Pound Pushing Higher on Better Growth

GDP Jumps in August

GBP is rallying today on the back of better growth data released this morning. GDP was seen rising 0.2% in August, up from 0% prior. The rise was linked to a positive month for construction, accountancy, manufacturing and retailers. Despite the uptick, the ONS warned that H2 growth is looking weaker against H1 as the country prepares to receive the Autumn budget at the end of October. UK PM Starmer has warned that the budget will be ‘painful’ for many with taxes signalled to rise.

BOE Expectations

The rally in GBP today comes despite expectations that the BOE will cut rates again when it meets next month. At 0.2%, the reality is that the economy has been close to stagnation for around 3 months and with the ONS warning that growth over H2 is looking weaker, the BOE is expected to step in to help buffer the economy again.

CAD Weakness

In terms of where GBP longs are best placed today, GBPCAD is trending nicely higher. The BOC is firmly committed to its easing path and is well-expected to ease again this year. Today’s CAD employment data is forecast to show an uptick in the unemployment rate which should help further anchor these expectations, keeping CAD skewed lower near-term, giving the pair room to run higher.

Technical Views

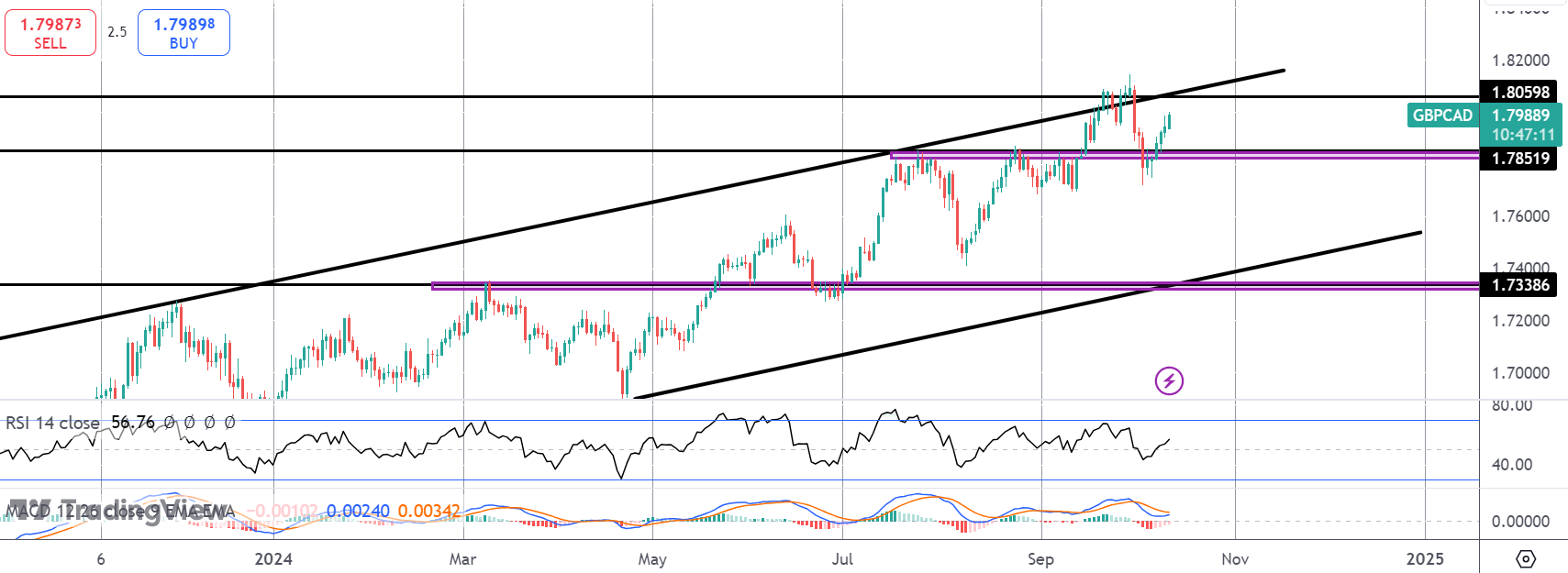

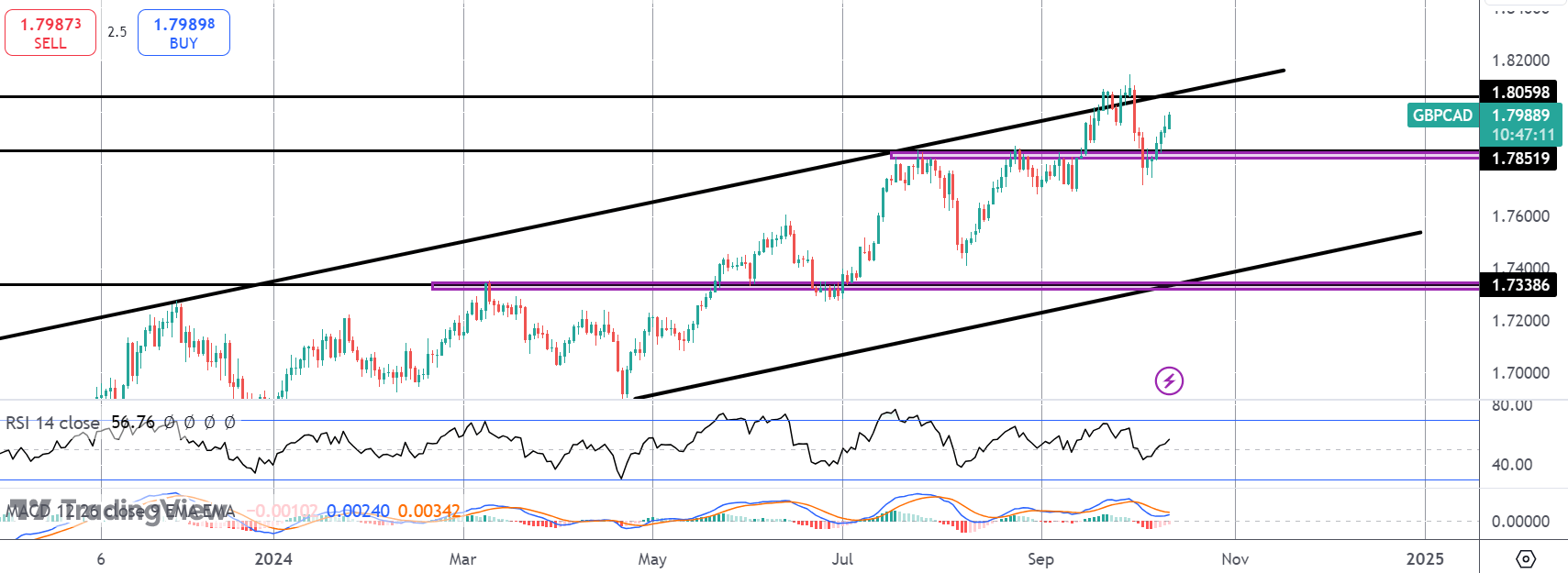

GBPCAD

The recent correction lower found strong support into the 1.7851 level with the market since turning back above the level. The focus is now on a fresh test of the bull channel highs and the 1.8060 region with an eye to breaking to fresh highs next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.