s Nvidia Forecasts

Given the current backdrop of fears over Chinese competition on AI and the risks around Trump’s trade crackdown on China, traders will be closely watching today’s results. On the numbers front, the market is looking for EPS of $0.85 on revenues of $38.1 billion. If seen, this would mark a strong uptick from both the prior quarter and the same quarter a year earlier ($0.49 EPS $22.1 billion revenues).

Trump’s China AI Crackdown

However, even if we see strong numbers again today, upside might be limited given the broader backdrop. News that Trump wants to take a harder stance on semiconductor chips being sold to China is a key threat to Nvidia’s business. In efforts to curtail China’s advance with AI, Nvidia is facing the prospect of tighter trade controls which will have negative implications for its bottom line at a time when the stock is already under pressure. The stock has fallen around 9% in recent days ahead of the earnings report as traders digest news that its news Blackwell AI chips could be delayed until later this year.

Technical Views

Nvidia

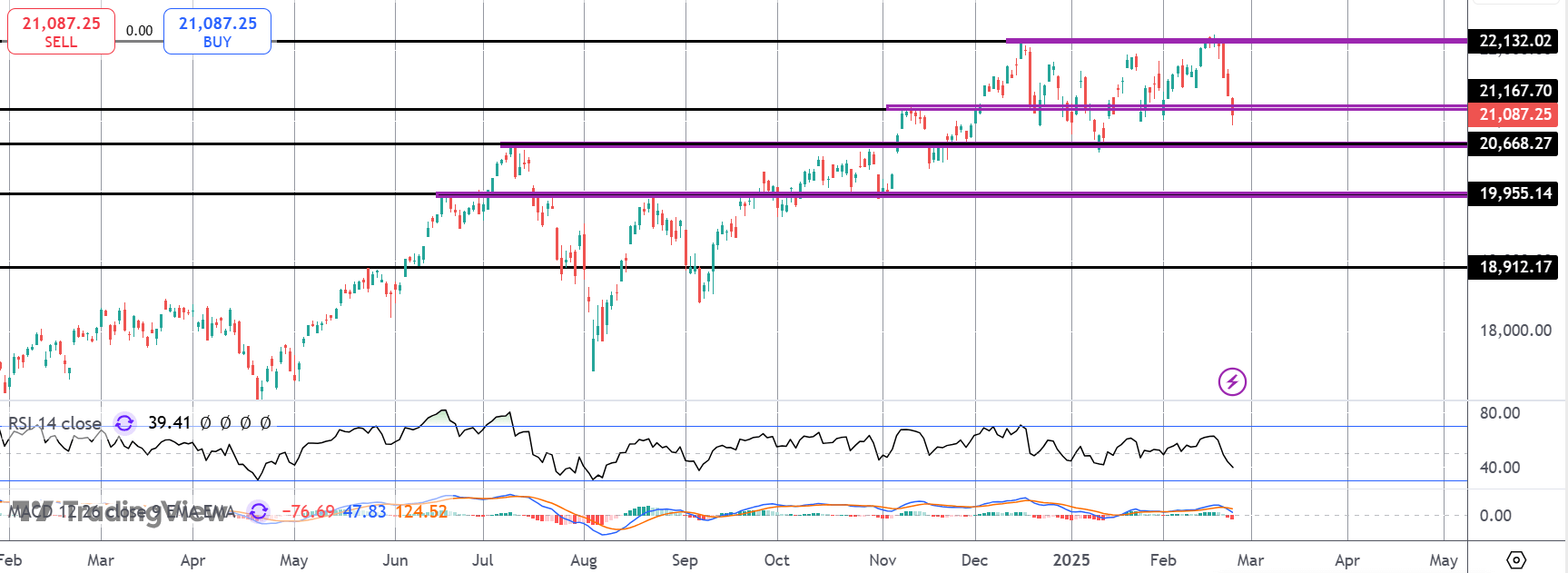

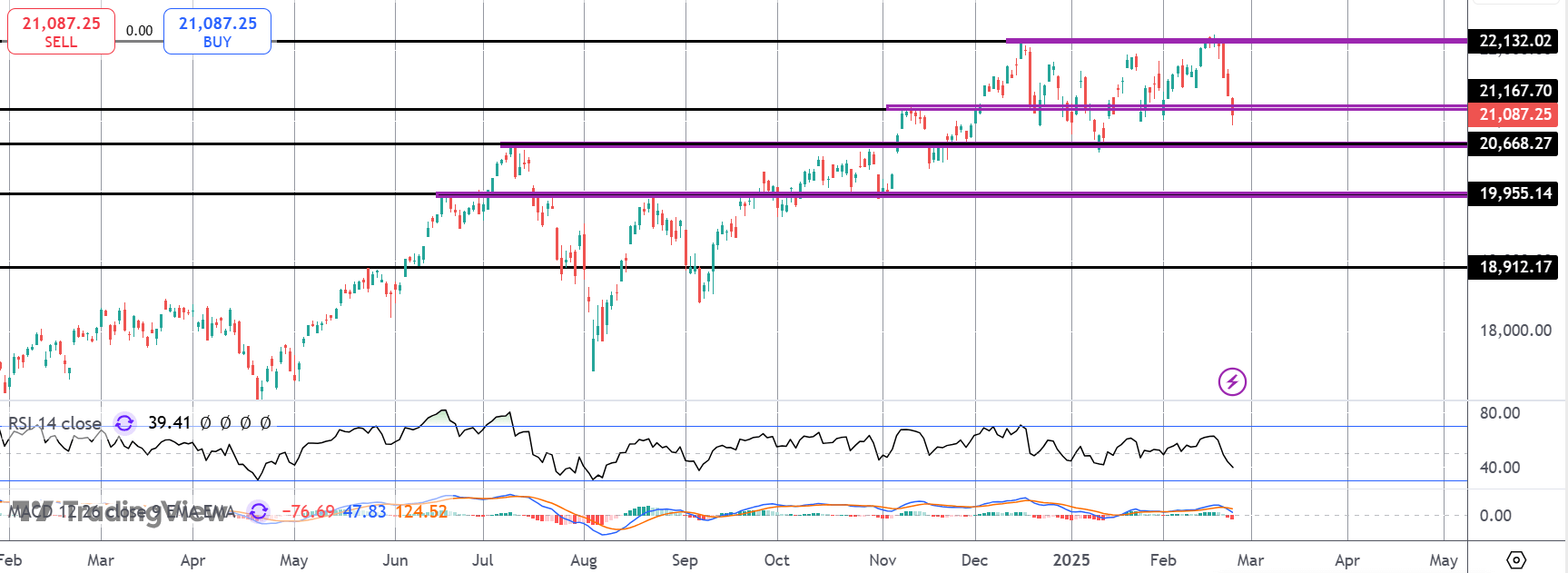

The failure at 22,132.02 has seen the market turning heavily lower with price now testing below support at the 21,167.70 level. The risk now is that a double top is developing. If the 20,668.27 (neckline) is broken, this will be firmly bearish for the index, opening the way for a deeper move towards 19,955.14 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.