SP500 LDN TRADING UPDATE 25/03/25

WEEKLY & DAILY LEVELS

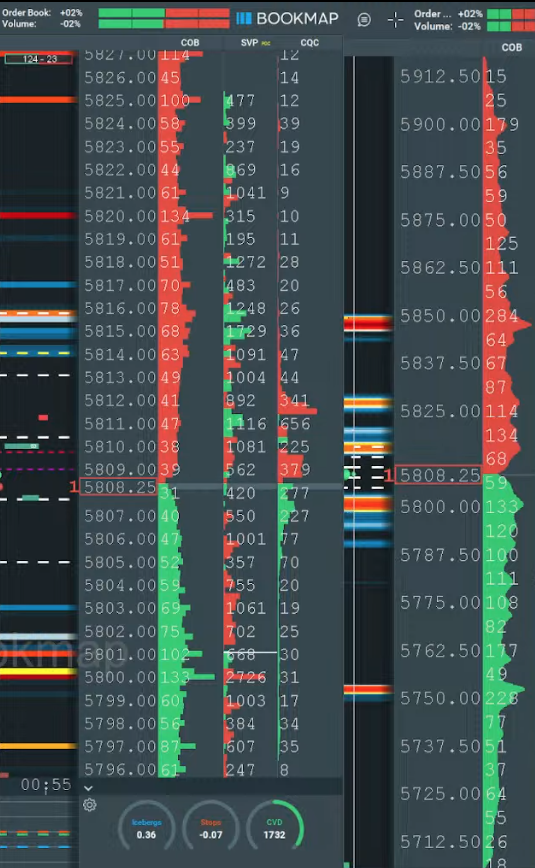

WEEKLY BULL BEAR ZONE 5690/5700

WEEKLY RANGE RES 5850 SUP 5590

DAILY BULL BEAR ZONE 5770/80

DAILY RANGE RES 5855 SUP 5770

2 SIGMA RES 5955.5 SUP 5677

5640 MARCH CONTRACT GAP

WEEKLY ACTION AREA VIDEO

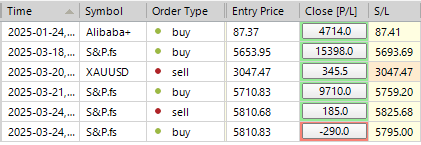

TODAY'S TRADES & TARGETS

LONG ON TEST/REJECT DAILY BB ZONE TARGET DAILY/WEEKLY RANGE RES

SHORT ON TEST REJECT WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: RELIEF RALLY

FICC and Equities | 24 March 2025

Market Performance:

- S&P 500: +176bps, closing at 5,767 with MOC buy flows of $1.2B.

- Nasdaq 100 (NDX): +216bps, closing at 20,180.

- Russell 2000 (R2K): +245bps, closing at 2,125.

- Dow Jones Industrial Average: +142bps, closing at 42,583.

Volume & Volatility:

- Total volume: 13.4B shares traded across U.S. equity exchanges (below YTD daily avg of 15.5B shares).

- VIX: -9%, closing at 17.48.

Other Asset Classes:

- Crude Oil: +139bps, settling at $69.23.

- U.S. 10-Year Yield: +9bps, now at 4.34%.

- Gold: -25bps, closing at $3,013.

- DXY (Dollar Index): +20bps, ending at 104.29.

- Bitcoin: +394bps, surging to $88,466.

Market Sentiment:

A broad-based "everything rally" followed weekend reports indicating that Trump’s April 2nd reciprocal tariff announcement would be narrower than expected, with some countries exempted. Cleaner positioning fueled a squeeze in growth-oriented and shorted market segments. High Beta Cyclicals, Meme Stocks, and Most Shorted names surged 400bps+. Hedge Fund (HF) VIP longs underperformed Most Shorted names by 228bps.

The S&P 500 recaptured its 200-day moving average (5,752) for the first time since March 7. However, activity remained subdued, as today marked the third-lowest volume session of the year.

Institutional Activity:

- HF buy skew reached its highest level since February 17, ranking in the 86th percentile on a 52-week basis.

- Long-Only (LO) investors turned net buyers (+$500M) after four consecutive weeks of selling.

Despite some buying, conviction on the long side remains limited, with investors navigating the market by adjusting short books. Notably, U.S.-listed ETF shorts decreased by 4%—the largest week-over-week covering in nearly four months—led by Small Cap, Large Cap, Corporate Bond, and Sector ETFs.

Flow of Funds:

- Buybacks are entering a blackout period, reducing demand by ~30%.

- Tailwinds expected from pensions (+$30B quarter-end rebalancing) and retail investors (last week’s buying resembled the surge seen in late January/early February).

- Potential CTA buying could emerge if the S&P 500 breaks above 5,900, with convexity to the upside in a strong rally.

Derivatives Market:

A quiet start to the week as volatility declined, with the VIX hitting its lowest level in a month. Most clients cleaned up positions, with some profit-taking in short-dated QQQ call spreads. Additionally, there was notable demand for upside in FCX, including a buyer of 50K May $50 calls. Last Friday’s expiry saw $2.8T in SPX notional roll off, resetting SPX open interest to its lowest level in nearly two years. Dealer gamma positioning remains flat, while the SPX ATM straddle through Friday’s close is pricing in just a 1.35% move.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!