Tech Traders Brace For Key Earnings Today

Nasdaq Under Pressure

The NASDAQ is in the spotlight today as tech traders prepare for a slew of earnings from some key players with Spotify, Alphabet and Tesla all due to report today. The index has been lower over recent weeks. Uncertainty around the US elections has seemingly overtaken Fed expectations for now with tech stocks weaker on the back of the recent rise in Trump’s forecasted election chances. A firmer US Dollar on the back of Trump’s assassination attempt and President Biden stepping down from the election campaign have created near-term headwinds for the Nasdaq.

Big Names Posting Earnings Today

On the earnings front, tech bulls will be hoping for some positive results today to help revive bullish sentiment. Yesterday, Verizon shares dropped sharply after the company missed Q2 revenue expectations. The fear is that further underperformance from Tela will add to bearish sentiment among tech stocks currently, dampening the NASDAQ once more.

Tesla

Tesla is on the back of three consecutive quarters of weaker earnings and given the recent news on its US EV market share falling below 50% for the first time, expectations are fairly dim today with both EPS and revenues targets set below the same period a year prior.

Alphabet

However, Alphabet might be able to provide some upside stimulus today. The company has been performing strongly across recent quarters due to AI driven gains. Fresh upside in results today will mark a six consecutive quarter of earnings gains for Alphabet and should help rally tech sentiment.

