Swift Oil Recovery Could be a Trap for Bulls

Oil prices posted one of the strongest daily gains on Monday since March, with Brent benchmark closing 5.5% higher. Part of the rally reflected a surge in demand for risk assets, as doubts that the Fed will rush with hawkish QE announcements mount. These doubts put a dent on brisk USD recovery, which in turn also underpinned commodity prices, which are nominated in USD. The news that China apparently won the battle against the virus announcing zero cases first time since the start of latest outbreak also propped up sentiment in oil market. This improved outlook for reopening of some key parts of the global supply chain, in particular, large seaports in China, which partial closure during the outbreak contributed to supply chain frictions.

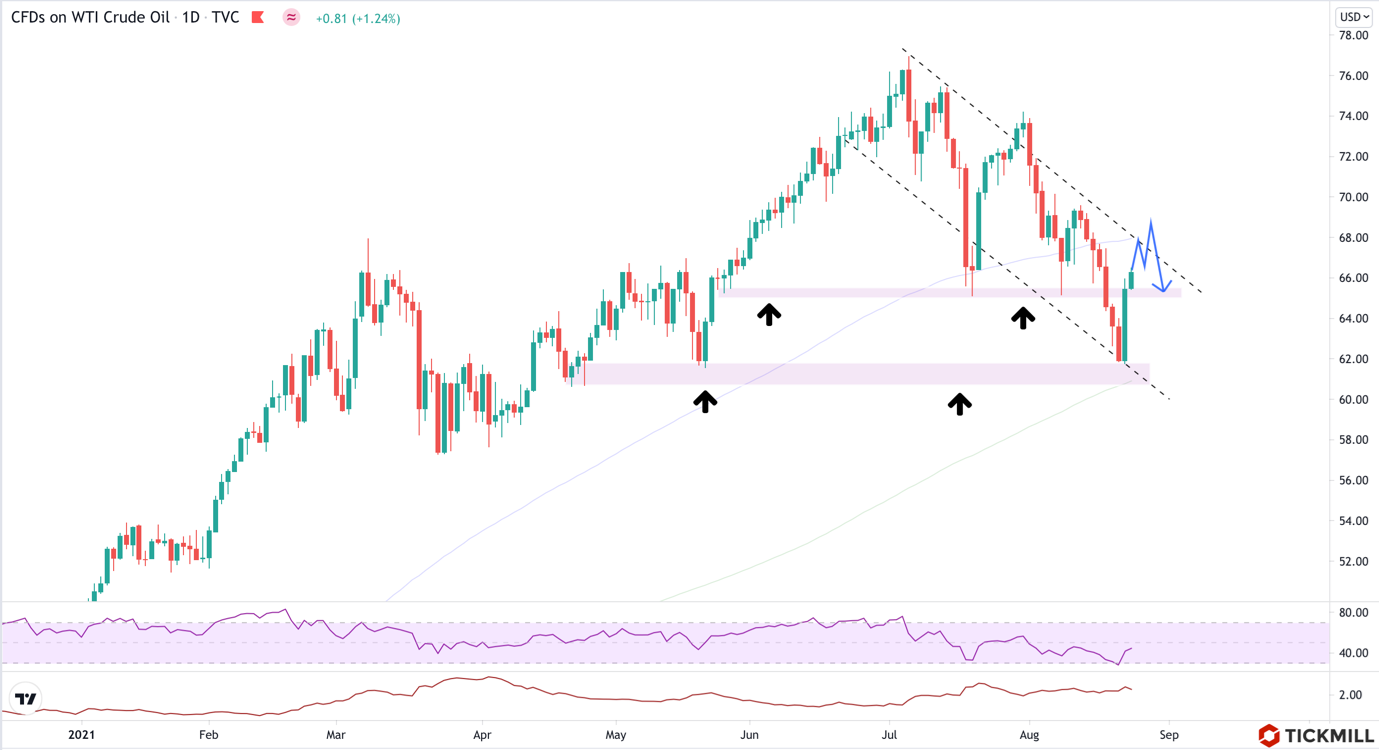

Last week, the market was stormy and the weekly decline in prices was the strongest since last October. A technical rebound this week was also one of the ideas to buy oil.

Despite strong gains on Monday, futures spreads fluctuated in a narrow range. The difference between December and the nearest Brent contract even decreased slightly yesterday:

A fire on a platform in the Gulf of Mexico forced shutdown of 125 oil rigs, which together reduced production by 421K b/d. This is about one fourth of Mexico's production. The operator plans to restore production in the near future, however a delay in the recovery of production will likely to provide additional moderate support for heavy oil grades.

The US Department of Energy announced a sale of 20 million barrels of strategic reserves between October 1 and December 15 this year. While it was assumed that the decision to sell was made due to good market demand and overall tightness, it is actually based on the recently passed US oil reserves phase-out bill.

The Markit report on activity in manufacturing and services sectors in the US in July released on Monday indicated that US expansion could slow in August. The index of activity in services sector eased from 59.9 to 55.2 (forecast 59.5), in the manufacturing sector - from 63.4 to 61.2. This is another argument in favor that the Fed may not rush to change the pace of asset-purchases. Also, this could be a wake-up call for the oil market, as PMIs of other top economies - Germany and the UK - also indicated that rebound of activity both in manufacturing and non-manufacturing sectors eased, which together with US PMI data could worsen outlook for oil demand.

From a technical point of view, oil is in a downtrend and its rise this week should be seen as a rebound from the May support ($62 WTI level). The price recovery may run out of steam near the upper border of the current channel - this is the level of $68 - $68.5 in WTI, after which prices may again poke into intermediate support at $65 mark:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.