Institutional Insights: JPMorgan Trading CPI

Institutional Insights: JPMorgan Trading CPI

JPM's Feroli's CPI preview anticipates a Headline MoM increase of +0.16% and a Core MoM increase of +0.31%, both aligning with market expectations. This translates to a 2.4% YoY increase for Headline and 2.9% YoY for Core.

The following scenario analysis is not part of JPM Research but reflects the trading desk perspective from JPM US Market Intelligence, focusing on Core MoM outcomes and 1-day SPX movements:

- [5.0% Probability] If Core MoM exceeds 0.40%, SPX could drop by 2% - 3%. This scenario may result from unexpectedly high Core Services and Core Goods, inconsistent with NFP expectations amid trade war impacts. Such a print might indicate a stronger inflationary effect from the trade war, prompting the yield curve to reprice higher, suggesting stagflation. If growth remains stable, as indicated by upcoming Retail Sales data, the 10Y yield might approach 5%.

- [25.0% Probability] A Core MoM between 0.35% - 0.40% may lead to an SPX decrease of 1.25% - 1.75%. Core Services might remain elevated, driven by sticky OER. Bonds could react negatively, and additional rate cuts might be anticipated later in the year due to expected inflation spikes this summer.

- [35.0% Probability] With Core MoM between 0.30% - 0.35%, SPX could range from a 0.25% loss to a 0.75% gain. This is the base case scenario, where the higher end might see a slight sell-off, while the lower end continues the rally.

- [30.0% Probability] A Core MoM between 0.25% - 0.30% may result in SPX gains of 1% - 1.5%. Recent dovish CPI prints across the G7 increase the likelihood of this outcome, creating a skewed distribution.

- [5.0% Probability] If Core MoM falls below 0.25%, SPX could gain 2% - 2.5%. This dovish scenario, similar to recent EU/UK results, would be significant. Expect the bond market to factor in at least two 25bp rate cuts, with equities reacting positively to the ensuing bull steepening.

Options Pricing: Options expiring on Wednesday indicate a 1% implied move, based on Monday's closing prices.

US Market Intelligence: We anticipate a dovish print is more likely than a hawkish one, considering recent EU/UK inflation data. However, market positioning suggests a hawkish print might be penalised more than a dovish print rewarded. An inline/dovish print could push the market to new highs soon, potentially inducing another squeeze in higher beta market segments. Long-term, monitor shipping price effects on Core Goods, as these prices have recently surged.

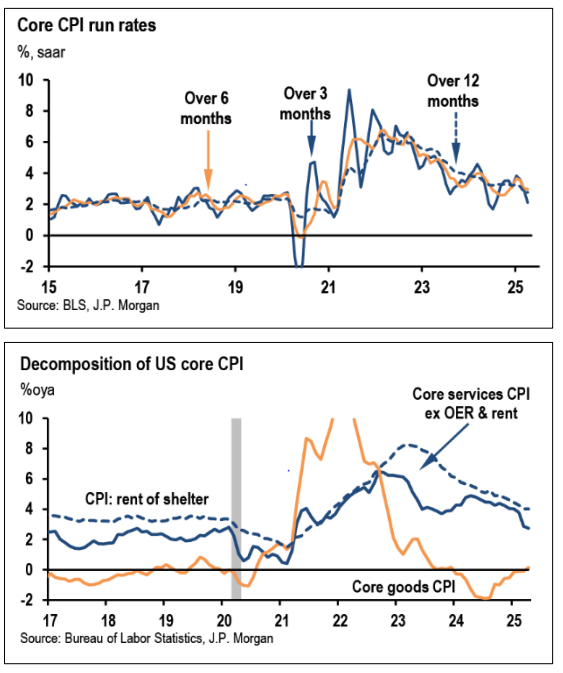

We forecast a 0.2% rise in May's consumer price index (CPI), similar to April, though tariff cost pressures may increasingly impact future months. Energy prices likely fell, with gasoline dropping 2.8% (seasonally adjusted), while food prices showed modest firming after April’s decline, despite continued egg price drops. Headline CPI is expected to rise 2.5% year-over-year, slightly faster than recent months but softer than early 2021 levels.

Core CPI is projected to increase 0.3%, raising the year-over-year core inflation rate to 2.9%. Shelter prices are anticipated to cool gradually, with owners’ equivalent rent up 0.33% and tenants’ rent rising 0.31%. Lodging prices may drop 0.5%, airfares could fall 4.5%, and public transportation CPI is expected to decline 3.4%.

Auto tariffs likely caused modest shifts: new vehicle prices may rise 0.2% after April’s flat reading, while used vehicles could climb 0.4% despite a 1.1% decline in industry data. Apparel prices likely rose 0.2%, reversing April’s drop, and medical care prices are expected to increase 0.4%, driven by services rather than commodities. Tariff-related pressures on select goods may persist but remain scattered across CPI categories.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!