Market Spotlight: RBA Hikes Again & Signals More to Come

Aussie Rates Hit 10-yr Highs

The RBA continued with its tightening program overnight. The December rates meeting saw the bank pressing ahead with a further .25% rate increase, as expected. Additionally, the bank signalled that further hikes would likely be necessary given the inflationary backdrop, warning that the path of monetary policy was not set in stone and is subject to change.

This latest hike takes Aussie rate sup to 3.1%, their highest level in 10 years. Furthermore, the outlook given at the meeting and language around potential further increases caught some players off guard. In line with the slower pace of tightening seen over recent months, some were looking for the RBA to a signal a forthcoming pause on rate hike. However, with the bank keeping its options open and warning that further hikes might be needed, there are still upside risks.

Further Hikes Ahead

Looking ahead, the key factors to watch for AUD will be labour and inflation data, with governor Lowe citing these two inputs as key for determining monetary policy. Should consumer prices start to cool more quickly, this will no doubt fuel expectations of a slower pace of hiking, turning focus back towards a potential pause. However, should inflation remain sticky at higher levels, this will keep the need for further rate hikes alive, and should underpin AUD.

Technical Views

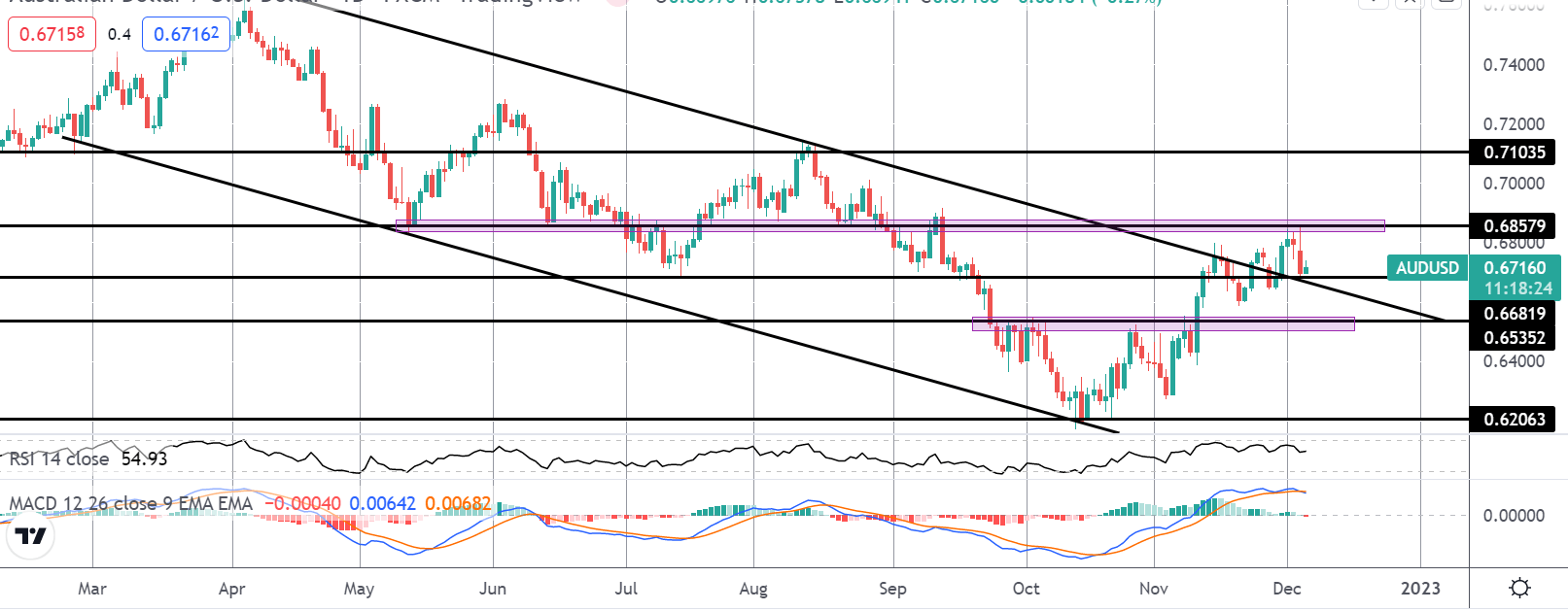

AUDUSD

The rally in AUDUSD off the YTD lows has seen the market breaking above the bearish trend line from YTD highs. For now, the move has stalled into a test of the .6857 level resistance. However, while the market holds above the broken channel top, the focus is on a break of the current highs and a continuation towards the .7103 level next. To the downside, .6535 is the main support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.