S&P Futures Jump on April 2nd Tariff Optimism

Reduced Tariff Risks?

US stock prices are recovering higher this week, bolstered by optimism that Trump will go for a more limited tariff approach on April 2nd. ,Trump's so-called 'tariff liberation day'. Stories run by Bloomberg and WSJ suggest that Trump will take a more concentrated set of actions with some countries to be exempt from tariffs and others to receive smaller tariffs than previously signalled. The news has helped drive a wave of better risk sentiment this week with equities prices rallying across the board. The S&P futures are now back up to their highest level since early March following a gap higher at the open yesterday and subsequent rally.

Fed Easing Expectations

The market is also being supported by dovish signalling from the Fed. At the recent March FOMC, the bank adjusted its rates forecast lower with two cuts now projected this year, down from one prior. Additionally, the prospect of weaker tariff action from Trump reduces upside inflation risks and keeps near-term rate-cut chances intact. The market is still currently pegging June for the next Fed rate cut and while this remains the case, stock prices should find room to continue higher near-term, provided we don’t see a spike higher in USD.

Technical Views

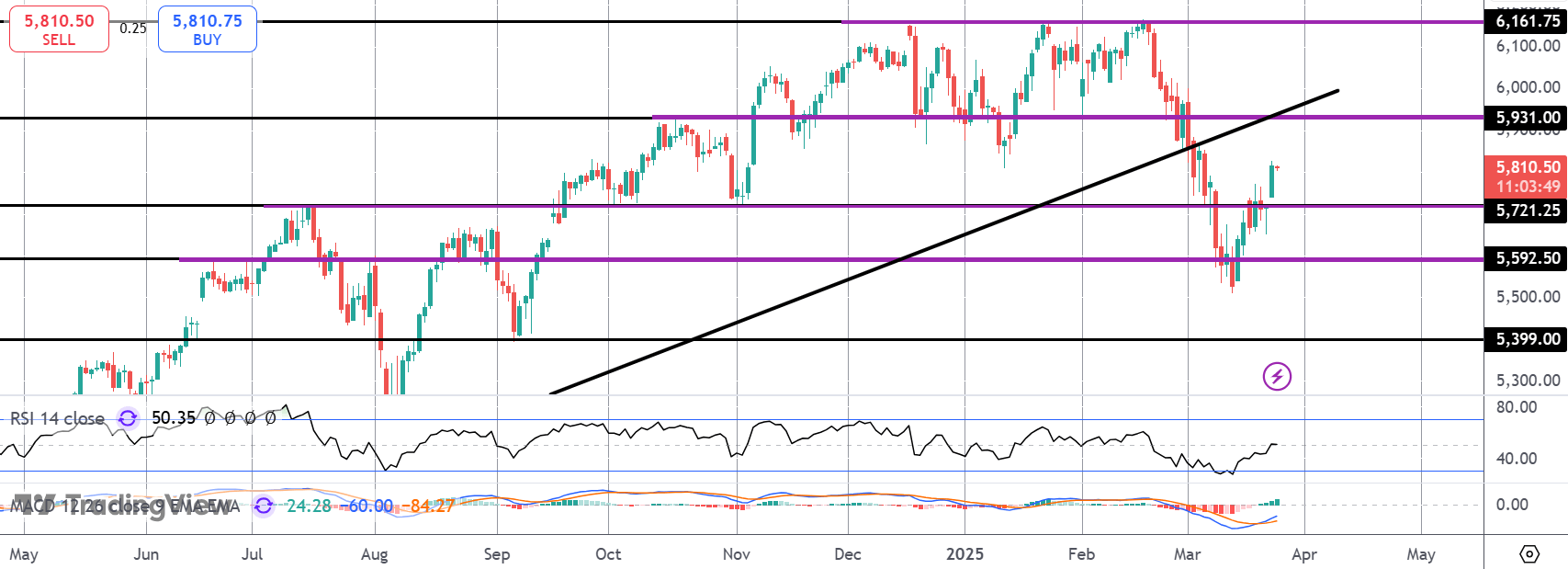

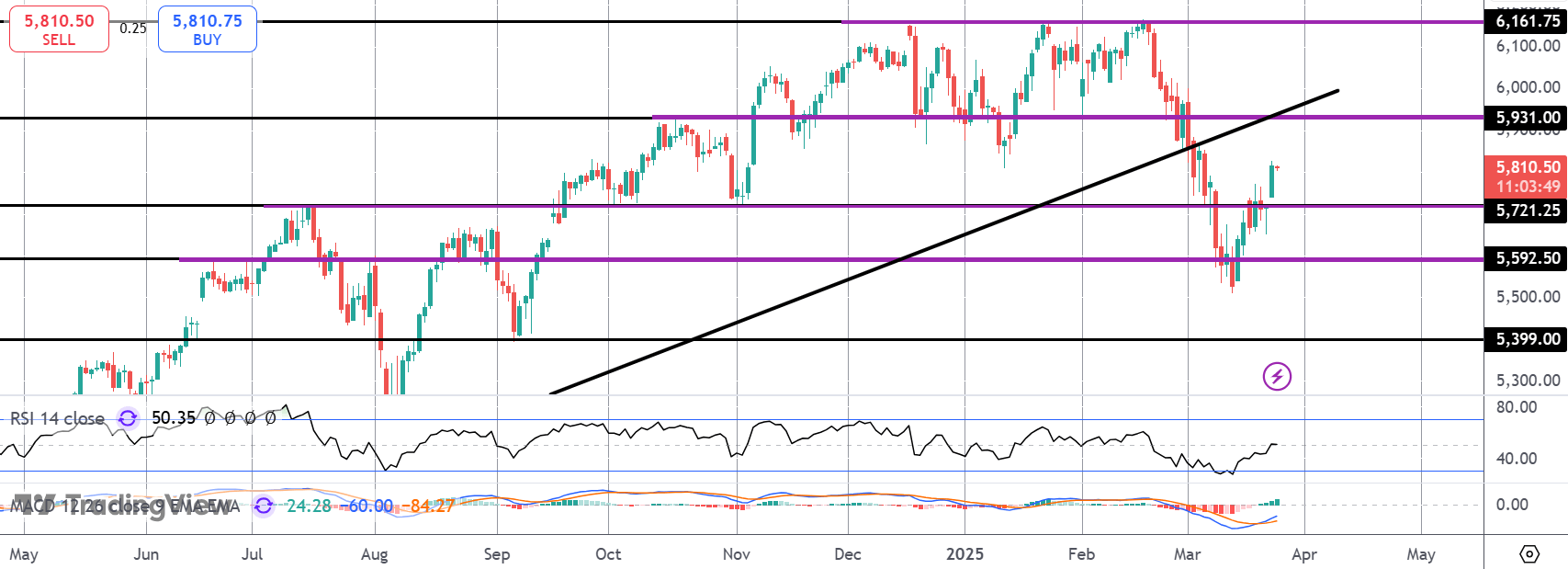

S&P Futures

The rally of the 5,592.50 level has seen the market breaking back above 5,721.25. With momentum studies bullish now, focus is on a continuation higher and a test of the 5,931 level next and retest of the broken bull trend line. This will be a key hurdle for bulls, putting focus back on YTD highs if overcome.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.