Market Spotlight: AZN Shares At Risk of Deeper Drop

AZN Stock Under Pressure

Shares in UK-headquartered AstraZeneca are back under heavy selling pressure on Monday as the stock extends recent losses. Now trading down by almost 7% from the 2023 highs, the company recently outlined plans to buy US bio-tech Firm Cin Cor for $1.8 billion. However, it seems that stockholders are not overly enthusiastic about the deal given the current price action we’re seeing.

Sales Disappointments

One reason for this, perhaps, is that the company has been suffering from weaker earnings growth when compared with the rest of the industry. The current decline is suggesting there is some caution about such a big outlay of capital at the start of the New Year. The stock is also likely suffering from the impact of recent sales disappointments. AstraZeneca announced last week that it was pulling its Lumoxiti (treatment for rare blood cancer) from US markets on the back of poor sales results. This comes a few years after the drug was also pulled in Europe, again due to unsatisfactory results.

Near-Term Downside Risks

While The company has seen a solid string of earnings reports since the last negative quarter in Q3 2021, there is perhaps some hesitation with AZN viewed more as a dividend stock than an earnings growth stock. The company saw its value balloon over the early part of the pandemic as profits linked to its covid vaccine helped drive valuations higher. However, as more companies brought their vaccines to market these profits have been eroded. While the stock remains well above pre-pandemic levels for now, risks of a deeper correction are growing with the upcoming earnings report

Technical Views

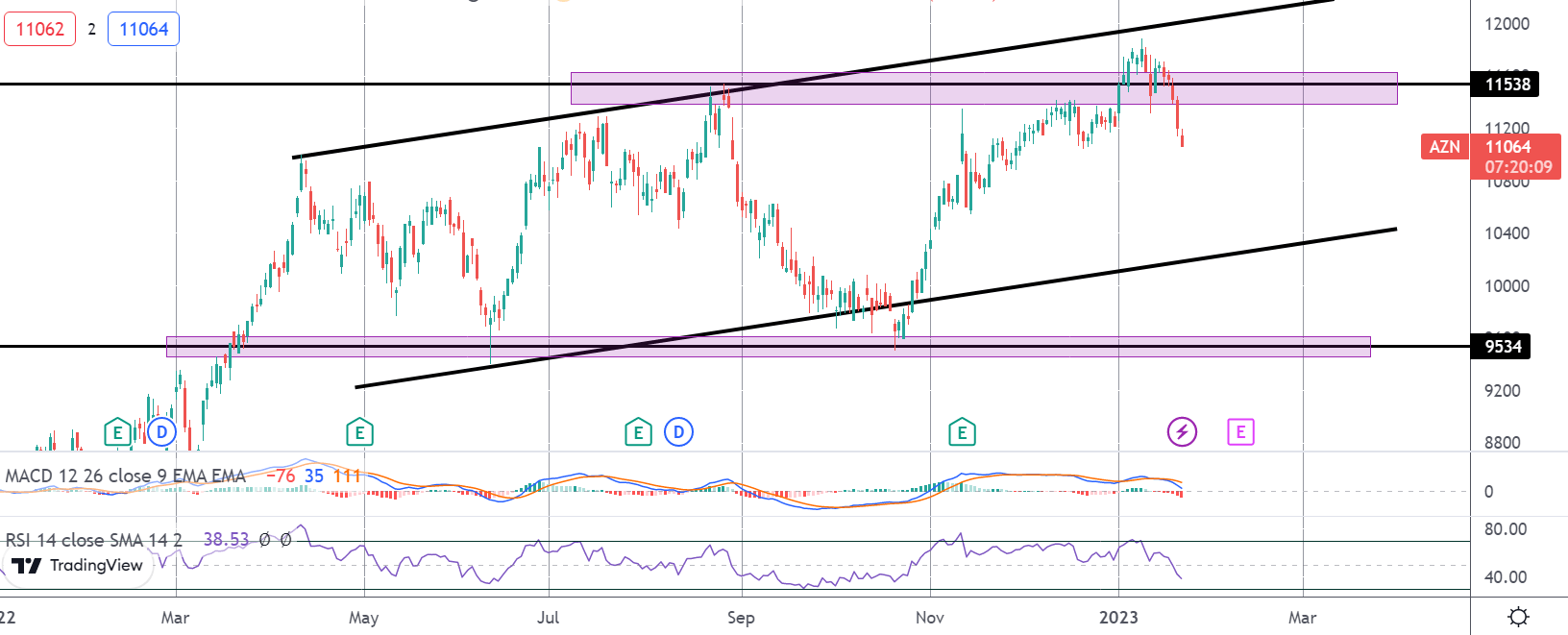

AZN

The stock has been moving with a shallow bullish channel over the last 9 months. However, we’ve seen strong bearish divergence on each fresh peak and with price having now reversed back under the 11538 level there is risk of a deeper run down towards the bottom of the channel, ahead of deeper support at the 9534 area.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.