Japanese CPI Jumps Again

The BOJ’s commitment to maintaining an easing presence in the market is being tested further this week. The latest econ data shows that Japanese CPI hit forty-year highs last month at 2.7%, rising from the prior month’s 2% reading and well above the 2.2% reading the market was looking for. Annually, CPI rose at 3.6%, above the 3.5% increase the market was looking for, marking the fastest pace of inflation since 1982 in Japan. Japanese CPI has now spent seven consecutive months above the BOJ’s 2% target, raising serious questions over the central banks easing strategy.

On the back of the data, BOJ governor Kuroda was quick to reaffirm the bank’s commitment to keeping rates at ultra-low levels in order to support the economy. However, Kuroda did acknowledge that price increases were significant and subject to upside risks in the near-future.

Speculators vs BOJ

Despite the BOJ’s attempts at underpinning JPY, the currency has weakened again recently creating further upward prices pressures in the domestic economy. Withs peculators essentially pitted against the BOJ, JPY looks vulnerable to further downside while the BOJ refuses to budge on rates, regardless of other tactics such as FX intervention.

Technical Views

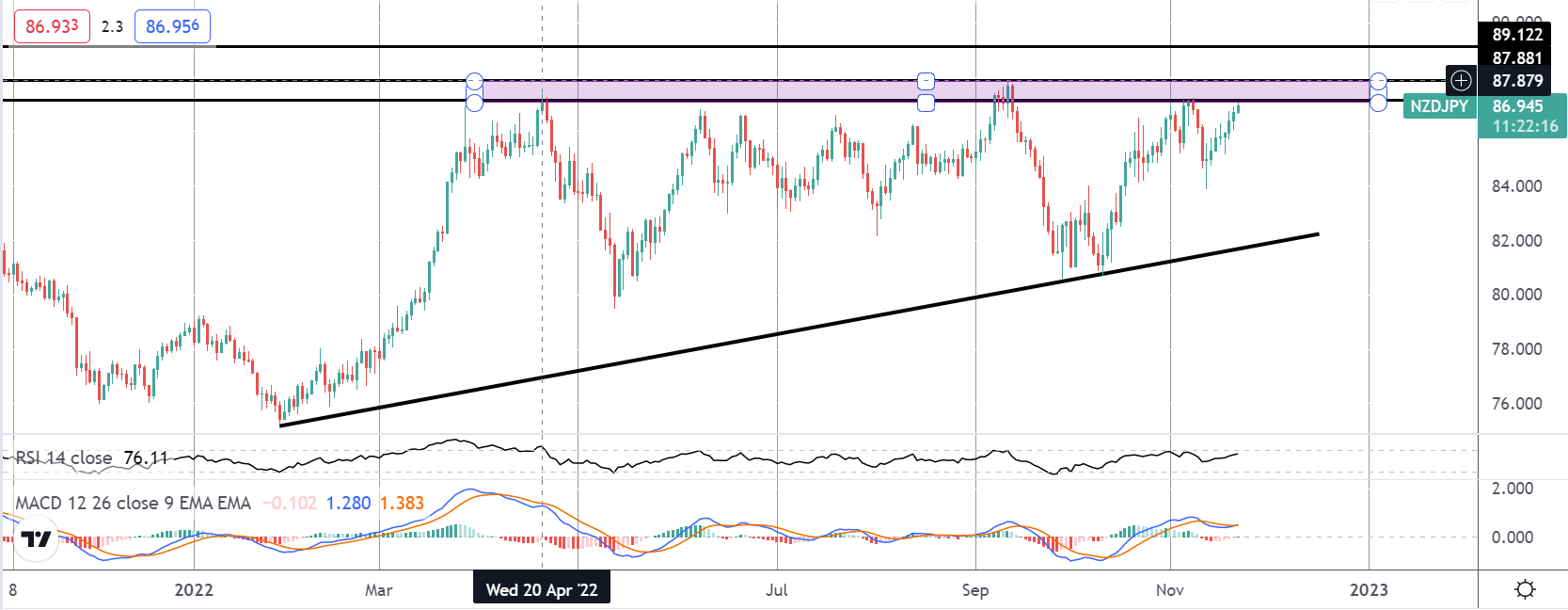

NZDJPY

NZDJPY has been stalled against the 87.15 – 87.88 level resistance since Q1, despite several attempts at breaking higher. Price is now once again pushing up against the level and with the retail market heavily short, risks of an upside break are growing, particularly with the RBNZ head tonight. If NZDJPY does break above current resistance, 89.12 will be the initial target on the move with the near-term focus remaining bullish while price holds above 87.88.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.