Institutional Insights: Nomura Cross-Asset: LONG-END AND USD BLEEDING EQUITIES JOY

.jpeg)

Nomura Cross-Asset: LONG-END AND USD BLEEDING EQUITIES JOY

Macroeconomic dysfunction re-emerged as the U.S. equities narrative on the "right side" of the distribution gained momentum, with the SPX poised to rally into Options Dealers' "Short (OTM Call) Strikes" above 6000 and beyond. The intertwined decline of the USD and the UST Long-End has revealed further downside vulnerabilities after over a decade of "U.S. Exceptionalism" and "QE Largesse," which had driven excessive ownership and is now unwinding.

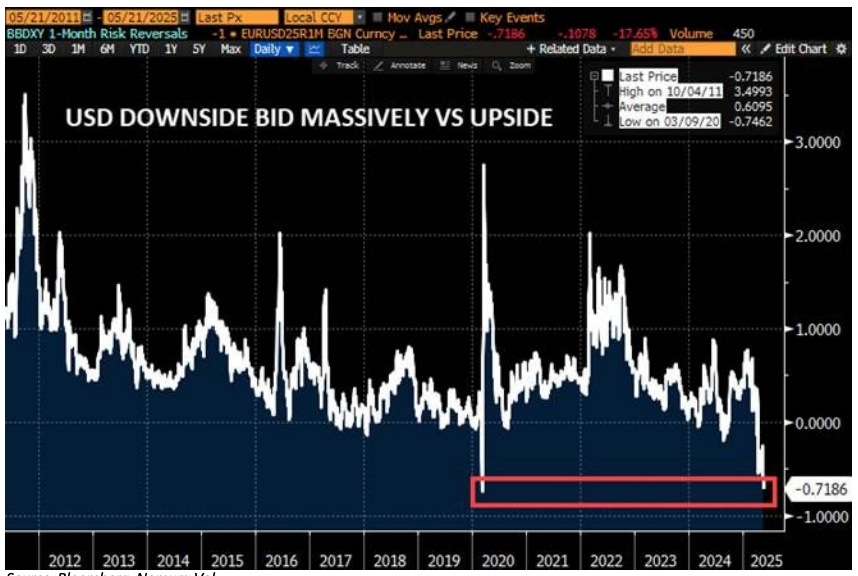

The current dynamics surrounding the Dollar and the "Exceptionalism Unwind" go beyond the narrowing growth premium and interest rate differentials relative to the rest of the world. A significant factor is the abrupt shift in Trump’s trade policy, where tariffs are being phased out in favor of a focus on foreign exchange (FX) agreements. Bilateral discussions on exchange rates are increasingly taking center stage, as evidenced by frequent reports from Asia. For instance, South Korea recently stated that "FX talks with the U.S. are ongoing, with no decision made." This shift has fueled a surge in demand for Dollar downside puts against currencies such as the Euro, Yen, Swiss Franc, and Sterling.

