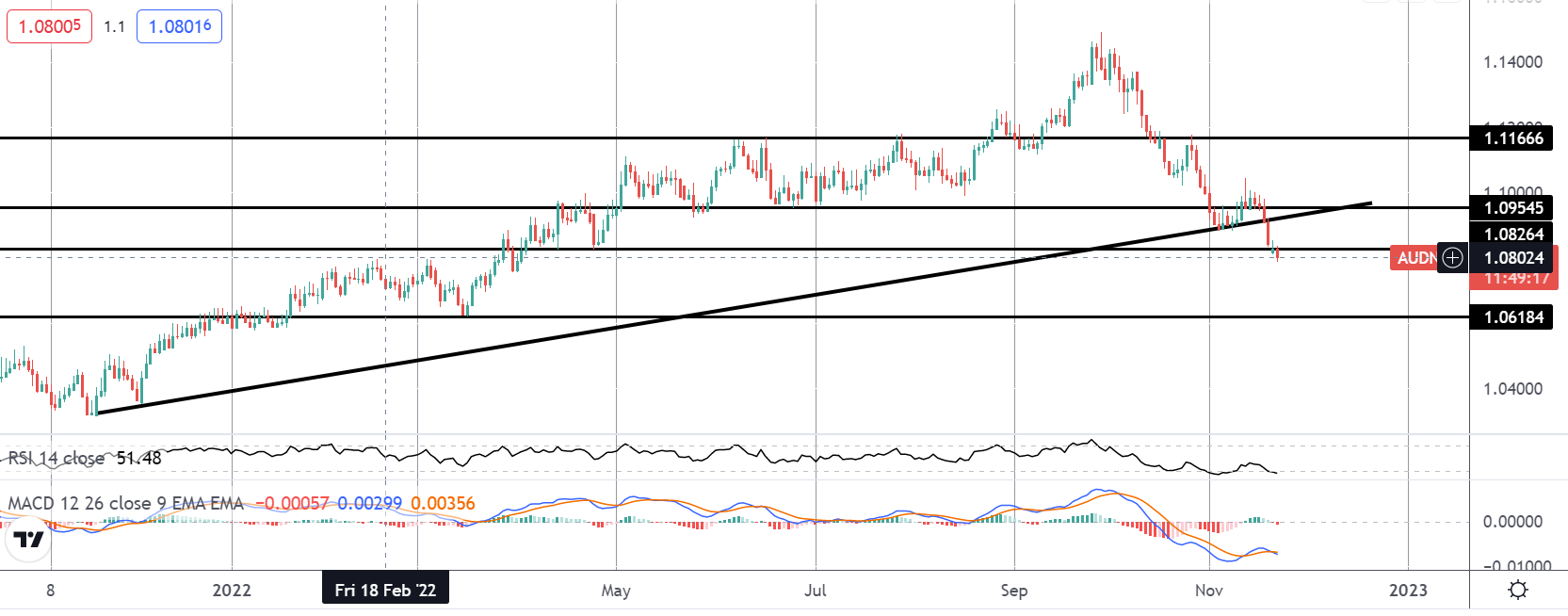

AUDNZD Breaking Lower

The reversal lower in AUDNZD from YTD highs has seen the pair shedding around 6%. The recent RBA pivot has been the main driver behind the move. With the RBA cutting back the pace of its tightening program, sentiment has swung in favour of NZD for now, with the RBNZ widely expected to step up the pace of its tightening, in contrast to the RBA.

RBNZ In Focus

The market is looking for a 75% hike at the upcoming November RBNZ meeting tonight, which will mark the biggest rate hike in RBNZ history. However, given that the move is already priced in, the bigger focus will be on the bank’s forward guidance. If the RBNZ is seen sticking to hawkish guidance, hat should keep the pair pressured lower near-term. Any sign that the bank might look to slow the pace of tightening after today’s hike, however, while likely fuel some bullish correction in the pair.

Technical Views

AUDNZD

The break below the rising trend line from Q4 2022 lows is an important technical development for the pair. With the retail market heavily long, there is plenty of room for the market to continue lower, in line with bearish momentum studies readings. Price is currently probing below support at the 1.0826 level. Below here, the focus is on a move down to the 1.0618 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.