Precious Metals Monday 14-11-2022

Metals Rally As USD Drops

Last week was an important week for the metals market with both gold and silver seeing strong gains amidst the deepening USD correction we saw. Gold prices are now sitting around 10% off the year’s lows with silver prices up more than 20%. Last week, the big catalyst for the fresh rally we saw was the sharp drop in USD. A much weaker-than-forecast October CPI report has strengthened the calls for the Fed to slow the pace of tightening in December. The subsequent repricing in rates markets reflects this shift in expectations.

US Retail Sales

Looking ahead this week, metals traders will want to see fresh downside in USD to help keep the rally alive. With this in mind the main focus will be on US retail sales which should help keep USD anchored lower if any surprise weakness is seen. Ahead of that release we also have US PPI which, given what we saw from CPI, should again lean towards a lower USD outcome.

Fed Commentary on Watch

It will also be prudent this week for metals traders in keep track of incoming Fed commentary. With several FOMC members speaking this week, the Fed’s message will be carefully scrutinized. Last night we saw Fed’s Waller citing his view that October CPI did little to change the Fed’s outlook and noted that US rates were still not that high. If this message is echoed by other Fed members this week, this might underpin USD, capping the rally in metals. On the other hand, if we start to hear a little more optionality in the Fed’s view and members discussing the possibility of a slower pace of hiking in December, this should bring USD under further pressure, allowing metals toom to run higher.

Technical Views

Gold

The breakout in gold prices above the bearish trend line from 2021 highs and above the 1679.77 level has seen the market trading up to just shy of testing the 1791.63 level. With both MACD and RSI firmly bullish here, the focus remains on further upside and a break of said level while 1722.37 holds as support.

.png)

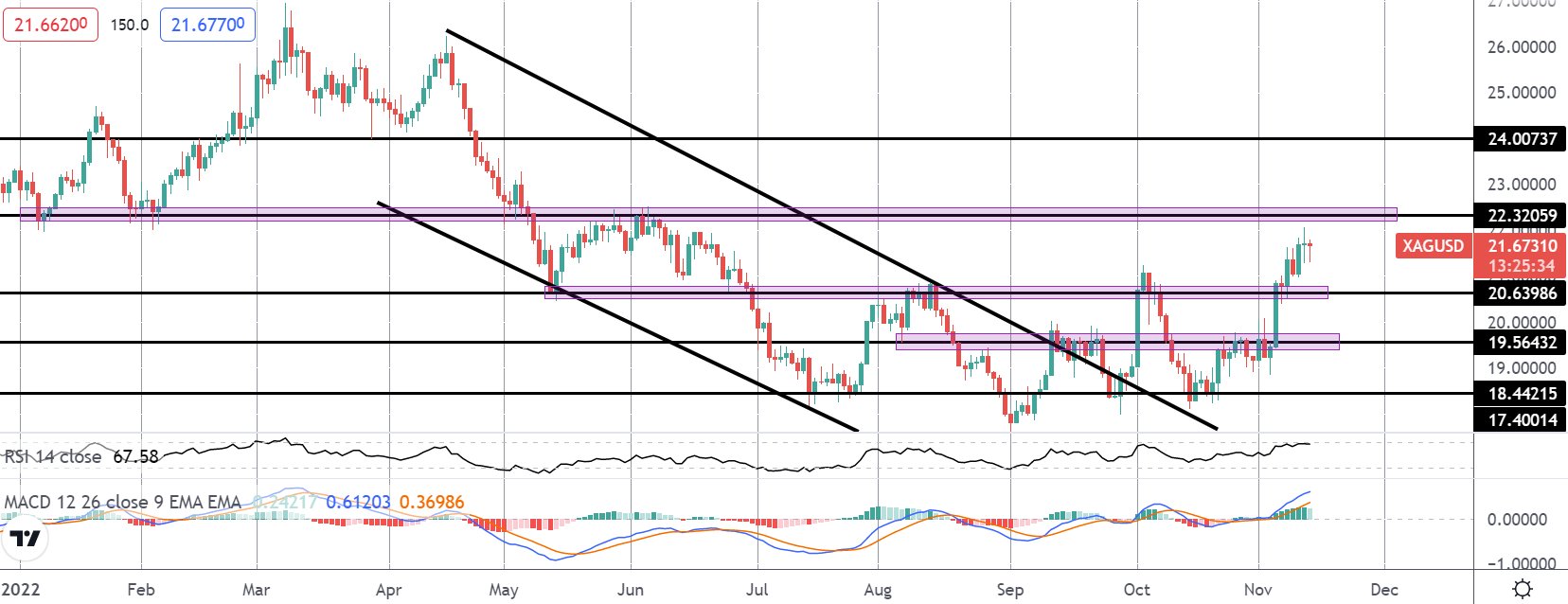

Silver

Similar to what we’re seeing in gold, silver prices are breaking out currently with the rally having taken the market through several key levels. The beak above the 20.6398 zone is firmly bullish and with both MACD and RSI on side here, the focus is on a break of the 22.3205 level and a continuation higher, while the 20.6398 level holds as support.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.