Nasdaq Drops Despite Nvidia Earnings Beat

Nvidia Beats Forecasts Again

Nvidia maintained its winning streak yesterday, posting Q4 EPS of $0.89 vs $.84 expected on revenues of $39.33 billion vs $39.1 billion expected. With revenues up 12% quarter on quarter and 78% year-on-year, there was plenty for investors to celebrate. However, the stock is only very slightly higher ahead of the open today, seeing none of the typical blowout reaction.

Bearish Factors

There are a few reasons why these bumper results have caused any fireworks. Firstly, the beat on revenues forecasts was by the smallest margin since February 2023, while earnings grew by the smallest amount since November 20022. This suggests that while the company is continuing to outperform, momentum is slowing. Secondly, while the company was upbeat in its outlook it did note that gross profit margins would be tighter than expected over the current quarter and coted risks around the current US trade war. Given Trump’s recent comments on cracking down on US companies selling chips to China, these comments have been taken as a sign of a deeper level of concern.

Mixed Near-Term Outlook

In all, weaker guidance, concerns over the broader AI industry, uncertainty around the impact of Trump’s trade policy, as well as smaller upside against forecasts, means that the report has done little to encourage fresh upside in Nvidia and the Nasdaq remains in a four-day losing streak. With USD catching a bid today the index is likely to remain pressured and could extend its losing streak to 5 days.

Technical Views

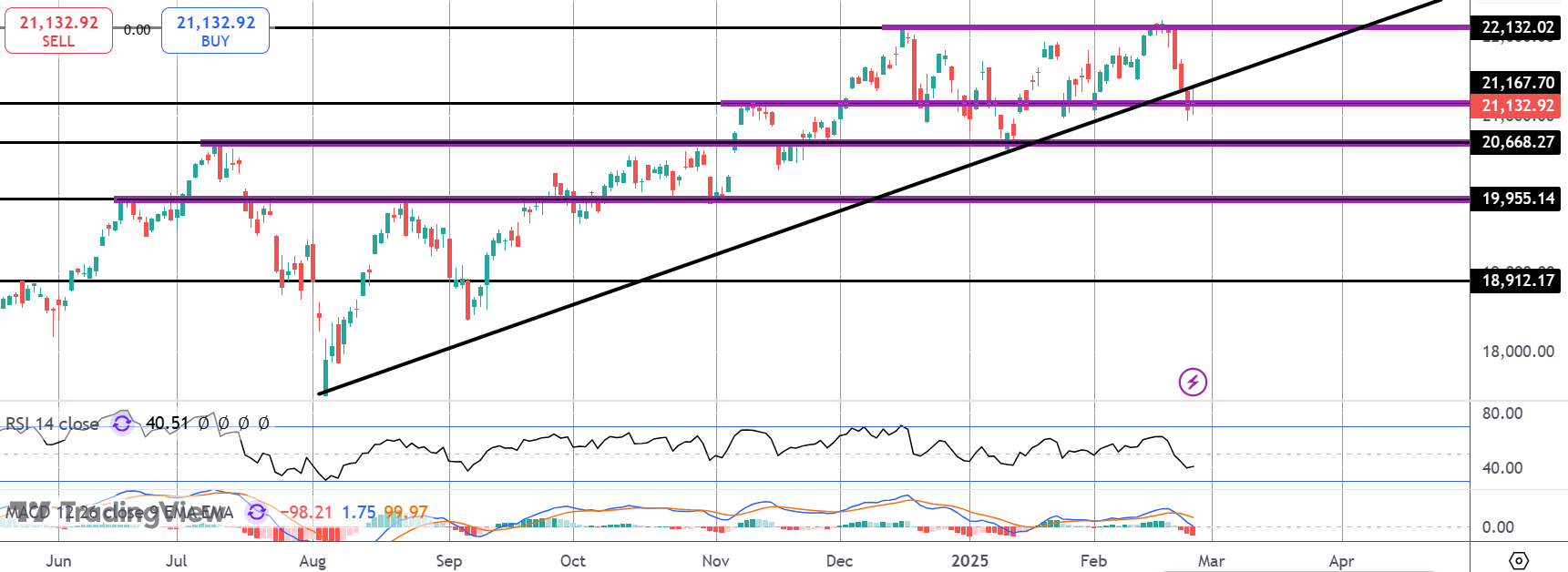

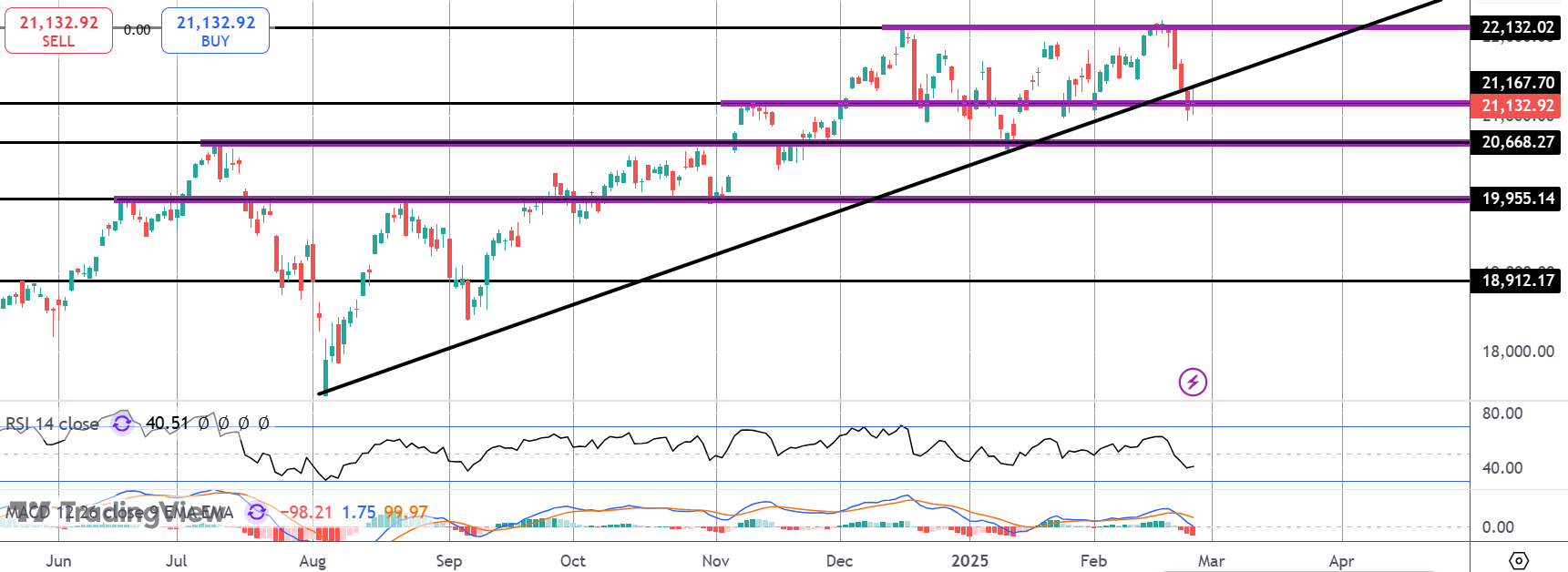

Nasdaq

For now, the Nasdaq is sitting on support at the 21,167.70 level after breaking down below the bull trend line. With momentum studies bearish, risks of a deeper drop are seen with 20,668.27 the next support to watch ahead of the deeper level at 19,955.14.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.