SP500 LDN TRADING UPDATE 20/03/25

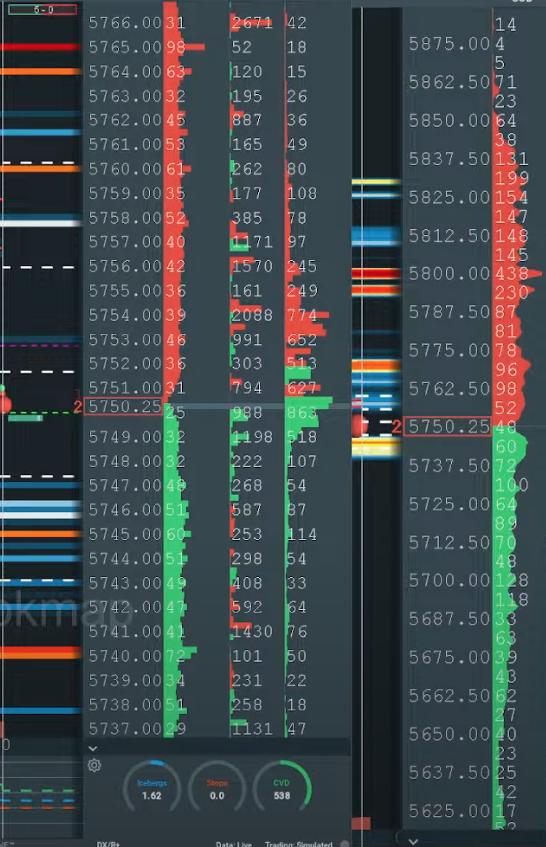

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5650/60

WEEKLY RANGE RES 5830 SUP 5550

DAILY BULL BEAR ZONE 5735/25

DAILY RANGE RES 5795 SUP 5711

2 SIGMA RES 5893 SUP 5613

5640 MARCH CONTRACT GAP

WEEKLY ACTION AREA VIDEO

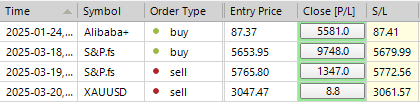

TODAY'S TRADES & TARGETS

LONG ON TEST/REJECT DAILY BB ZONE TARGET DAILY>WEEKLY>2 SIGMA

SHORT ON TEST REJECT DAILY/WEEKLY RANGE RES TARGET DAILY BB ZONE

LONG ON TEST REJECT OF 5640 TARGET DAILY RANGE SUP

SHORT BELOW 5640 TARGET 2 SIGMA> WEEKLY RANGE SUP

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: FOMC

Market Performance Recap:

- S&P 500: +1.08% closing at 5,675, with a MOC sell imbalance of $2.3B.

- Nasdaq 100 (NDX): +1.30% at 19,736.

- Russell 2000 (R2K): +1.51% at 2,080.

- Dow Jones: +0.92% at 41,964.

- Volume: 13.48 billion shares traded across U.S. equity exchanges, below the YTD daily average of 15.5 billion.

Volatility & Commodities:

- VIX: -8.25%, closing at 19.9.

- Crude Oil: +0.45%, ending at $67.20.

- Gold: +0.37%, closing at $3,046.

- U.S. 10-Year Yield: -4 bps at 4.24%.

- DXY (Dollar Index): +0.26% at 103.51.

- Bitcoin: +4.52%, trading at $85,745.

FOMC Meeting Takeaways:

The much-anticipated FOMC meeting concluded with little surprise. The committee maintained a consistent projection of two rate cuts for 2025. Fed Chair Powell’s commentary struck a reassuring tone, stating, "Michigan inflation expectations are an outlier, hard data remains solid, and while recession risks have increased, they are still not high." This sentiment provided the market with a temporary rally catalyst, pushing the S&P 500 above Monday’s highs and bringing the 200-day moving average (5,746) back into focus. The day’s price action, particularly pre-FOMC, felt driven by short squeezes and pension rebalancing flows, even though month-end is still a week away.

Sector & Style Leadership:

- Top Performers: Bitcoin-sensitive stocks, high-beta 12-month winners, non-profitable tech, liquid most-shorted names, and retail-favored baskets all gained over 2%.

- Cyclicals vs. Defensives: The largest single-day percentage rally YTD (+1.68%).

Market Liquidity & Flows:

Despite a post-FOMC activity boost, total market volumes hit YTD lows, with just 13.5 billion shares traded (vs. the YTD average of 15.5 billion). Liquidity in the S&P 500 remains thin, with top-of-book liquidity hovering around $2 million, far below the 1-year average of ~$13 million.

- U.S. Pensions: Modeled to buy $32 billion in equities for quarter-end (92nd percentile for buy/sell estimates over the past three years).

- CTAs: Now a bullish factor, with projected purchases of $8.3 billion on a flat 1-week tape and $22 billion on a flat 1-month tape. Interestingly, CTA flows highlight a significant rotation out of U.S. equities (-$34 billion short) into European equities (+$52 billion long), marking the largest spread on record.

FOMC Decision Details:

- Rates: Target rate unchanged at 4.25%-4.50%.

- Balance Sheet: Monthly Treasury runoff cap reduced from $25 billion to $5 billion, slowing the pace of balance sheet reduction (a positive for equities).

- Economic Projections: The Summary of Economic Projections (SEP) reflected higher core inflation and unemployment forecasts for 2025, alongside lower GDP growth projections for 2025-2027.

Powell’s press conference further reassured markets, emphasizing that while recession fears have risen, they remain "not high."

Trading Floor Insights:

Activity levels on the trading floor were moderate, rated a 5/10.

- LOs (Long-Only Funds): Net sellers (-$2 billion) for the second consecutive day, with concentrated selling in Industrials and Healthcare. LOs were net buyers in Energy and Macro products.

- Hedge Funds (HFs): Flows were balanced, finishing ~$300 million net for sale. HFs sold Financials and Macro Products.

Derivatives Market:

Ahead of the FOMC meeting, the SPX straddle implied a 1% move, slightly elevated compared to the average of ±0.8% for the last four meetings. Post-meeting, the market rallied, volatility collapsed, and the VIX fell below 20 for the first time in two weeks. The straddle for the remainder of the week stands at 1.28%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!