Institutional Insights: Standard Chartered, Bitcoin Path To $500k

.jpeg)

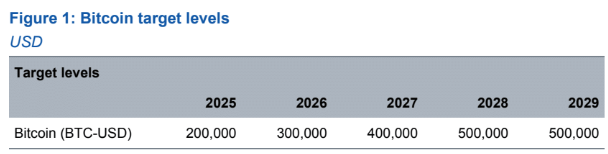

Bitcoin – Pathway to the USD 500,000 level

• We believe two key factors will influence Bitcoin prices in the long run: investor access and volatility.

• Investor access significantly improved with the introduction of US spot ETFs and is expected to rise further with Trump’s administration.

• We anticipate that volatility will gradually decrease once the ETF market matures, thereby increasing Bitcoin’s share in an optimal gold-BTC portfolio.

• The combination of increased access and reduced volatility could propel Bitcoin to the USD 500,000 level before Trump concludes his term.

Increasing access, decreasing volatility We are of the opinion that Bitcoin (BTC) is moving towards a more stable role within global investment portfolios. Bitcoin serves as a unique hedge against the challenges confronting traditional finance (TradFi), whether in the private sector (e.g., the SVB collapse in March 2023) or the public sector (e.g., risks to the US Treasury). In this regard, we believe that enhanced investor access will be the primary catalyst for long-term appreciation in Bitcoin’s price. Access to BTC surged in January 2024 following the launch of spot ETFs in the US. These ETFs have generated a net inflow of USD 39 billion thus far, supporting the notion of pent-up demand being released due to improved access. Additional enhancements to investor access have started under the Trump administration. The recent repeal of SAB 121 – SEC guidance mandating that companies holding digital assets on behalf of customers must account for these holdings as liabilities on their balance sheets – is significant. Trump’s order on January 23 for the administration to assess a possible national stockpile of digital assets is also crucial, as this may motivate other central banks to explore investments in Bitcoin. Moreover, we foresee a decline in Bitcoin’s volatility as the ETF market develops and as the financial infrastructure supporting the Bitcoin market enhances, particularly through more options markets and counterparties. As volatility decreases, Bitcoin’s proportion in an optimized two-asset portfolio with gold increases. The combination of improved investor access and lower volatility is expected to lead to long-term price appreciation as portfolios aim for their optimal/logical configurations. In light of these developments, which align with our prior expectations, we maintain our target for BTC to reach the USD 200,000 mark by the end of 2025. Following that, we project BTC to achieve around USD 300,000 by the end of 2026, USD 400,000 by the end of 2027, and USD 500,000 by the end of 2028, remaining at that level until the end of 2029.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!