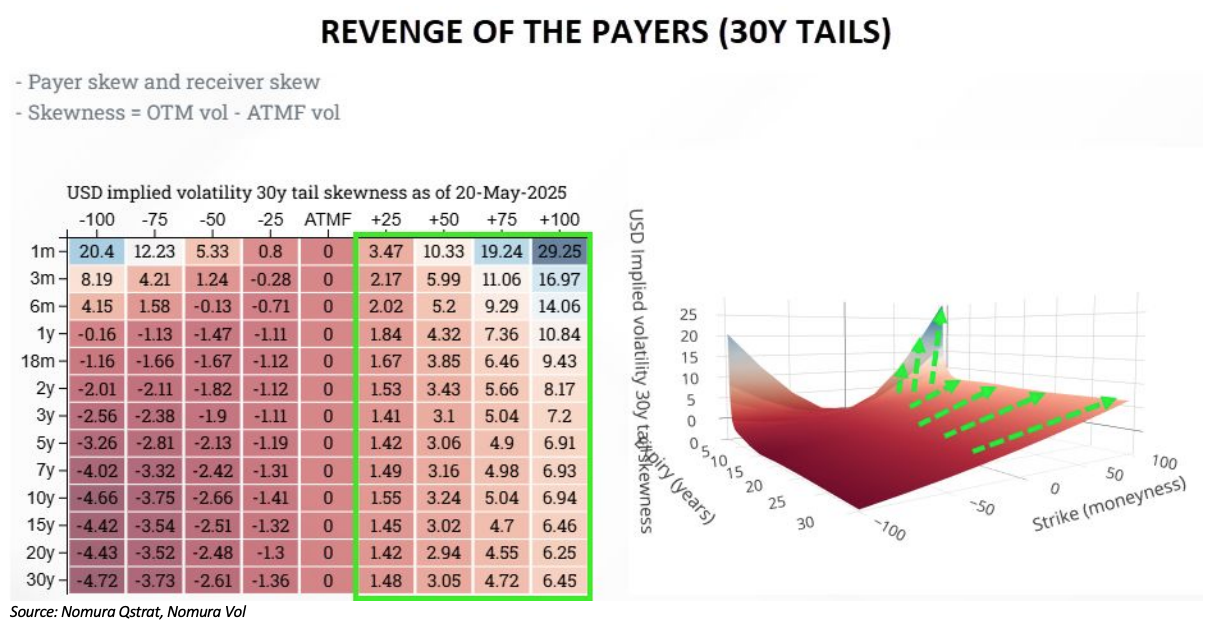

The U.S. yield curve remains unusually flat given the current state of fiscal profligacy, which continues to consume the economic landscape and necessitates a notable rebuilding of term premiums. This dynamic underpins the ongoing, gradual steepening trend we’re witnessing, driving persistent demand for curve caps and long-end volatility instruments (particularly 30-year payers). The global long end currently feels exceptionally fragile and uncertain.

From Nomura Rates Sales: “Historically, we’ve observed consistent support for the long end across regions whenever the 5% level was approached in long bonds. However, last night showed limited sponsorship, suggesting that higher yields may need to be tested to attract renewed interest, particularly from the Asian region. Notably, TLT ETF flows yesterday recorded a decline of -1.1mm/01, reinforcing the weakness in the long end. In the swaps market, the prevailing pain trade seems to be a continued gradual narrowing of spreads for now. A test of -60 in 10-year spreads appears likely in the near term.”

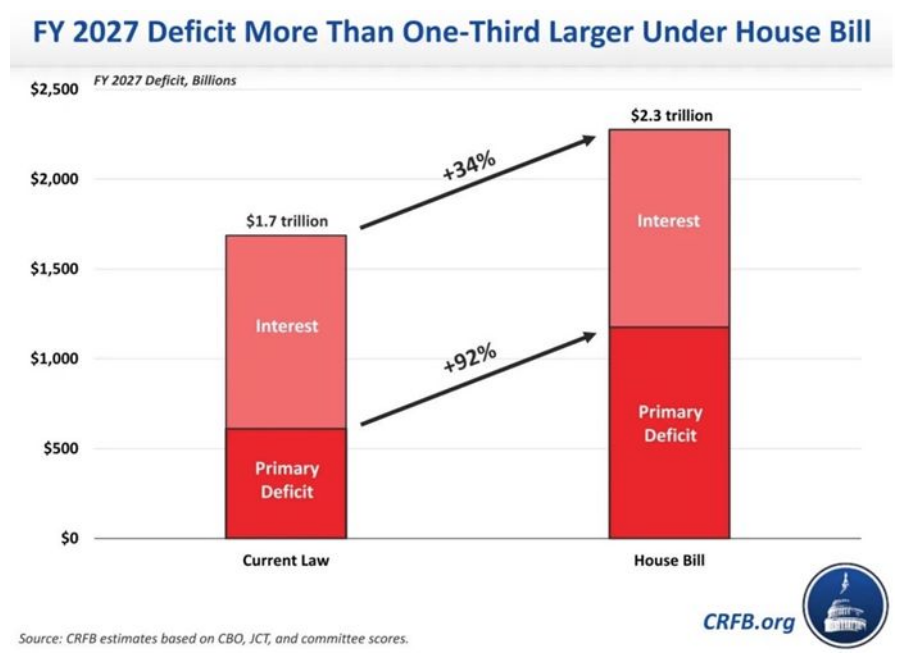

The trajectory of U.S. deficit spending is veering off course, embedding risks such as elevated inflation, higher debt servicing costs, and an increasing likelihood of adverse outcomes. This occurs even as nominal GDP remains resilient, supported by a combination of above-trend growth and inflation in the post-COVID fiscal stimulus era. Consequently, the Federal Reserve finds itself constrained, unable to implement deep rate cuts, as the anticipated recession or sharp economic slowdown has yet to materialize. This is particularly evident as corporations, still grappling with post-COVID reopening challenges, are reluctant to lay off workers. This reluctance sustains wage levels and employment, keeping the "U.S. Consumer Miracle" somewhat intact, albeit in a fragile, zombie-like state. However, this delicate balance could unravel quickly if steep margin compression erodes corporate earnings, triggering layoffs and a potential downturn.

