Silver Rallying On Rising Fed Rate-Cut Bets

Silver Pushing Higher

Silver prices continue to grind higher today with the recovery in the futures market striving to gain further ground. The push higher is being driven mainly by an increasingly dovish market view on the Fed. Following last week’s NFP shock, which saw the reading print sub 100k jobs with two heavy, prior downward revisions, the market has moved to price in a more than 80% chance of a Fed rate cut in September with pricing for a further cut by year end rising now too. Against this backdrop, silver prices should continue to firm provided the narrative doesn’t change. Indeed, any further US data weakness and/or dovish Fed commentary should strengthen the move, putting focus on a return to YTD highs in silver.

Fed Easing Expectations

The shift in market outlook on the Fed is an important development for silver prices. Speaking yesterday, Fed’s Daly voiced her opinion that risks are now skewed towards two Fed cuts this year, beyond just the single cut the Fed itself is currently projecting. Ahead of last week’s jobs numbers, dovish expectations had been creeping higher. However, the Fed has been resolute recently in reaffirming its commitment to keeping rates higher as necessary to protect against a fresh inflationary rise. Much of this view was likely bolstered by strong jobs numbers too. However, with the jobs market seen to be far weaker than previously thought, the path to Fed easing now looks much clearer and silver prices look poised to benefit from this as the Fed begins easing next month.

Technical Views

Silver

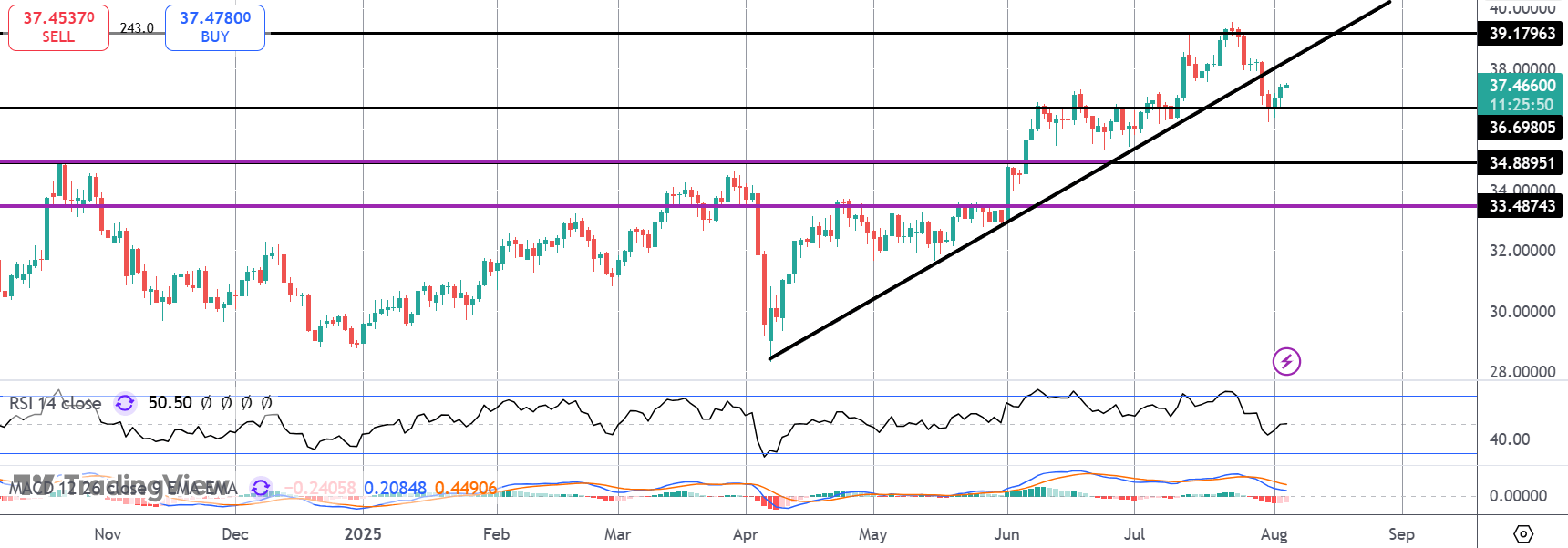

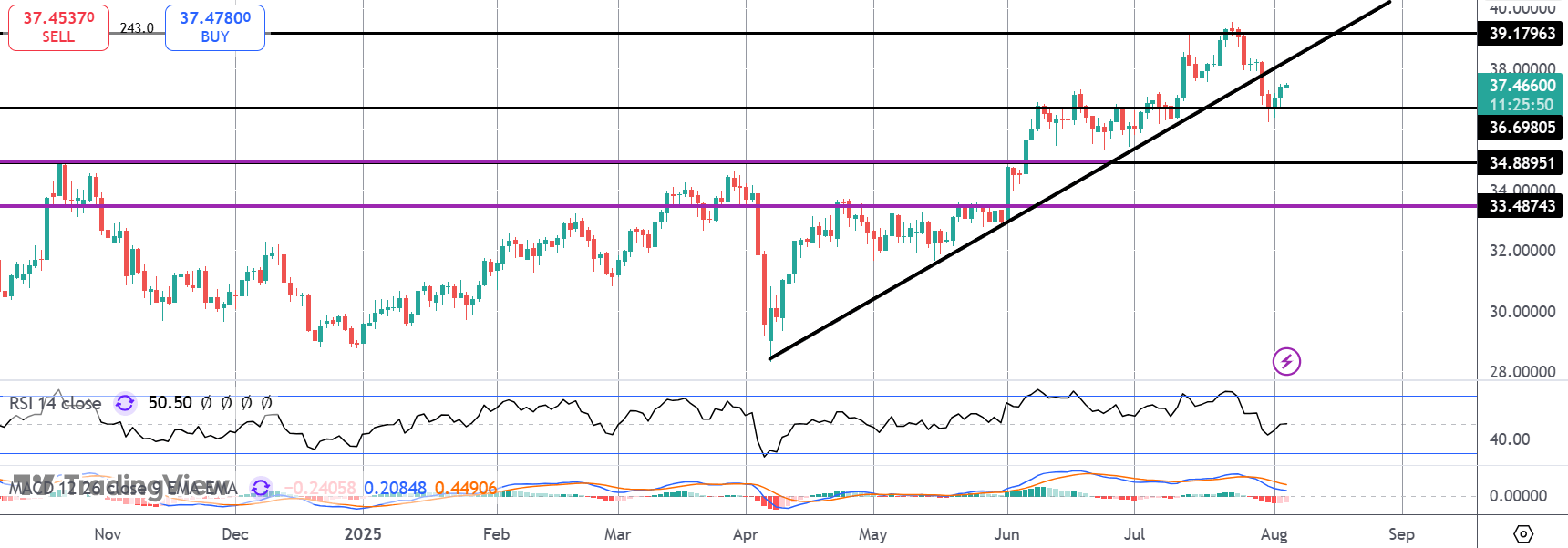

The sell off in silver prices has seen the market breaking down below the bull trend line from YTD lows, stalling into a test of the 36.6980 support for now. While this level holds, a fresh push higher still looks viable given the broad bull trend. However, should we break below this level, focus turns to deeper support at 34.8895 in line with bearish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.