Market Spotlight: UK Govt Announces Banking Reforms Package

UK Govt To Reverse 2008 Banking Reforms

In a clear sign that the UK government is agonising over the loss of London’s status as the financial capital of Europe, cabinet today announced a new package of reforms aimed at boosting growth in the financial sector. The package of 30 measures, named ‘The Edinburgh Reforms’ essentially a comprise a vast swathe of measures which amount to deregulation and a reversal of many of the safe-guards and restrictions put in place following the GFC in 2008.

'Brexit Freedoms'

Announcing the measures, UK chancellor Jeremy Hunt said “The Edinburgh Reforms seize on our Brexit freedoms to deliver an agile and home-grown regulatory regime that works in the interest of British people and our businesses.” Hunt went on to say “ we will go further – delivering reform of burdensome EU laws that choke off growth in other industries such as digital technology and life sciences.”

With Paris having recently overtaken London as the largest stock exchange in Europe and with an increasing amount of banks relocating staff away from London back to Italy, France and Germany, the UK government hopes to alter the narrative.

Fears of Deregulation

As expected, however, the reforms are immediately drawing opposition with many fearing a return to the conditions which led to the GFC. John Vickers who previously headed the Independent Commission on Banking commented that “special favouring of the financial services sector ... could be detrimental to it, as we all saw 15 years ago.”

Technical Views

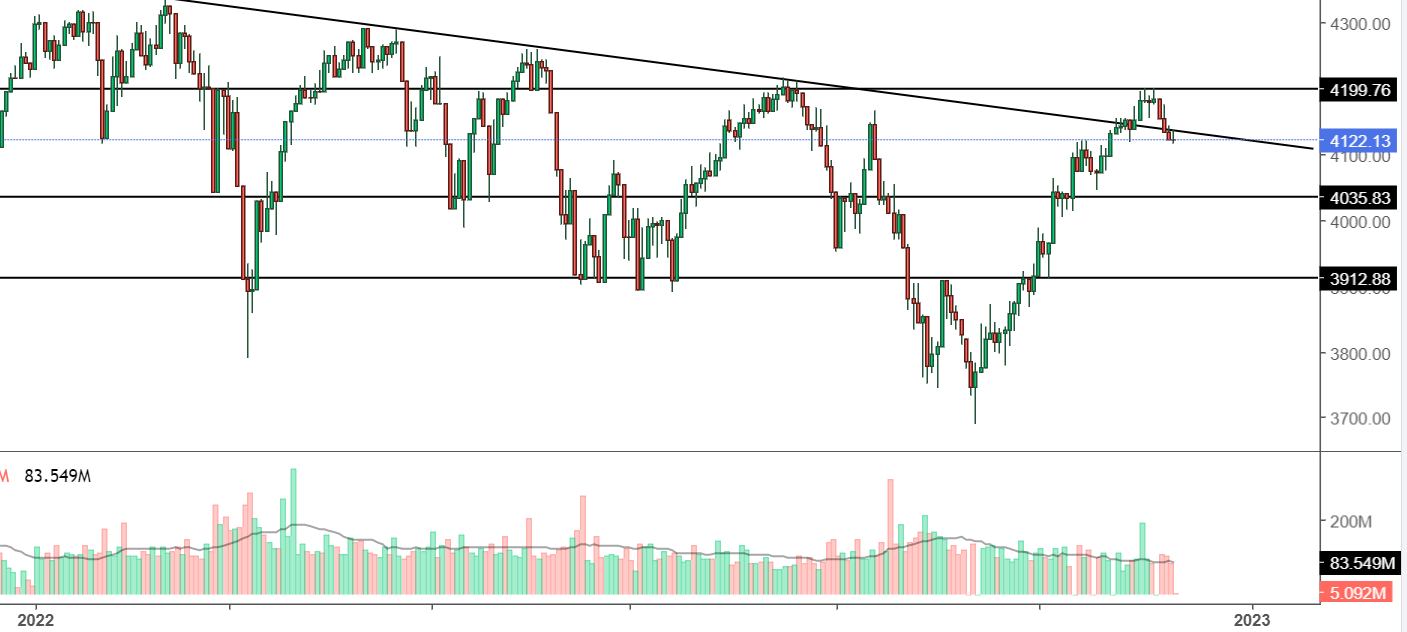

FTSE 350

The recent rally in the index saw the market breaking above the bearish trend line from YTD highs. However, price stalled into a test of the 4199.76 level and has since reversed lower, trading back below the trend line for now. While back below the trend line, the focus is on a further correction towards support at the 4035.83 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.