Strong Start for Stocks - What to Watch This Week

Markets Cheer Trump Treasury Pick

US Stock markets are beginning the week on a positive footing following news over the weekend that President-elect Trump plans to nominate hedge fund boss Scott Bessent for Treasury Secretary. Bessent is seen as a market friendly candidate with strong experience, likely to reassure investors and avoid the volatility we might have seen around a more left-field choice.

US Data on Deck

Looking ahead this week, traders will be watching a slew of incoming US data with advance GDP, durable goods, weekly jobless claims and core PCE on deck as well as the FOMC meeting minutes on Tuesday. The US Dollar is starting the week a little softer following the heavy we rally we saw through most of last week. However, the greenback looks likely to find its feet and continue higher again unless we see any downside data surprises.

Risks Flows

Traders will also be keeping an eye on the broader geo-political climate and global risk sentiment. Fears of an escalation of Israel’s attacks on Lebanon as well as the risks of an escalation in the Russia/Ukraine war, means that there are plenty of downside risks for stocks. Any negative headlines linked to either situation are likely to drive a move back into safe haven buying, weighing on stocks again.

Technical Views

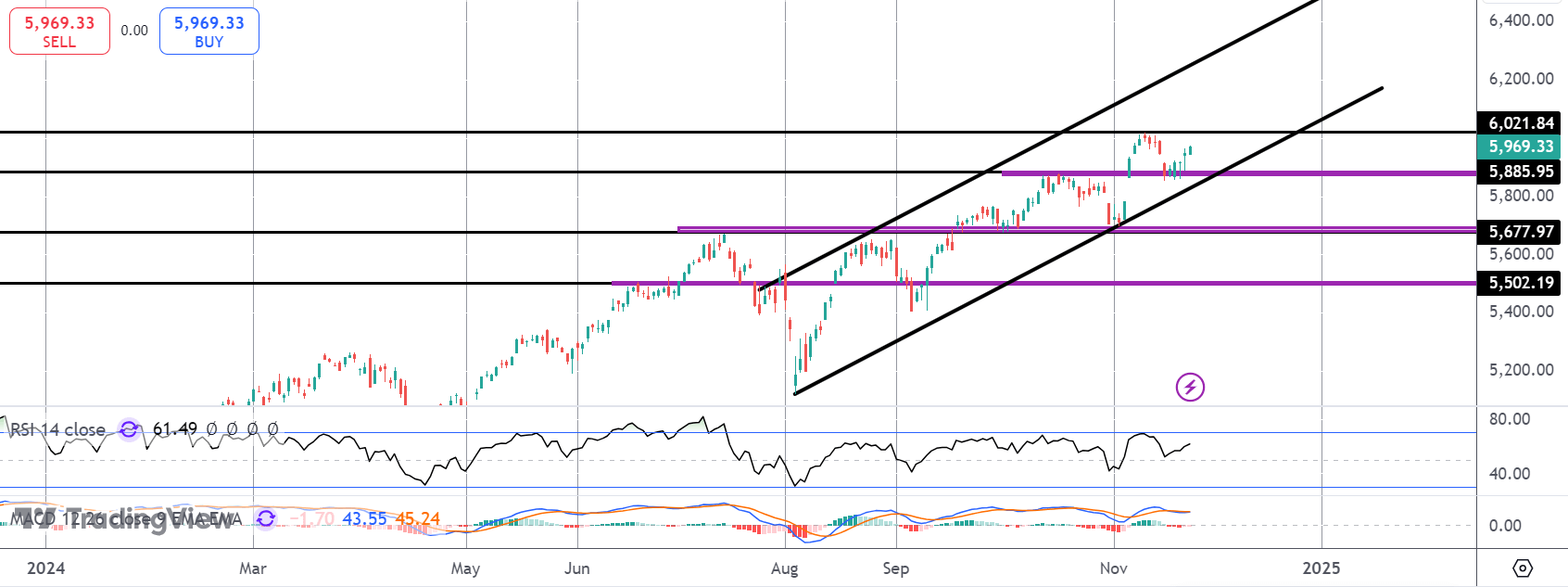

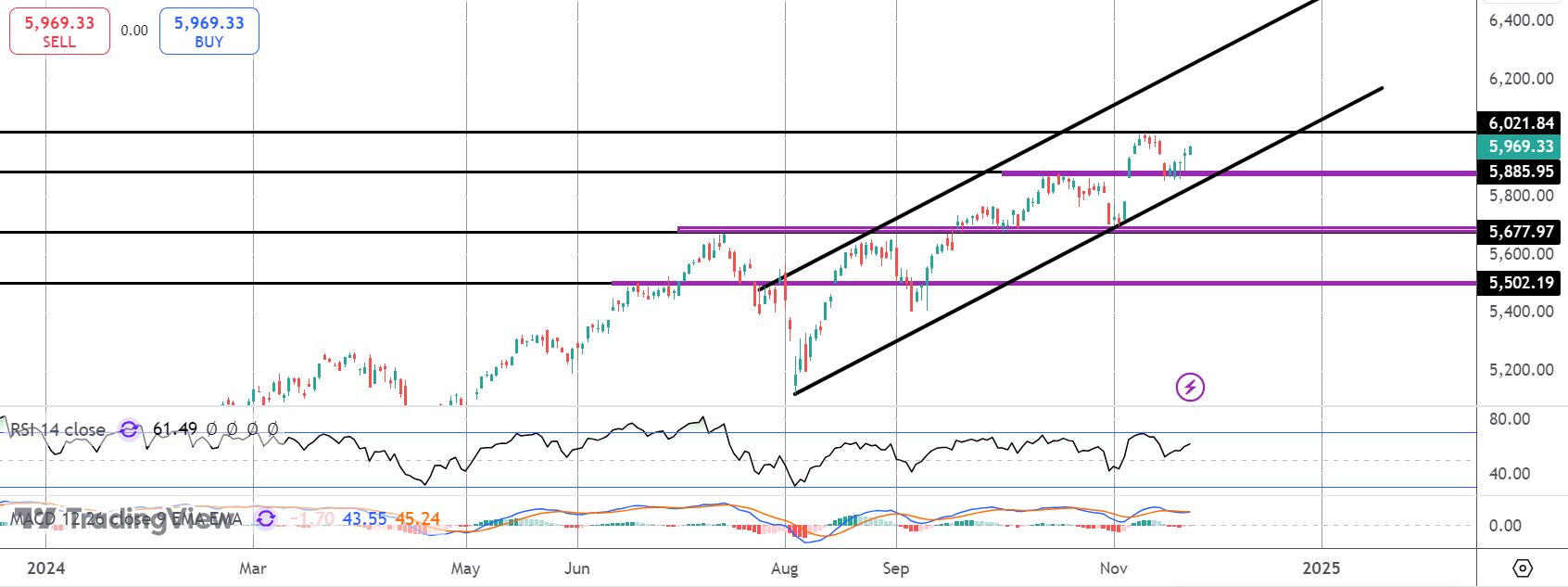

S&P 500

The correction lower in the S&P has found fresh support into the 5,885.95 level with the index now turning higher again. Still within the bull channel, focus is on a break of the 6,021 highs and a continuation higher. To the downside, 5,677 remains key support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.