Market Spotlight: AUDJPY Bull Trend to Resume?

AUDJPY Turning Higher Again

The latest test of the 88.02 level in AUDJPY has seen the pair turning sharply higher with price now up almost 5% from the initial 2023 lows. The main driver behind the move has been the better risk sentiment we’ve seen on the back of recent US data and China reopening. Softer US wages growth last month has raised hopes for a further cooling of inflation, to be shown in tomorrow’s US CPI report. With equities and commodities rallying across the board, AUD has been well supported while JPY has seen weaker demand due to reduced safe-haven inflows.

At the same time, news of China relaxing border controls there for the first time since the pandemic began is also helping lift sentiment. Despite near-term uncertainty regarding fresh covid fears, the reopening is expected to filter into higher demand and better activity in coming months, which is good news for the Australian economy.

More recently, data overnight showed a fresh surge in domestic AUD inflation which hit 7.3% from 6.9% prior. With renewed risks of an uptick in RBA tightening, AUD looks set to gain against JPY where BOJ easing remains firmly in place. Looking ahead then, tomorrow’s US CPI print will be key. Confirmation of further cooling, especially if we see a downside surprise, should send AUD higher on better risk sentiment. However, if we see any unexpected uptick in US CPI, expect risk sentiment to reverse sharply, taking AUDJPY lower.

Technical Views

AUDJPY

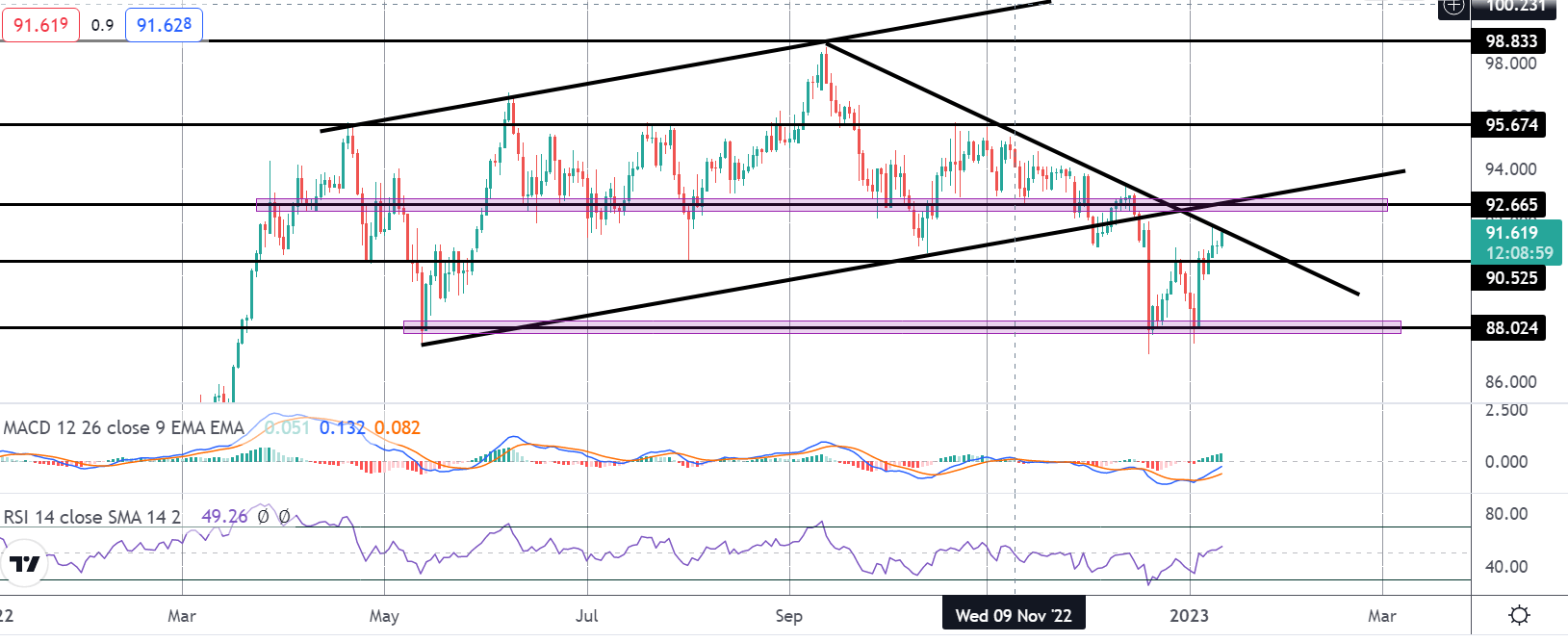

The 88.02 level has once again held as support, turning price higher. The pair is now testing the bearish trend line from 2022 highs ahead of the key area at 92.66 (retest of broken bull channel lows). This is the pivot for the pair, above there and 95.67 is the focus. Failure there, and current lows will likely be seen again.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.