Silver Reverses From 12-yr Highs

Silver Falls from Highs

Silver prices continue to slide from recent highs on Thursday as market uncertainty, fuelled by rising tensions in the Middle East and a shifting outlook on the Fed, drive trader sentiment. Earlier this week, silver hit its highest level since 2012, supported by a blend of safe-haven demand, strong industrial usage, and a tightening supply outlook. However, developments through the week have seen silver shedding some these gains.

US Planning Iran Attack?

The mood in the market soured through the back of the week with reports suggesting the US may be preparing for military action against Iran. The news is stoking concerns about wider regional instability and potential disruptions. Despite this, USD has emerged as the preferred safe haven with silver prices tracking the move lower in gold for now.

Fed Impact

USD has also been boosted this week by the Fed which kept interest rates on hold this month and adopted a more cautious policy stance. Despite softer inflation recently, Powell flagged upside risks, particularly the potential for President Trump’s tariffs to drive up inflation and complicate the economic picture. Against this backdrop the Fed said that it would need to be more cautious with any future policy adjustments. If USD remains supported near-term this should keep silver prices anchored lower as gold remains offered.

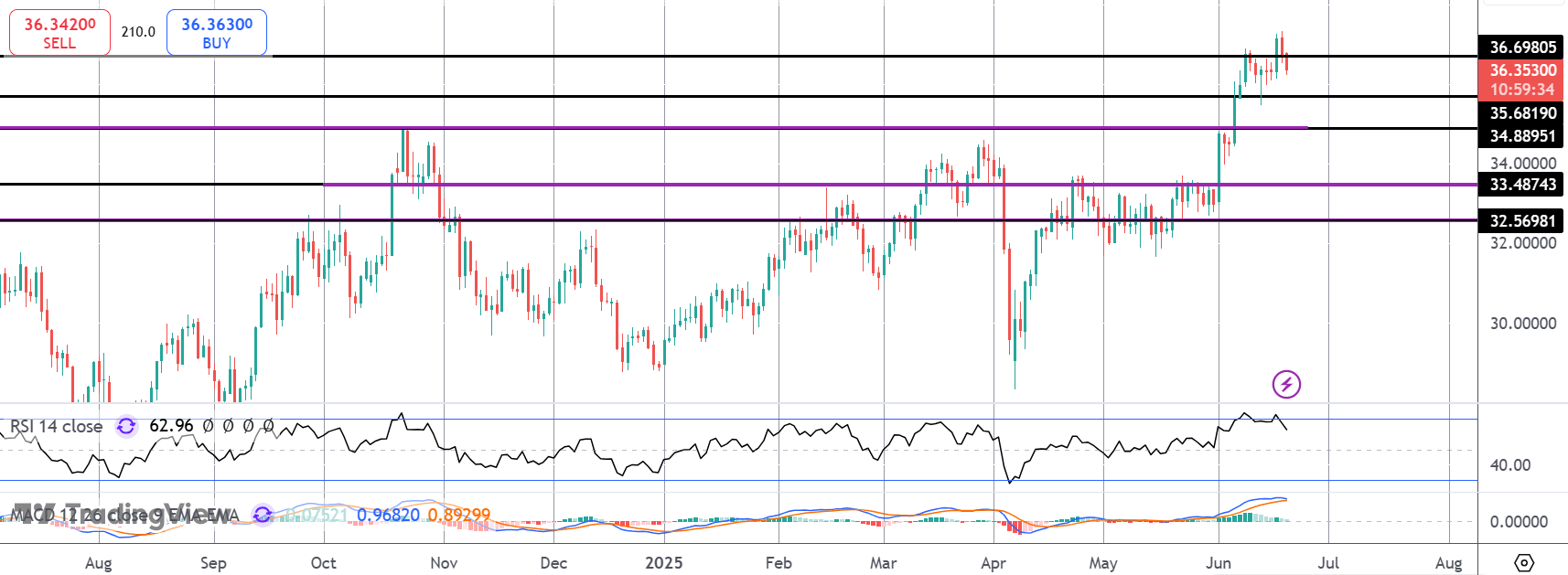

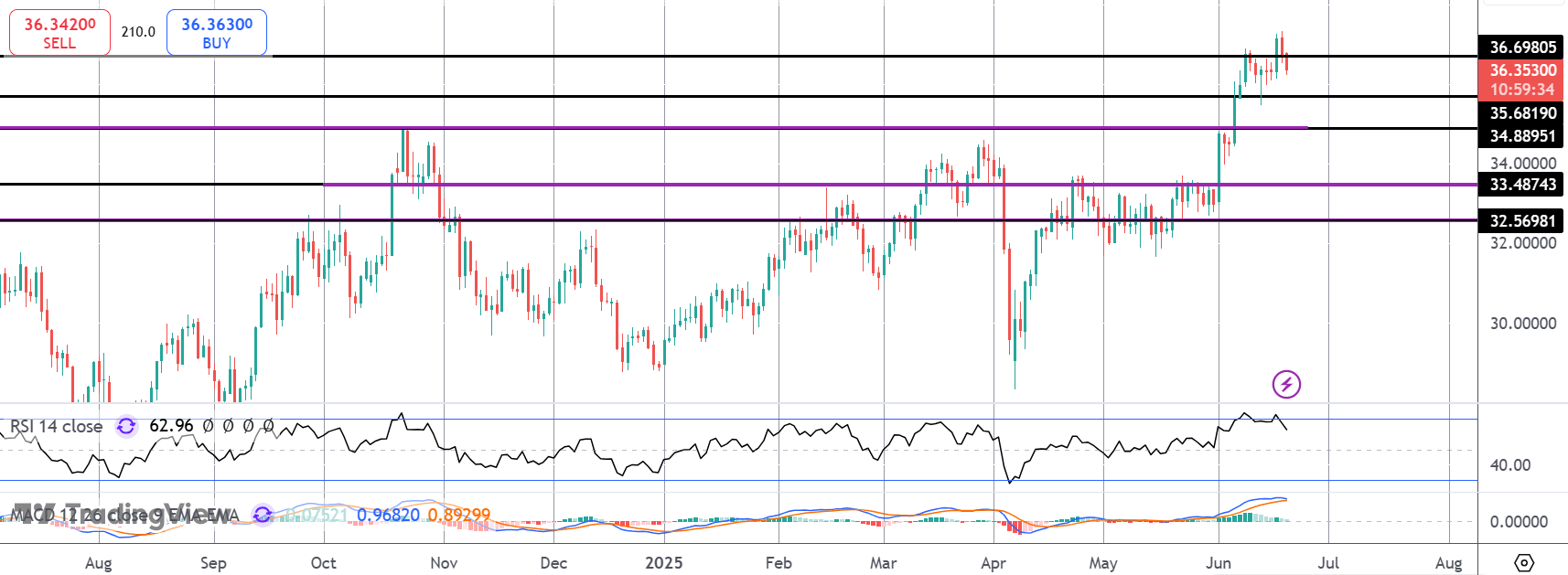

Technical Views

Silver

The rally in silver has stalled for now with price reversing back under the 36.6980 level. While below here and with momentum studies turning south, focus is on a deeper correction with 35.6819 the next support to note. Bulls will need to defend this level to keep the broader bullish bias intact and prevent a deeper drop towards 34.8895.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.