Market Spotlight: Easyjet Spikes Higher on Profit Guidance

Lower Pre-Tax Losses

Shares in Easyjet are trading around 10% higher from yesterday’s close after gapping higher at the open on a more upbeat update from the company. Easyjet forecasts its first annual profit in 2023 since the pandemic began on the back of record bookings. The spike in bookings has helped the company reduce its pre-tax losses to £133 million in the December quarter from £213 million over the same period a year earlier.

Higher Passenger Numbers

The company also noted a 47% jump in passenger volume from a year earlier. Interestingly, the airline also noted the return of “New Year” holiday bookings which had died down massively over the prior year. In all, the company now forecasts first half losses to be significantly lower than expected with a return to annual profit seen over H2.

Outlook Improving

Airlines have been hard hit over the last year with the post-pandemic recovery blighted by the Russian invasion of Ukraine, the cost-of-living crisis and soaring fuel costs. However, with inflation finally starting to cool across Europe and with fuel costs having fallen massively, the outlook is starting to improve. The relaxing of China’s borders for the first time since the pandemic began is also expected to feed into a pickup in global travel this year which should help further underpin Easyjet shares.

Technical Views

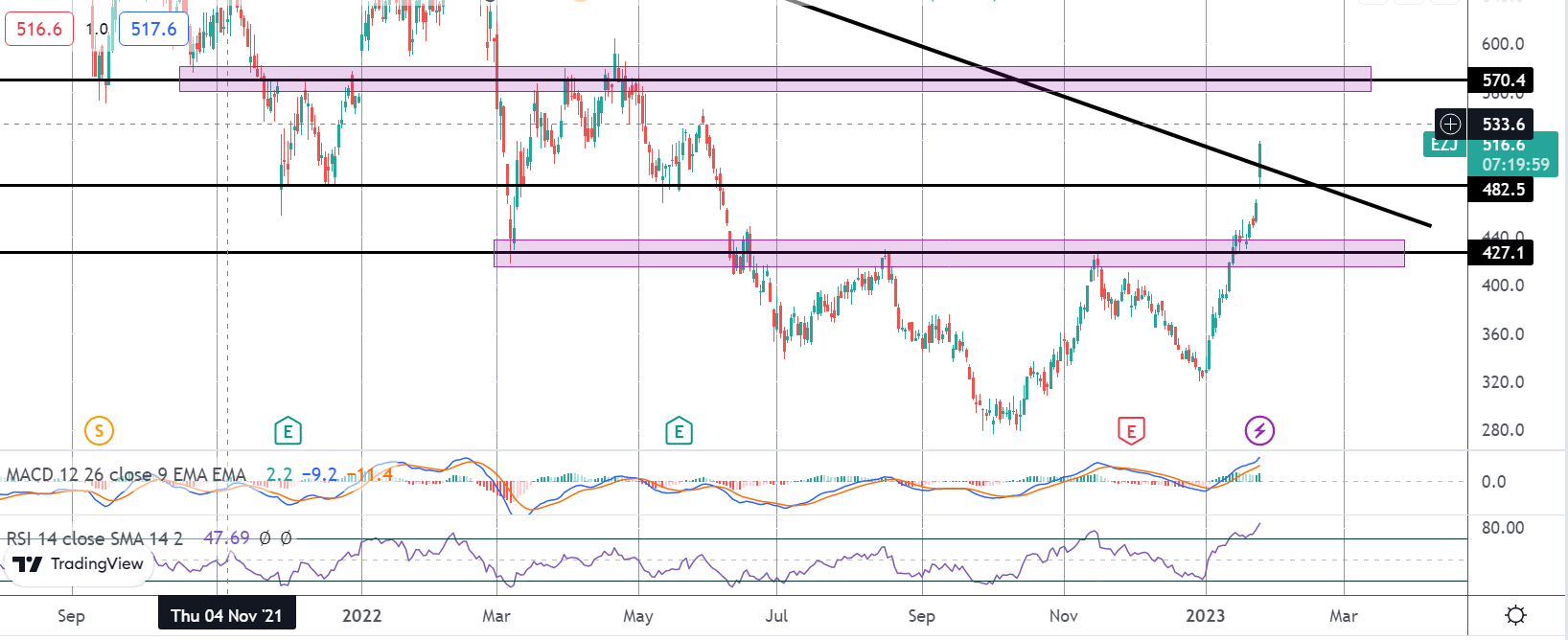

Easyjet

The rally in Easyjet shares has seen price breaking out above the 482.5 level and above the bearish trend line from 2021 highs. With momentum studies firmly bullish, the focus is on a continuation higher while price holds above this level, putting 570.4 in view as the next upside target for bulls. To the downside, should price reverse back below the trend line, 427.1 is the main support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.