House Speaker Johnson recently announced an agreement on the $40,000 SALT deduction cap, suggesting progress on the House GOP budget. The messaging from Wall Street indicates that the structuring aims to keep the stimulus effect front-loaded through tax cuts. However, with such a narrow margin for approval, there remains a risk that the final budget could be scaled back, potentially disappointing expectations for robust stimulus measures.

Globally, pressures on long-term yields persist for various reasons:

- In Europe, the removal of legacy austerity-driven debt brakes signals a shift toward increased debt issuance. This change reflects efforts to address long-standing issues such as underinvestment in defense, security, industrialization, and energy infrastructure. The result is expected to be a significant increase in supply.

- Japan is drawing significant attention following a sharp rise in JGB yields and a weak 20-year bond auction earlier this week. The structural oversupply of super-long-term JGBs, coupled with decades of QE, ZIRP, and NIRP policies, has left the market highly illiquid and dependent on perpetual BoJ intervention. As the BoJ reduces outright purchases and tightens policy to escape its prolonged deflationary spiral, the market faces a challenging normalization process amid above-trend growth, sticky inflation, and rising wages.

- Inflation remains a key focus globally. Recent hot CPI prints in the UK and Canada, combined with bullish consumer sentiment from U.S. corporates like Home Depot, Lowe’s, and Amer Sports, contrast with the persistent fears of recession and downside growth risks.

Given this backdrop, demand for long-duration assets is unlikely to surge until markets establish a proper clearing price, incorporating higher term premiums to compensate for these risks. This dynamic is particularly relevant to today’s U.S. Treasury 20-year auction.

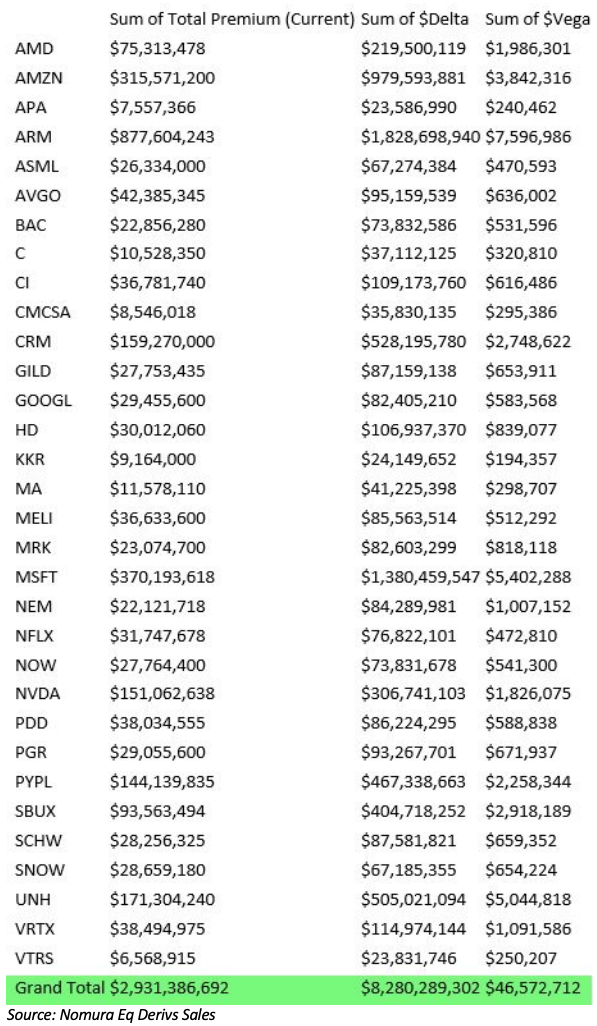

Turning to equities, the ongoing macroeconomic dysfunction does not appear to deter at least one significant investor in U.S. equities. A major "real money" participant has been aggressively accumulating long-dated, at-the-money call options (LEAPS). According to the Ed Derivs Sales desk, this investor has deployed approximately $3 billion in options premium, generating $8.3 billion in delta exposure and $46.6 million in vega. This activity highlights a substantial bullish stance despite broader uncertainties.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!