Investor Sentiment Improves Amid Chinese Bond Deferral, Dollar Strengthens on Inflation Expectations

Investors have taken a more positive view of the systemic risk situation in China following news that the major Chinese developer Country Garden has been granted a deferral of coupon payments on some medium-term bonds. This development has lifted investor sentiment in global markets, with Asian stocks reacting optimistically to the news from China today.

European indices initially opened with strong gains but lost all their momentum during the trading session due to weak data from the ZEW agency, which showed that economic sentiment in the Eurozone declined more than expected. The corresponding index fell from -5.5 to -8.9 points in August, compared to a forecast of -6.2. The negative sentiment also affected the currency market, as European currencies depreciated slightly against the dollar. The Japanese yen also seemed to digest yesterday's news related to strong verbal intervention from the head of the Japanese central bank, who hinted that the monetary policy direction could change by the end of the year.

The dollar index, after correcting to the level of 104.50, is once again testing the recent high near the 105 level. Questions about the upward trend, which began in mid-July, are likely to arise near the 104 level according to the technical chart:

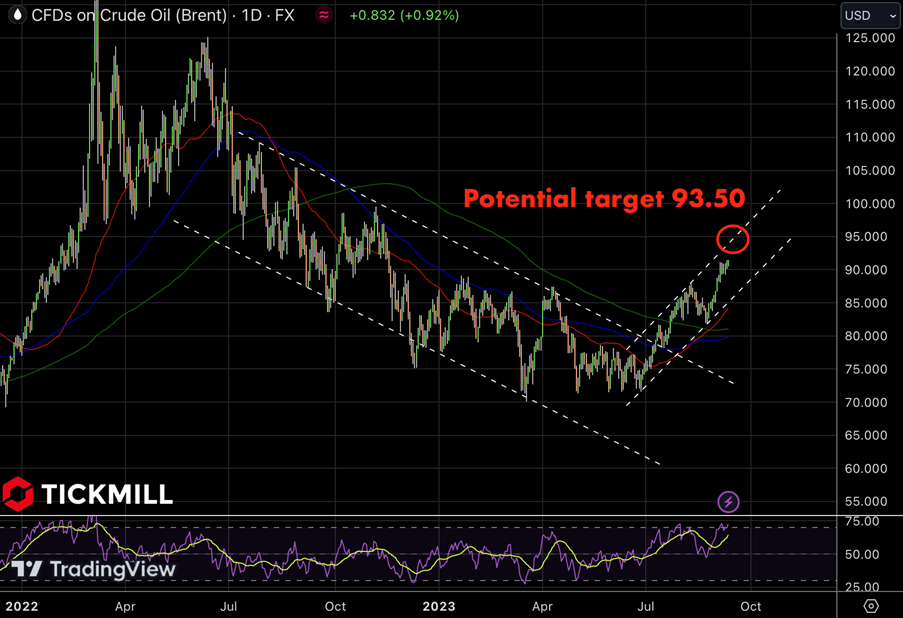

Oil prices have broken through a local maximum after a brief pause, supported by relatively upbeat data on the American economy (PMI in the services sector, labor market data), as well as the latest news on stabilizing the financial market in China. The short-term uptrend, judging by the boundaries it forms, could extend to the 93.50 level in Brent spot price:

However, Commerzbank warned in its latest analytical note that the potential for oil price growth is almost exhausted, and a pullback is possible, as demand forecasts may begin to be revised downward in the near future.

The strengthening of the American currency is also being driven by market expectations for tomorrow's inflation report in the United States. In the second half of last week, after the PMI data and initial jobless claims, expectations gradually started pricing in the possibility of a stronger figure than the forecast (0.2% MoM). As a result, the dollar is not giving up attempts to decisively break the 1.07 level against the EURUSD and test the support line around 1.24 in the pound-dollar pair:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.