SP500 LDN TRADING UPDATE 20/8/25

SP500 LDN TRADING UPDATE 20/8/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! CASH US500 EQUIVALENT LEVELS SUBTRACT ~15 POINTS***

WEEKLY BULL BEAR ZONE 6410/00

WEEKLY RANGE RES 6560 SUP 6380

DAILY BULL BEAR ZONE 6450/60

DAILY RANGE RES 6495 SUP 6376

2 SIGMA RES 6555 SUP 6314

VIX DAILY BULL BEAR ZONE 18.50

DAILY MARKET CONDITION - ONE TIME FRAMING DOWN 6476

One-Time Framing Down (OTFD): This describes a market trend where each successive bar forms a lower high, indicating a pronounced and steady downward movement.

TRADES & TARGETS

LONG ON TEST/REJECT WEEKLY BULL BEAR ZONE TARGET DAILY BULL BEAR ZONE

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TARGET WEEKLY RANGE SUP

LONG ON TEST/REJECT WEEKLY RANGE SUP TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

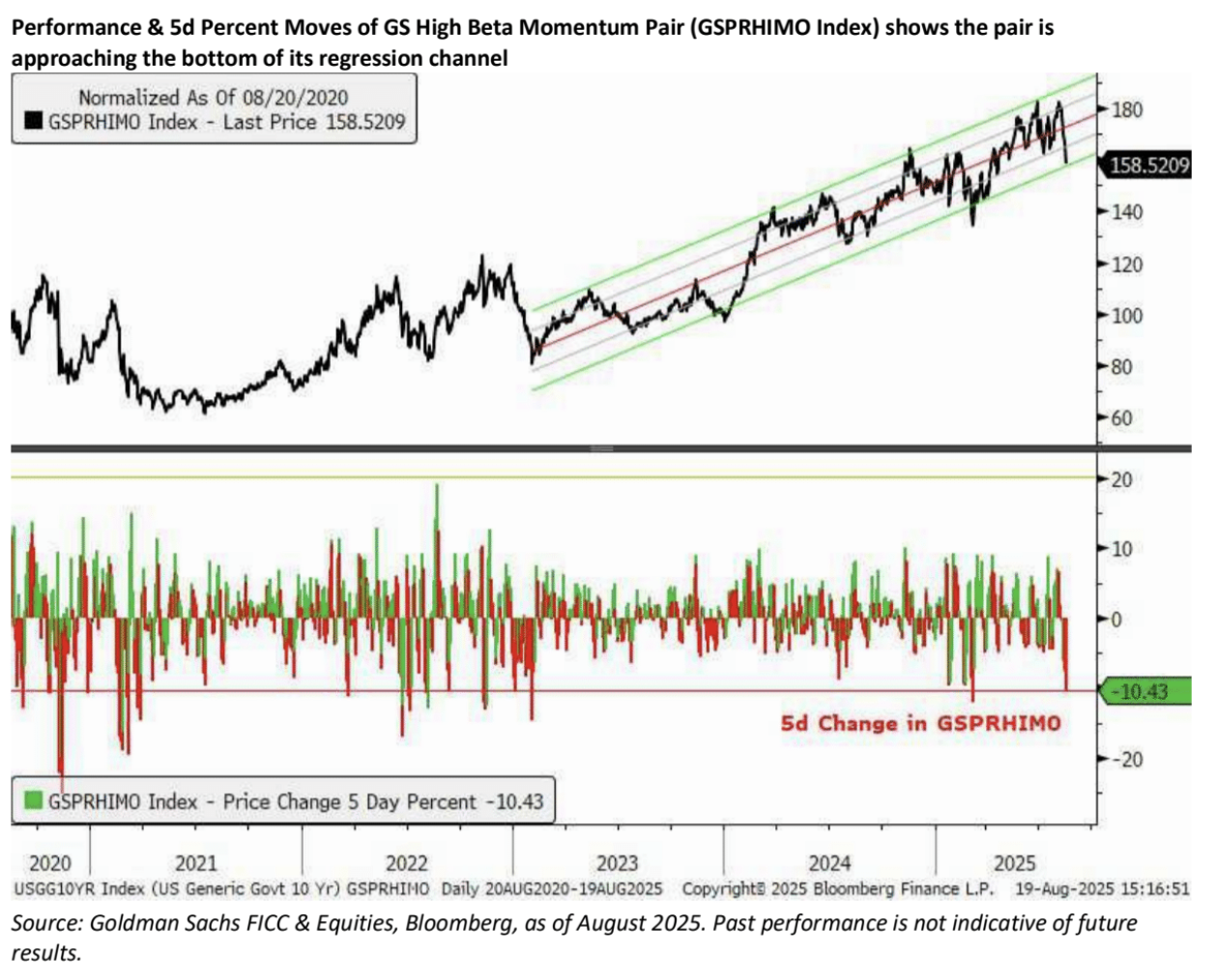

GOLDMAN SACHS TRADING DESK VIEWS

Today's decline in high momentum stocks is bringing our High Beta Momentum Pair (GSPRHIMO) closer to key support levels. The sell-off began with short positions, but this week's trading indicates that the long positions are now carrying the weight, especially as sectors like AI are feeling the effects of this shift. Since its peak on August 11, High Beta Momentum has dropped approximately 13%, with more than 10 percentage points of that decline occurring in the past five days. The skew in sector performance and the cyclical versus defensive bias in momentum is inflicting greater losses on GSPRHIMO, whereas pure momentum (GSPUMOMO) and Momo excluding AI (GSPUMOXX) have seen less severe underperformance. Analyzing the last ten instances when the high beta momentum pair fell by over 10% in five days, we observe that 80% of the time, there was positive performance in the subsequent week. The median return following a five-day decline is 4.5% over one week and 11.05% over the next month. With technical support from the regression line, the 200-day moving average, and RSI, this might present a favorable entry point into the historically rewarding factor, barring any prolonged sell-off in AI driven by tech earnings next week. It's also noteworthy that momentum had a tough day in Europe (GSP3MOMO Index), primarily due to the plummet in EU Defense. The performance and five-day percentage movements of the GS High Beta Momentum Pair (GSPRHIMO Index) indicate that the pair is nearing the bottom of its regression channel.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!