Market Spotlight: ETH Potential Double Bottom With Bullish Divergence

Weaker USD Boosts ETH

With USD on the backfoot following dovish comments from Fed’s Powell yesterday, risk assets have seen a wave of demand. Better risk appetite has even found its way into the ailing crypto market. Digital assets have been rocked by a slew of negative publicity over recent months which has further dampened retail interest and driven volumes lower still. However, despite the bearishness around the collapse of crypto broker FTX, digital coins are looking a little more alive this week. With a potential shift in Fed policy to start in December, the outlook is improving somewhat.

Merger Rally Yet to Materialise

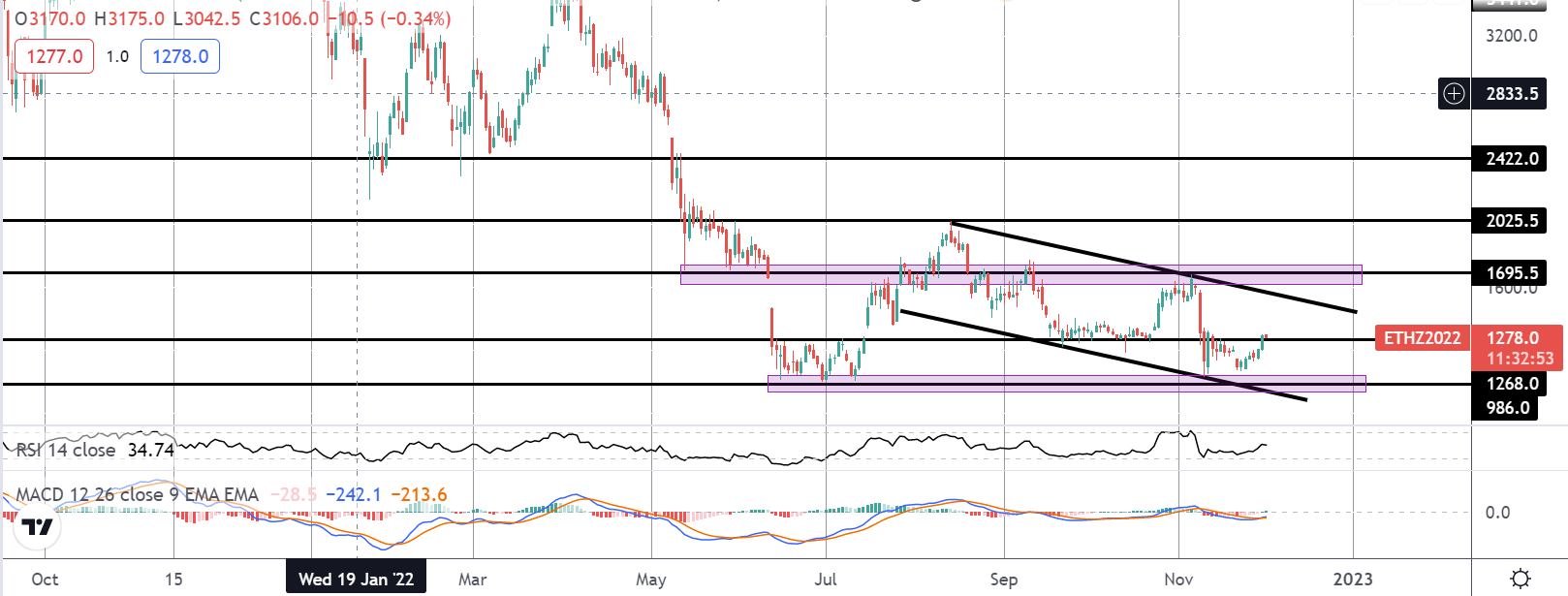

Ethereum is currently testing the 1268 level, attempting to get back above, following a test of the YTD lows around 986 which are holding for now. Much was made of the merger in ETH earlier this year with many analysts and commentators calling for a sizeable rally in ETH on the back of the technological upgrade. However, that upside has yet to materialise though, while the current YTD lows hold we could be setting up a potential double bottom suggesting room for a bullish reversal near-term.

Technical Views

ETH

The market has been grinding lower since the August highs, framed by a bearish channel which took price back down to a test of the YTD lows. With these lows holding for now and with strong bullish divergence in momentum studies, it is worth noting bullish reversal risks. The key level to watch will be the 1695 level. A break of this area, and channel top, should signal a shift in sentiment putting the focus on a continuation higher.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.