Market Analysis: Dollar Strengthens Amid Robust US Labor Data; Euro and Pound Weaken on Rate Cut Expectations

The US Dollar stalled after breaking out from the major bearish channel and reaching the key horizontal resistance level. The currency was buoyed by robust labor market data, released last Friday, that has led investors to reassess the Fed’s monetary policy trajectory. In contrast, the Euro and Pound Sterling have weakened against the USD amid rising expectations of imminent interest rate cuts by the ECB and the BoE, respectively.

The US Dollar Index is trading near 102.50, reflecting the Greenback's strength against major currencies:

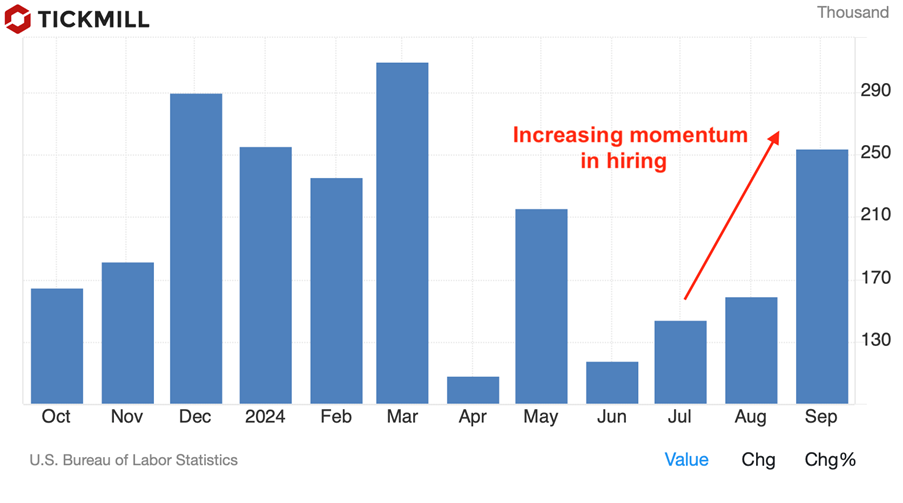

The catalyst for this appreciation is the surprisingly strong September employment report:

The economy added 254K jobs, significantly surpassing the consensus estimate of 140K and the upwardly revised August figure of 159K:

Unemployment Rate: Fell to 4.1% from 4.2%, indicating tightening labor market conditions.

Average Hourly Earnings: Accelerated by 4.0% year-over-year, above expectations, with a month-over-month increase of 0.4%.

The robust labor market data suggest that the US economy remains resilient despite the recent rate cut by the Federal Reserve. The stronger-than-expected wage growth raises concerns about persistent inflationary pressures, potentially complicating the Fed's mandate to balance employment and price stability.

The Federal Reserve initiated its policy-easing cycle with a 50 basis point cut in September, a larger-than-usual move aimed at cushioning the economy against global uncertainties. However, the latest employment figures have led market participants to reconsider the likelihood of another 50 bps cut in the upcoming November meeting.

The upcoming US CPI release on Thursday will be critical in shaping November FOMC expectations. A higher-than-anticipated CPI could further diminish the probability of aggressive rate cuts.

The EUR/USD pair remains vulnerable trading below 1.10 handle, weighed down by both USD strength and concerns over the Eurozone's economic outlook. The annual Eurozone inflation decelerated to 1.8% in September, below the ECB's 2% target and consensus estimates. Another important macroeconomic report, Eurozone’s Retail Sales, showed growth by 0.8% year-over-year in August, missing the expected 1% growth. Month-over-month growth was a modest 0.2%.

Growing risks of sustained below-target inflation have intensified speculation that the ECB may cut interest rates again at its October 17 meeting. François Villeroy de Galhau, ECB Governing Council member and Governor of the Bank of France, emphasized the need for caution against prolonged restrictive monetary policy. His comments suggest a shift in focus from preventing inflation overshoot to avoiding undershoot due to weak growth.

The prospect of further monetary easing by the ECB adds downward pressure on the Euro. A rate cut would widen the interest rate differential with the USD, making the Euro less attractive to yield-seeking investors.

The Pound Sterling has depreciated against major currencies, influenced by both a cautious market mood and rising expectations of a BoE rate cut in November. Andrew Bailey indicated a willingness to be more aggressive in cutting rates if inflationary pressures continue to decline. With inflation showing signs of easing, the BoE may prioritize supporting economic growth over controlling price levels.

From the technical perspective, GBPUSD looks poised to test the 1.30 level, with a possible false bearish breakout, before the buy side of the market could initiate a rebound attempt:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.