Technical Views

Nasdaq

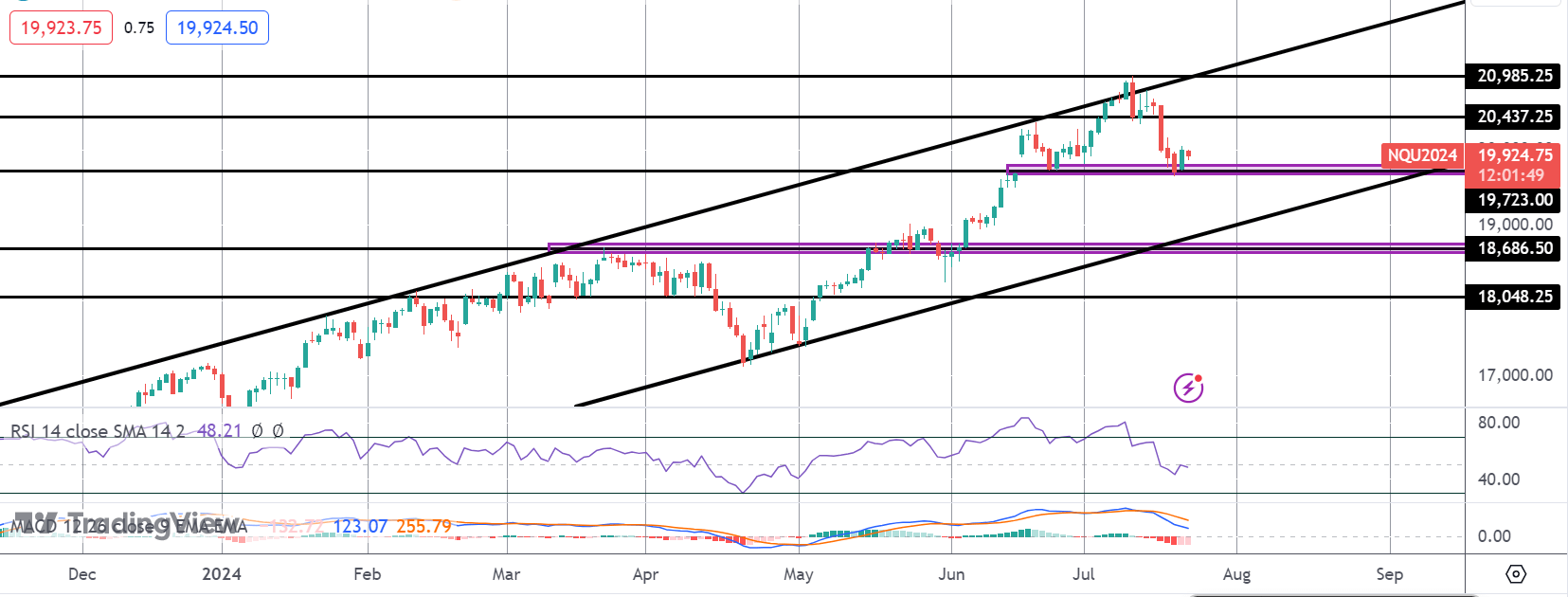

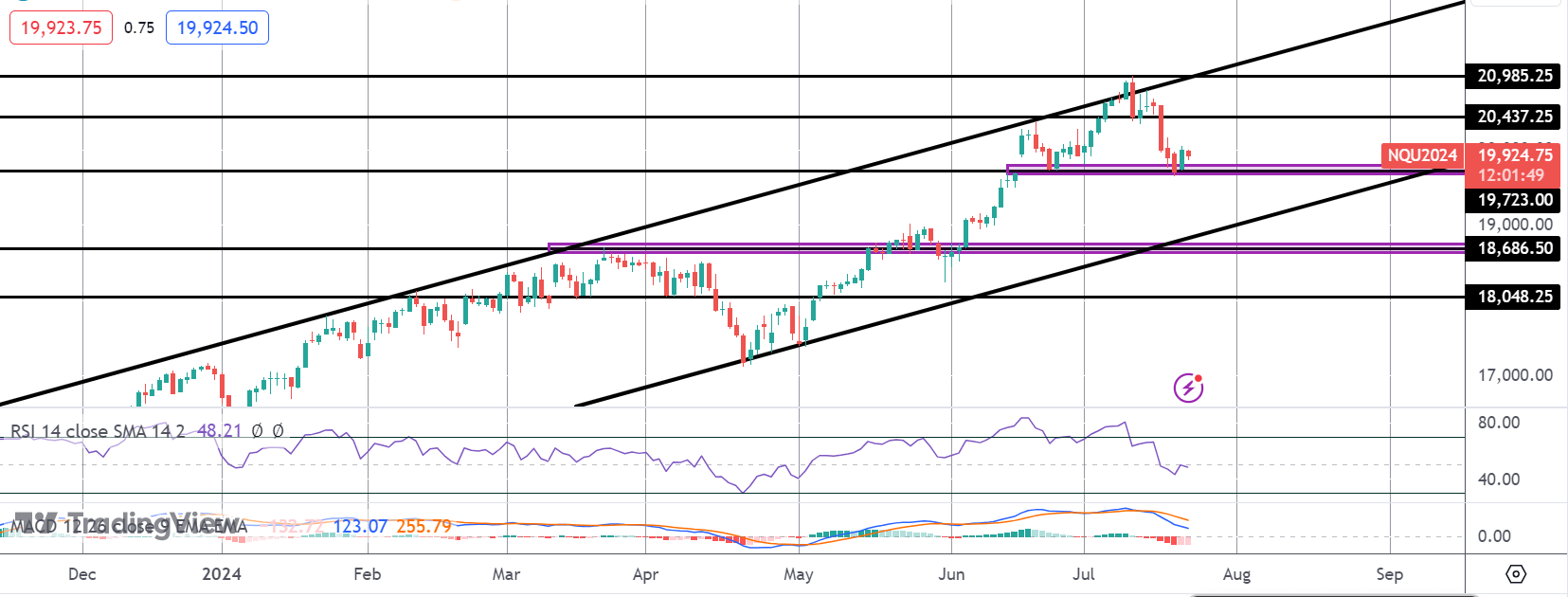

For now, the index is sitting on a ledge of support at the 19,723 level following the correction lower from the bull channel highs. While this area holds, focus is on a fresh push higher. Should we break below, however, focus turns to 18,686.50 next, in line with bearish momentum studies, with the bull channel lows coming in just above.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.