Recap of the Week: Where are we Heading for in the Trade war Labyrinth?

Greenback trades slightly lower ahead of the weekend as the remarks of China leader that he hopes to reach the interim agreement with US soon supported risk appetite. Xi balanced his hopes with a warning that in case of further escalation China won’t hesitate to fight back.

This week was undoubtedly full of various trade headlines, especially the first half, which created the impression that making a concession first was disadvantageous (and unsafe) for both parties. In the second half of the week, rumors started to circulate that American top negotiators were invited to China for an unplanned meeting. In general, both superpowers strive to maintain the status quo and try their best to hide stalling talks under peaceful statements to keep fragile market balance.

Nevertheless, repeating same words without taking any action becomes less and less convincing what is reflected in declining odds that the interim agreement will be reached in December. This basically opens door for December tariffs that will hit consumer goods.

The dollar is trading weaker today against majors and safe heavens. Taking advantage of this, gold develops a bullish momentum, which also reflects attempts to prepare for potential surprises over the weekend, which Trump is well known for. This precautionary measure is also justified by unusual behavior on the FX market where recent movements feature low volatility and relatively narrow ranges.

German GDP for the third quarter was broadly in line with expectations, indicating an increase in exports, government and consumer spending and a lower than expected decrease in capital expenditures, thereby reducing the risk of recession in the fourth quarter.

