SP500 LDN TRADING UPDATE 22/7/25

SP500 LDN TRADING UPDATE 22/7/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! CASH US500 EQUIVALENT LEVELS SUBTRACT ~30 POINTS***

WEEKLY BULL BEAR ZONE 6300/6280

WEEKLY RANGE RES 6410 SUP 6260

DAILY BULL BEAR ZONE 6310/00

DAILY RANGE RES 6407 SUP 6290

2 SIGMA RES 6466 SUP 6231

GAP LEVELS 6147/6077/6018/5843/5741/5710

VIX DAILY BULL BEAR ZONE 18.75

DAILY MARKET CONDITION - ONE TIME FRAMING HIGHER - 6341

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signaling a strong and consistent upward movement.

TRADES & TARGETS

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: JULY 21, 2025 | 8:25 PM UTC

Market Performance:

S&P 500: +14bps, closing at 6,305 with MOC flow of -$500m to SELL.

NASDAQ (NDX): +50bps, closing at 23,180.

Russell 2000 (R2K): -28bps, closing at 2,245.

Dow Jones: -4bps, closing at 44,323.

Volume: 19.8bn shares traded across all U.S. equity exchanges, exceeding the YTD daily average of 16.8bn shares.

VIX: +146bps, closing at 16.65.

Crude Oil: -50bps, closing at $67.

U.S. 10-Year Yield: -3bps, now at 4.38%.

Gold: +155bps, closing at $3,410.

DXY (Dollar Index): +60bps, closing at 97.89.

Bitcoin: -90bps, closing at $117,059.

Session Highlights:

The trading session was relatively uneventful, characterized by low volatility and a steady melt-up in major indices. Despite losing momentum near the close, the NASDAQ and S&P 500 advanced ahead of a busy earnings week. Underlying market dynamics revealed significant factor volatility and aggressive retail participation. Bond yields eased following Japan's election results, boosting early-session sentiment in lower-quality sectors.

A notable observation from Brian Garett: calls accounted for ~70% of total market volume at 10 AM — the highest since the 2021 "meme stock" era.

Systematic Demand and Buybacks:

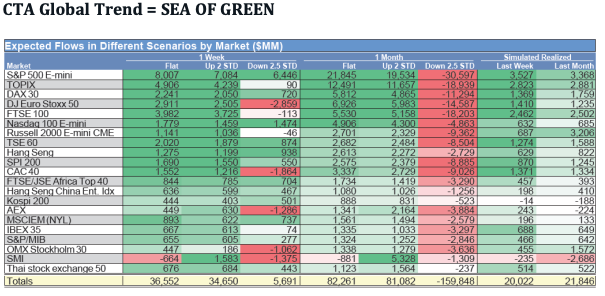

Systematic flows remain strong, with an estimated >$80bn in global index futures demand over the next month. Buybacks are set to resume next Monday (July 28), with ~40% of S&P 500 companies expected to enter open windows post-earnings within 1-2 days. The Federal Reserve is in blackout mode ahead of its July 30 meeting.

Desk Activity:

Our floor rated a 4/10 in activity levels but finished +150bps better to buy versus the 20-day average of +73bps.

LOs (Long-Only Funds): Net buyers (+$1bn), driven by demand in mega-cap tech.

Hedge Funds: Slight net sellers, with small supply across financials, energy, and utilities.

Single Stock Highlights:

VZ: +4% on earnings beat and guidance raise.

XYZ: +7% following S&P 500 inclusion.

NXPI: -4% post-earnings beat and guide above, continuing its streak of post-report declines (4 quarters in a row).

Upcoming Focus:

GOOGL: Rated 6.5/10 on our positioning scale. Length has been reduced throughout the year, particularly amid "AI scare" sell-offs. GOOGL is a material underweight for LO and Long/Short funds. Consensus expects a "beat and fade" reaction, with the August DOJ ruling potentially limiting upside post-earnings.

TSLA: Rated 3/10 on positioning scale. 1Q delivery numbers (384K, better than expected) are known, but expectations are for FY guidance revisions. Risks to gross margins (consensus 16.6%) remain, as better deliveries may have pressured profitability. Short interest is elevated (~80M shares), similar to levels seen last quarter. Retail activity is expected to dominate trading, while institutions remain slightly short.

Derivatives Market:

Client activity was muted, with notable flows in China upside via FXI call spreads. The S&P straddle implied move was just 0.31% — one of the lowest 1-day levels in over five years. Interest in downside hedging is emerging as costs continue to decline.

NVDA: Volatility reset to multiyear lows despite the stock reaching new highs. Attractive hedging opportunities exist in Aug 1st contracts, capturing earnings updates from megacap tech names (GOOGL, META, AMZN, MSFT), expected to address capex and AI strategies.

Economic Calendar:

Key releases this week include:

Fed Manufacturing Data (July 22)

Existing Home Sales (July 23)

PMI Composite & New Home Sales (July 24)

Durable Goods Orders (July 25)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!