Market Analysis: USD Strengthens Amid Geopolitical Tensions and Recalibration of Monetary Policy Expectations

The US Dollar has exhibited broad-based strength ahead of the ISM Manufacturing PMI release, driven by reduced expectations of imminent Federal Reserve rate cuts and heightened geopolitical tensions in the Middle East. The Euro and British Pound are under pressure due to weaker-than-expected Eurozone inflation data and mixed signals from the Bank of England, respectively.

The USD is trading positively as market participants trim excessive expectations of a dovish Fed, which may have been built up as a result of an overreaction to recent negative data surprises in US inflation and labor market data. Comments from Fed Chair Jerome Powell have prompted traders to price in fewer cuts, reflecting a data-dependent stance amid persistent inflationary pressures.

The upcoming ISM Manufacturing PMI will be critical in gauging the health of the US manufacturing sector. A reading above expectations could reinforce the Fed's hawkish bias, supporting the USD further. Conversely, a weaker print may revive discussions around economic slowdown risks.

EUR/USD has dipped below the 1.11 level following the release of weaker-than-expected Eurozone inflation figures. The preliminary EU inflation figures showed deceleration to an annual rate of 1.8%, falling short of the ECB 2% target and market estimates:

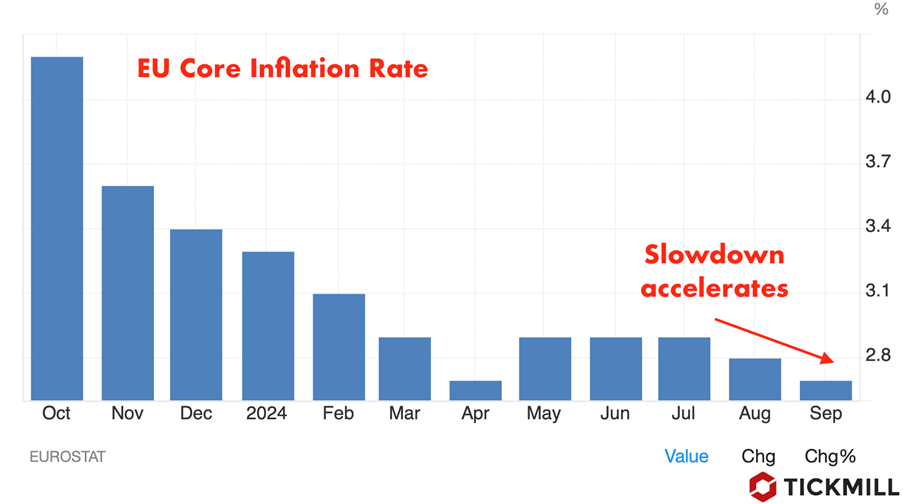

The core HICP, excluding volatile items, also slowed to 2.7%. This deceleration may intensify speculation that the ECB will maintain or even loosen monetary policy in the coming months:

The US JOLTS Job Openings report is anticipated to provide further insight into labor market dynamics. Expectations are for a slight decrease to 7.670 million from 7.673 million. A significant deviation could influence the Fed's assessment of labor market tightness and, by extension, its policy decisions.

Moreover, with five Fed members scheduled to speak today, any guidance on future monetary policy will be closely scrutinized. Chair Powell's recent comments suggest the Fed remains data-dependent, even during blackout periods, underscoring the importance of upcoming economic releases.

According to interest rate derivatives in the US, the probability of a 50 basis point rate cut in November has decreased to 35% from 58% a week prior. This shift reflects the market's recalibration of Fed expectations in light of persistent inflation and robust economic indicators.

Escalating tensions in the Middle East, particularly Israel's initiation of a "limited ground offensive," have increased demand for safe-haven assets. Historically, such geopolitical uncertainties bolster the USD due to its reserve currency status and perceived safety.

The GBP is underperforming against major counterparts, primarily due to USD strength and mixed signals from the BoE. Recent comments from BoE external policy member Megan Greene highlight concerns over renewed inflationary pressures driven by consumption and elevated services inflation at 5.6%:

While Greene acknowledged that headline inflation is moving in the right direction, she emphasized caution due to potential volatility in energy prices and persistent core inflation. Market expectations for a BoE rate cut in November have diminished, but the possibility of policy adjustments in December remains on the table.

Current market dynamics are influenced by a confluence of geopolitical tensions, central bank communications, and key economic data releases. The USD appears poised to benefit from both safe-haven flows and a reassessment of Fed rate cut expectations. Meanwhile, the EUR and GBP may face continued pressure unless forthcoming data or central bank actions provide support.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.