RBA, BOC Rate Hikes Put Fresh Focus on Fed

Hawkish Risks into FOMC

On the back of surprise rate hikes from the RBA and BOC this week, traders are mulling the prospect of the Fed opting to retain a hawkish stance at the upcoming FOMC. Odds for a further hike in June have jumped to around 35% from less than 20% at the start of the week. Recent Fed commentary has leaned in favour of a pause at the upcoming meeting though with a skew towards further tightening being outlined as likely. This so-called ‘hawkish pause’ is likely to prevent USD from dropping in the same way it might have if the Fed simply ended its tightening campaign. However, with fresh hikes seen elsewhere and the ECB widely expected to hike rates further next week, might the Fed opt to go for one last hike this month?

CPI on Watch Next Week

The dealbreaker is likely to be next week’s US CPI reading. If inflation is seen to have fallen firmly again last month, this should keep the Fed on track to hold rates steady while signalling the potential for further hikes down the line if necessary. However, should there be any upside surprise in the inflation data next week, this might cause the Fed to err on the side of caution and push ahead with a further hike which would be heavily bearish for stocks near-term.

Technical Views

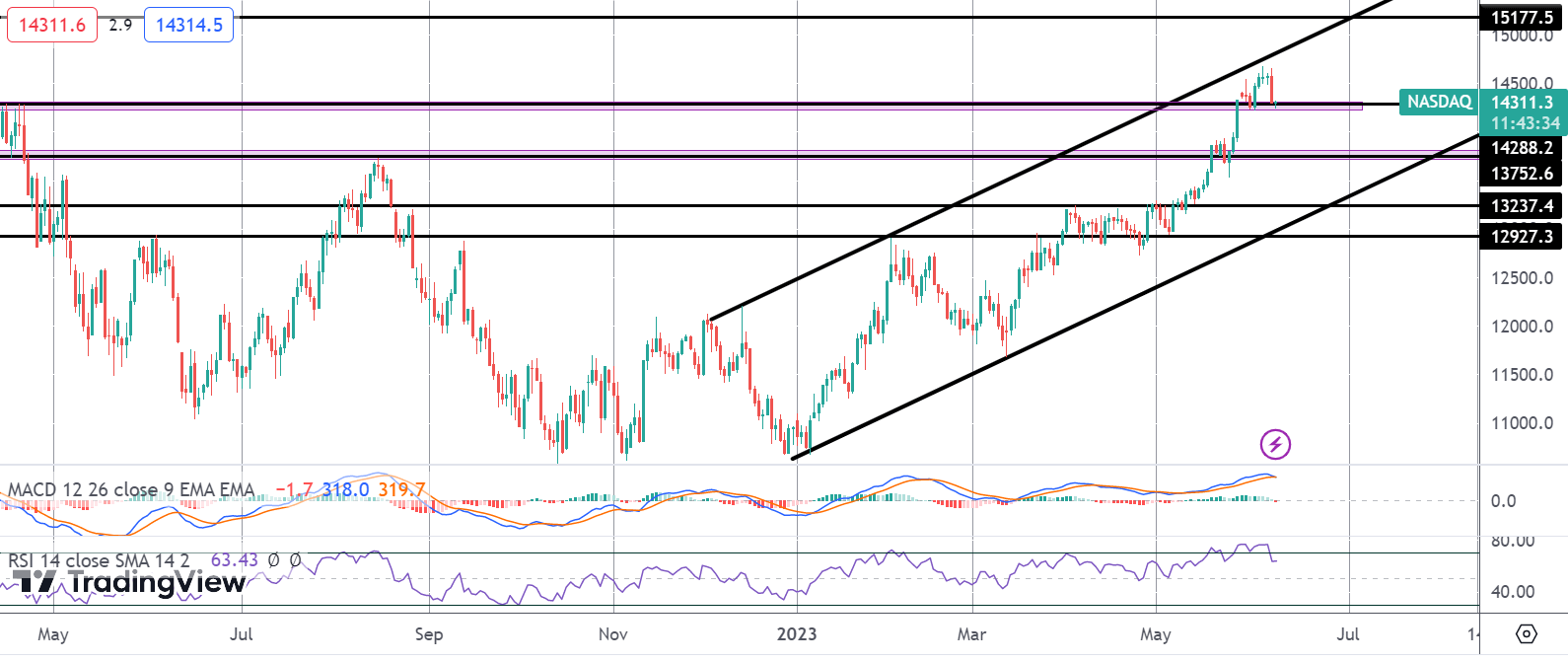

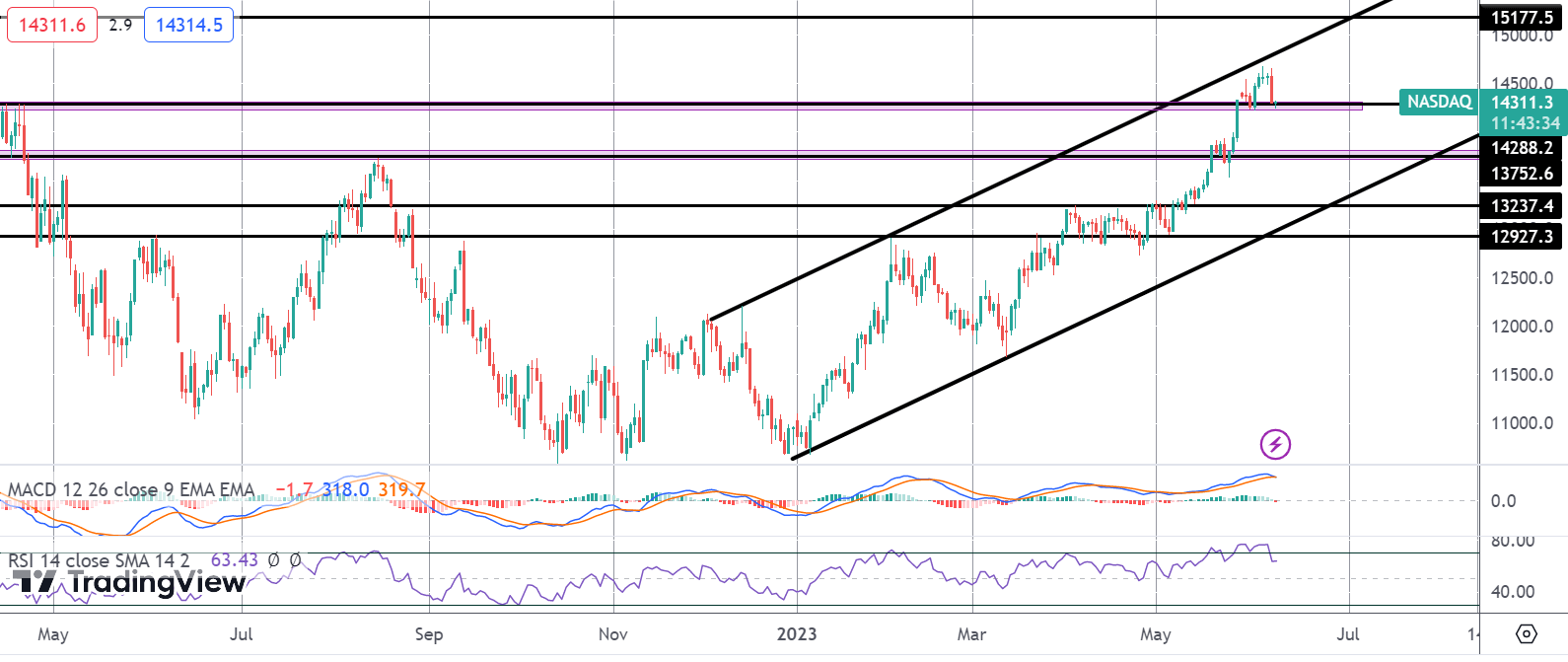

Nasdaq

The rally in the Nasdaq saw price breaking above the 14288.2 level recently. However, the move has since run into selling interest with price reversing sharply lower to retest the level from above. While this area holds as support, the focus is on a continuation of the bull channel towards 15177.5. However, with momentum studies dropping, risks of a break lower are growing, putting 13752.6 in view as next support.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.