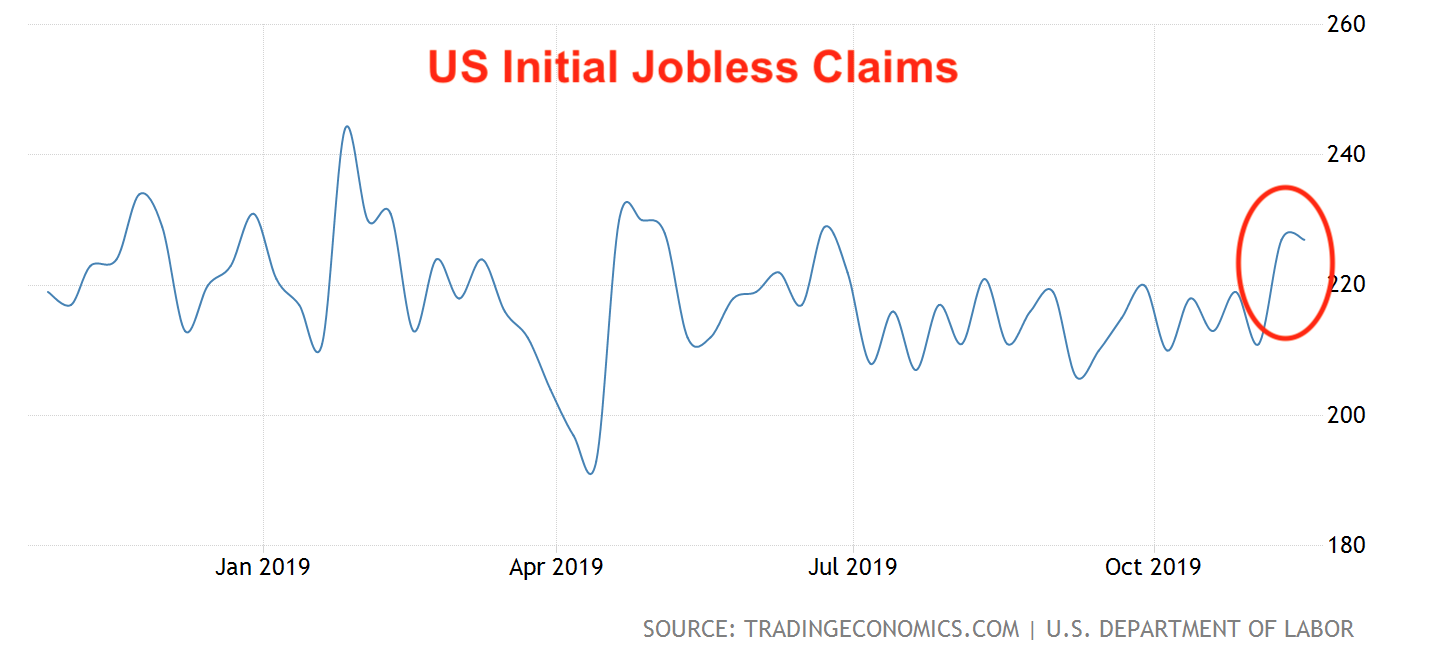

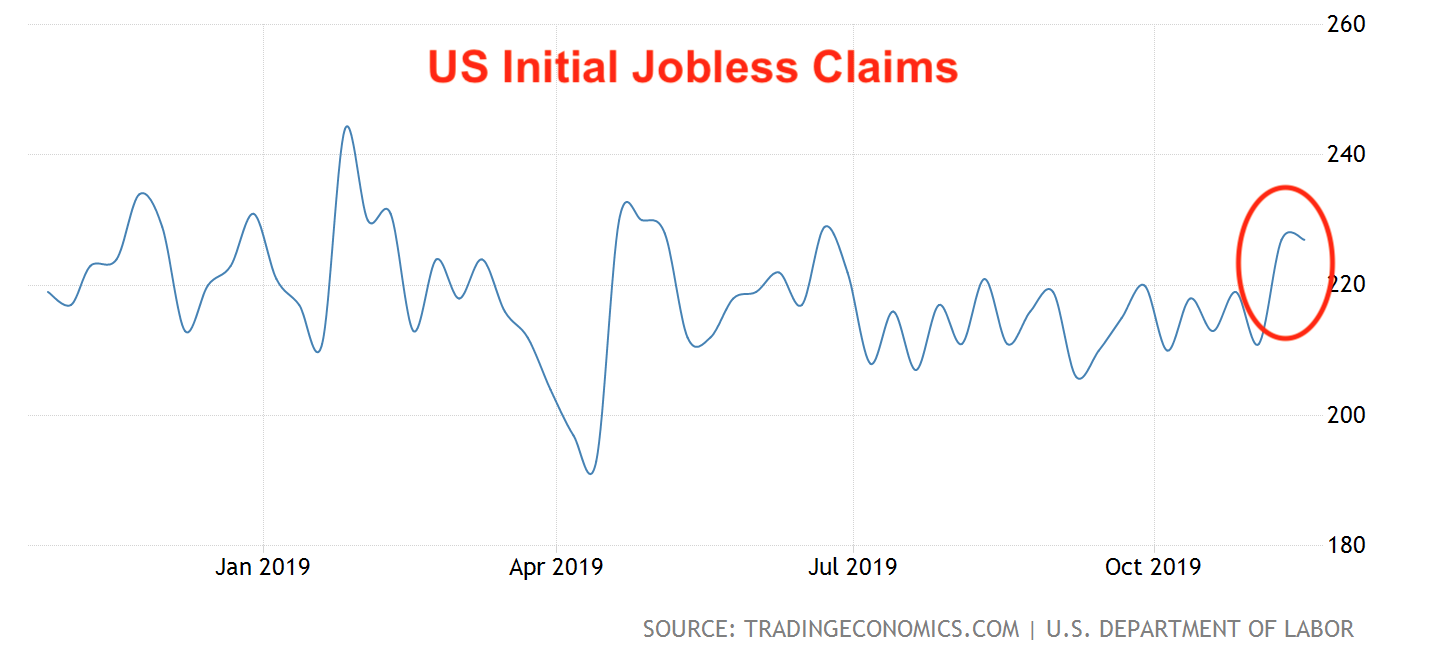

US jobless claims remained at a 5-month high, data showed on Thursday:

This unwelcomed persistence in jobless claims will be taken into account in the November NFP and is likely to drag final figures lower. On the other hand, we can expect a positive impulse from the strike of 46,000 GM workers who will be paid this month and counted in the data.

A decrease in the number of working hours, new vacancies, an increase in applications for unemployment benefits indicate a slight cooling of demand for labor. The minutes of the October meeting of the Fed confirmed these concerns.

Despite the growth of the broad business climate index from the Philadelphia Fed (from 10.4 to 5.6), it is worth paying attention to the “leading” details of the report. The 6-month capital expenditure index fell from 36.4 to 19.4 in October, reflecting a strong decline in investment plans due to trade uncertainty. Metrics of new orders, employment and shipments also declined in October.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.