Risk-Off Trading Weakens Copper Futures

Copper Sliding Again

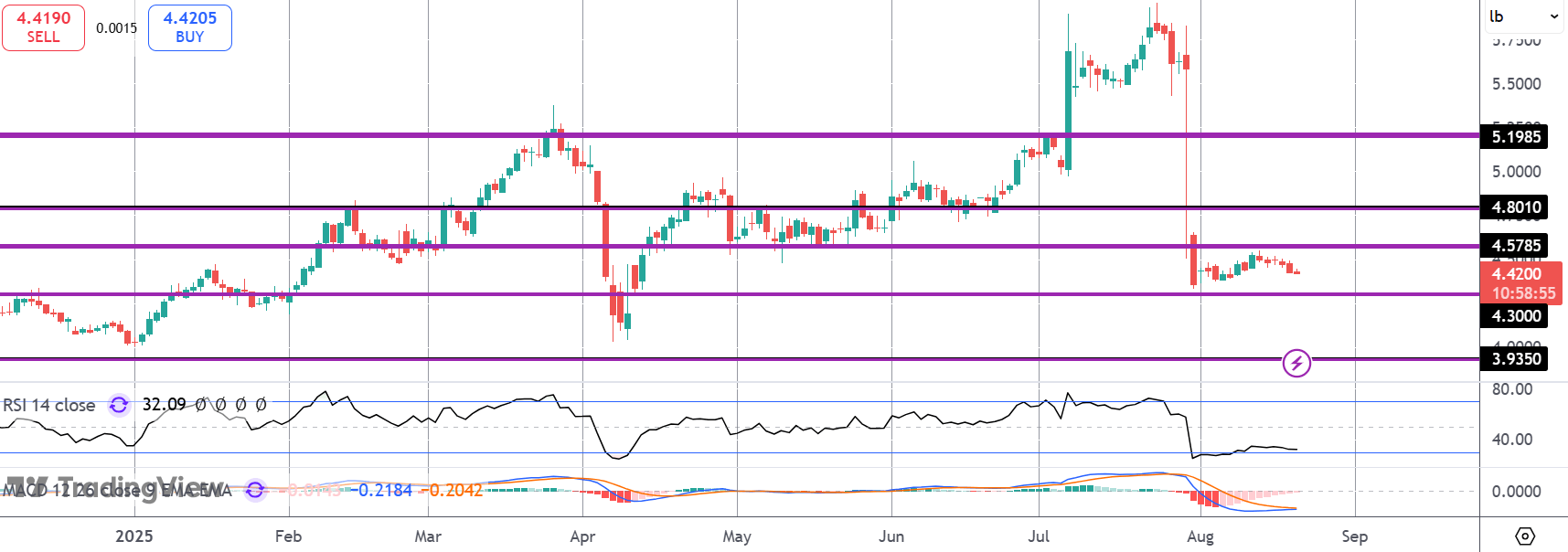

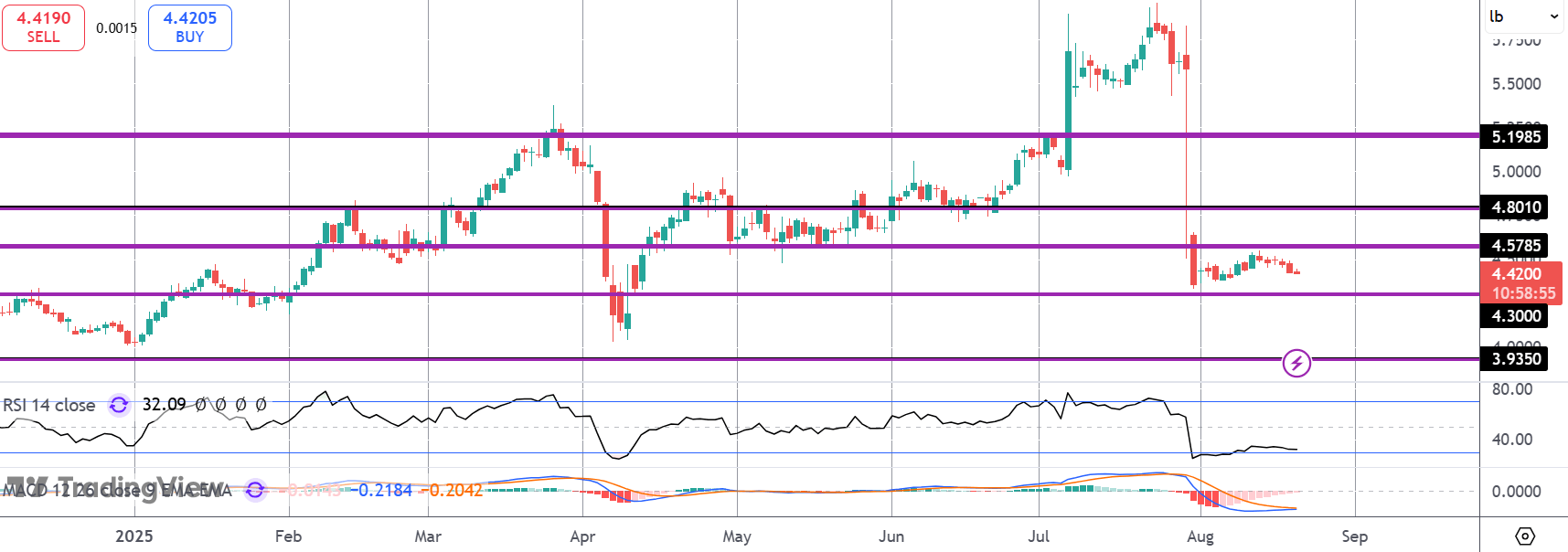

Copper price has softened this week with the futures market continuing its slide from the 4.5785 level. Following the record plunge lower we saw at the end of July, the market had been attempting to recover but the rally proved shallow and price is now turning lower again as risk-off sentiment builds ahead of the FOMC minutes later today and the Jackson Hole symposium on Friday. The current price action across markets suggests some trepidation among traders with the potential for USD to rally if USD bears don’t get the dovishness they’re looking for this week.

FOMC Minutes

Looking ahead to the minutes first, given that the big downside NFP miss and downward revisions came after the July FOMC, the release might see a more neutral tone. Inflation concerns are likely to remain a key roadblock to the easing argument and as such, the minutes might see risk assets tumbling further ahead of Jackson Hole on Friday. Powell’s speech on Friday will give a much more accurate reflection of where the Fed is at right now.

Jackson Hole

Traders will be keen to hear how Powell addresses the shift in jobs market data with the potential for USD to fall and risk assets to rally if Powell strikes a dovish tone and signals forthcoming easing next month. In this scenario, copper should start to rebound. However, if Powell keeps his cards close to his chest and refrains form giving an easing signal, USD could squeeze higher seeing copper and other risk assets fall deeper near-term.

Technical Views

Copper

The failure at 4.5785 has seen the market turning lower again with the 4.30 level the next support area to watch. If we break below there, the way is open for a test of 3.9350 next. Only a break back above 4.5785 near-term will alleviate these downside risks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.