Powell Speech at Jackson Hole May be a Non-Event and Here’s Why

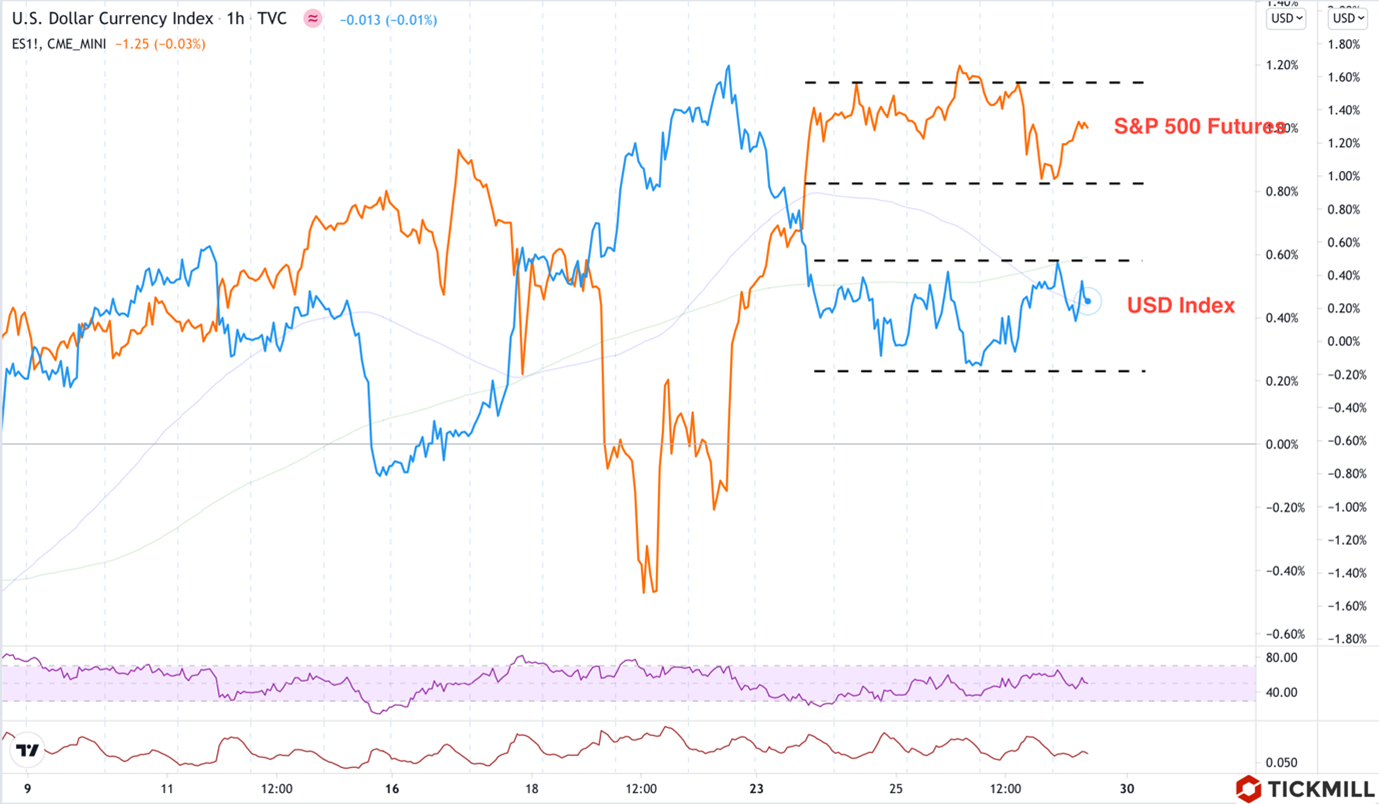

Greenback and US equities hold in a wait-and-see stance before Powell Jackson Hole's speech. The prices have been staying range-bound almost the whole week:

The Fed chair is unlikely to give details on timing and pace of QE tapering however, what should give us insight about the Fed tightening bias is tone of remarks, assessment of economic recovery, growth and inflation outlook.

The main part of risk-off related to uncertainty surrounding the Jackson Hole event apparently took place last week, when the S&P 500 dropped from 4475 to 4363 points. However, the index quickly erased the decline and even set a fresh ATH, without even waiting for the outcome of the speech. This may indicate that some of the informed market participants are not waiting for revelations from Powell that would impact the odds of QT this year:

If Powell downplays impact of Delta strain on economic activity and prefers to point out progress in employment, markets will likely interpret it a signal that the Fed will begin policy tightening this year. In this case, the dollar and bond yields are likely to respond with more upside while risk assets may struggle to make additional gains on the back of fears of rising discount rate.

There is small likelihood that Powell will instead place emphasis on headwinds and risks for employment and economic activity. It’s worth to note that incoming US data started to indicate fading momentum, which is seen from 10 points drop of consumer sentiment index from U. Michigan in August, sluggish US retail sales in July, continued pullback in broad PMI indices. However, as we discussed earlier this week, the dynamics of employment indicators in the US remains quite positive, firms continue to suffer from labor shortages and are ready to increase hiring, so there is apparently less need to maintain anti-crisis stimulus for the Fed.

Yesterday "minutes" of the July meeting of the ECB showed that the central bank is still far from discussing reduction of asset purchases. The main risk for EURUSD now is further divergence of the ECB and Fed policies, especially if Powell leaves the door open for September action today. In my view, the pair will lean towards 1.17, unless, of course, Powell today gives concrete hints that the Fed is not going to change the stimulus level either, which seems to be an unlikely scenario.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.