New All-Time Highs For Bitcoin

BTC Breaks Out

Bitcoin is on watch today after the futures market broke out to fresh all-time highs yesterday. BTC hit a new peak of $112,593 as the market moved higher amidst the continued pickup in risk appetite on the back of Trump’s tariff deadline extension. Global markets have welcomed news of the extension and are hopeful that the extra time will allow for continued negotiations and trade deals which can avoid tariffs be raised as high as they were earlier in the year. Near-term, BTC looks poised to move higher on any further positive headlines linked to trade with news of any fresh US trade deals likely to provide the strongest upside reaction. If trade deals don’t materialise, however, BTC could be vulnerable to a sharp correction lower if tariffs are hiked again on August 1st.

Soaring Institutional Demand

The rise in bitcoin has been accompanied by a sharp uptick in institutional demand. Over the last month, Bitcoin ETF inflows have soared to fresh record highs, reflecting the growing mainstream appetite for exposure to crypto assets and the bullish outlook held by investors. The options market too reflects a firm bullish vias with open call interest heavily outweighing put interest. Looking ahead, BTC looks poised to continue to push higher so long as the trade landscape remains supportive. The rally could further be helped if a September rate cut from the Fed starts to look more solid.

Technical Views

BTC

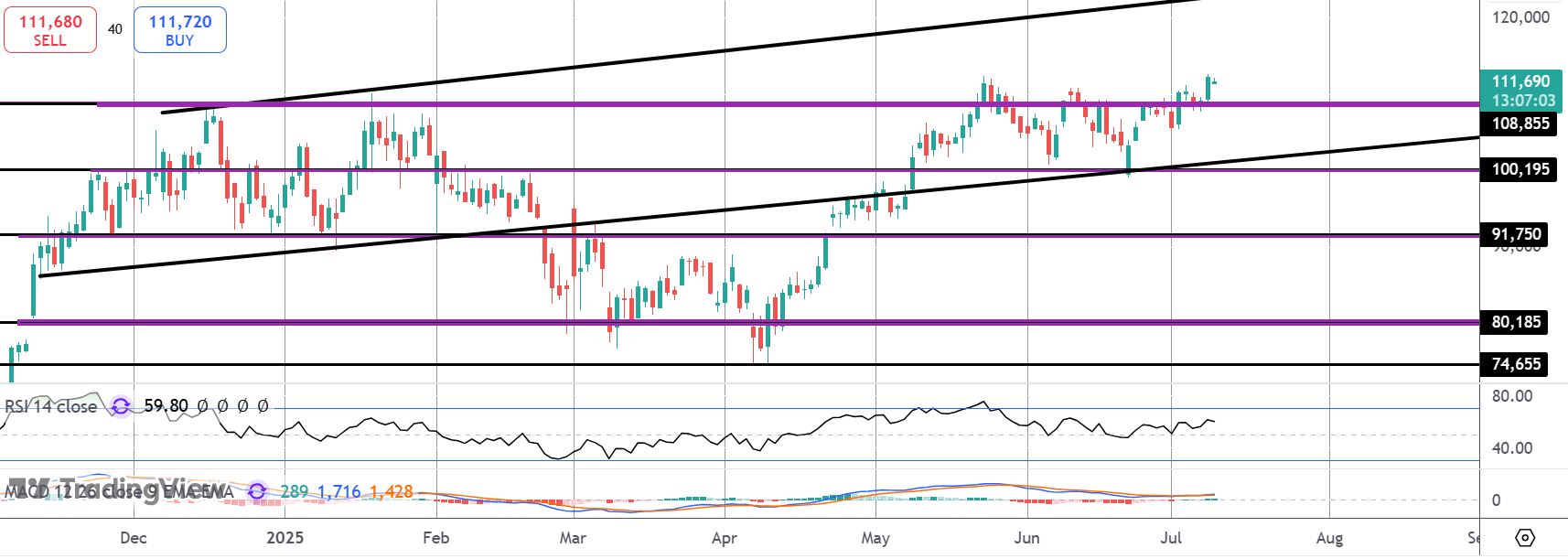

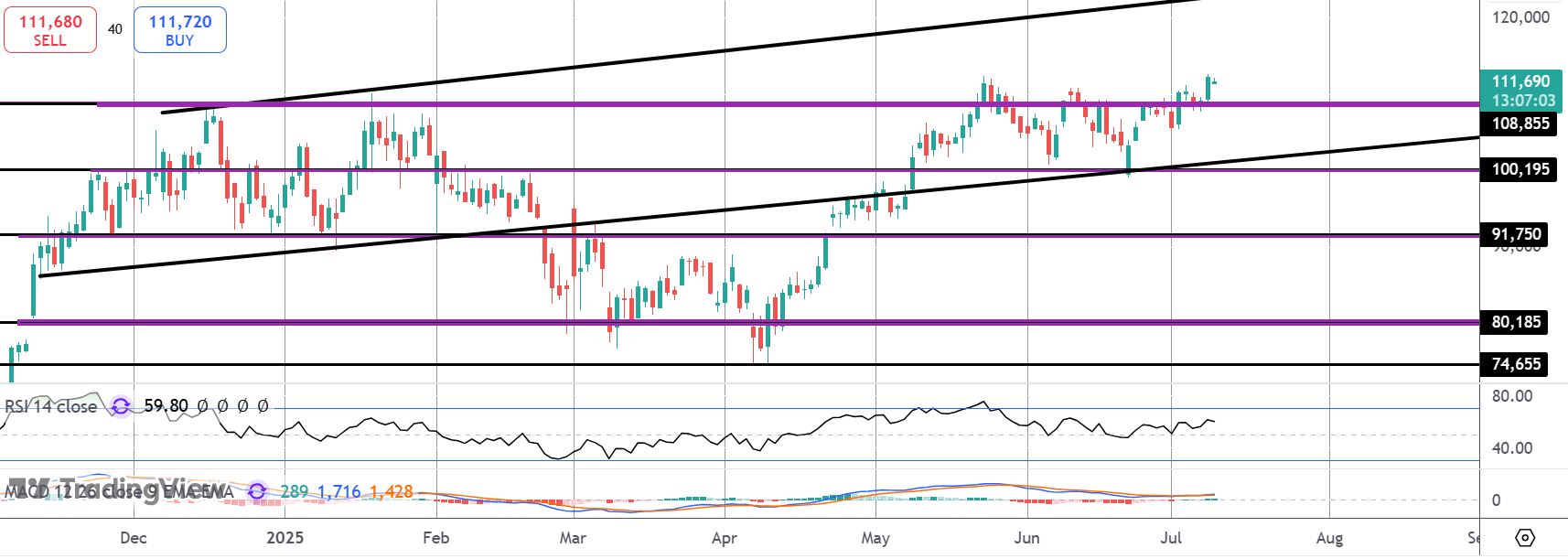

With BTC now firmly above the $108,855 level and with momentum studies bullish, focus is on a continuation higher. The bull channel highs and the $120k mark will be the next objective for bulls while any move sub $108,855 will turn focus back to the $100k mark.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.