Tariff Deadline Extension Boosts Crude Prices

Crude Higher Midweek

Crude prices remain bid mid-week as traders react to news that Trump has pushed out the tariff deadline to August 1st. The reaction across risk assets suggests that traders feel hopeful the extra time will lead to more negotiations and ultimately produce trade agreements avoiding the need for a broad rise in reciprocal tariffs. Near-term, crude prices look likely to rise further on any positive headlines regarding trade negotiations or trade deals. In particular, traders will be looking for news on an EU, Japan or China trade deals which could be firmly bullish for crude if announced. On the other hand, if no breakthroughs are made and it looks as though tariffs will be increased on August 1st, this should start to weigh on crude as we move through the month.

EIA Inventories Data Due

Looking ahead today, traders will be watching the latest EIA inventories data, expected to show a fresh drawdown of almost 2 million barrels over the last week. If seen, this should add further support for crude near-term. There is some uncertainty ahead of today’s release, however, given the spike in the API inventories figure released yesterday. If a surprise inventories surplus is reported today this could cap the rally in crude for now. Any downside reaction will likely prove short-lived with the broader focus remaining on the tariff story for now.

Technical Views

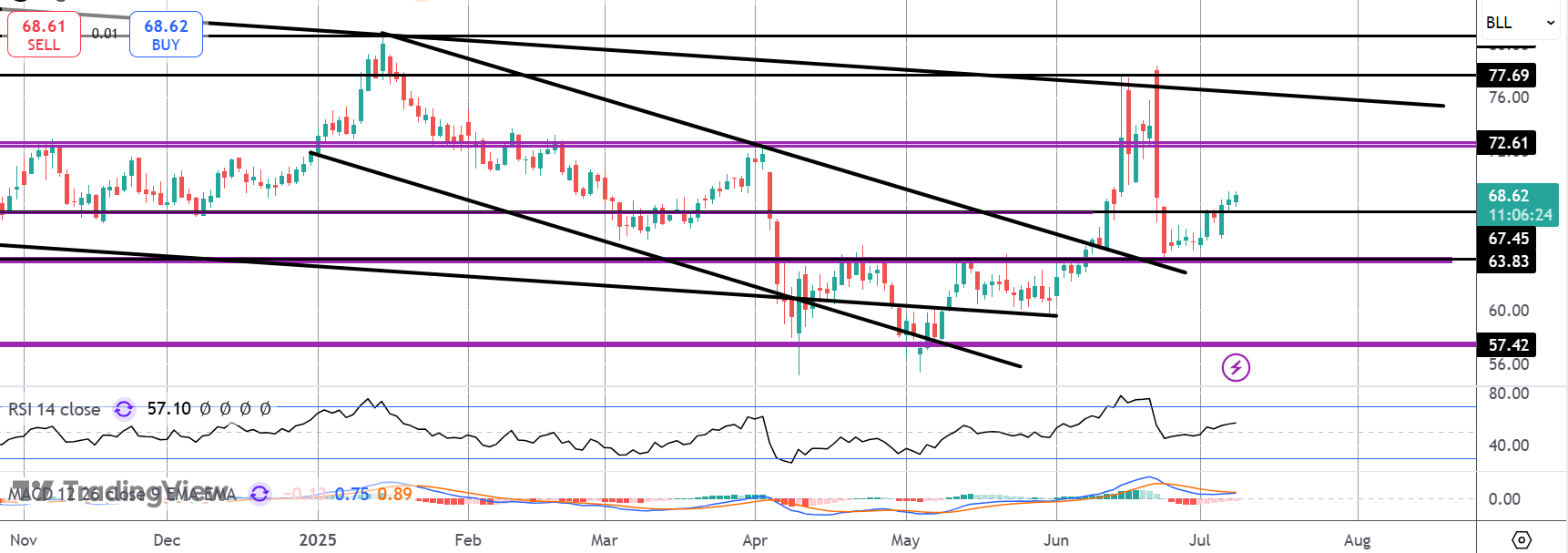

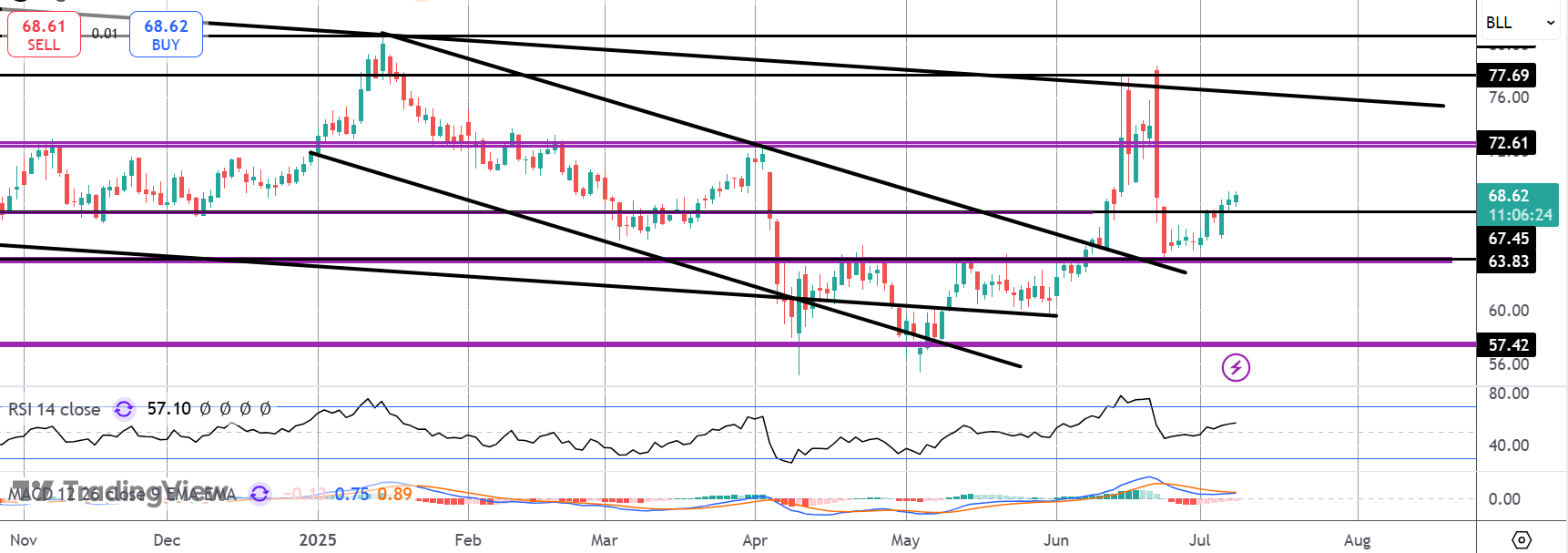

Crude

Crude prices continue to test above the 67.45 level today. While above here, focus is on a move back up towards the 72.61 level next, in line with rising momentum studies readings. Given that price remains within the bear channel, however, downside risks remain and if we see a break of 63.83, 57.42 will be the next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.